Experian: Deep subprime quarterly originations drop below 2%

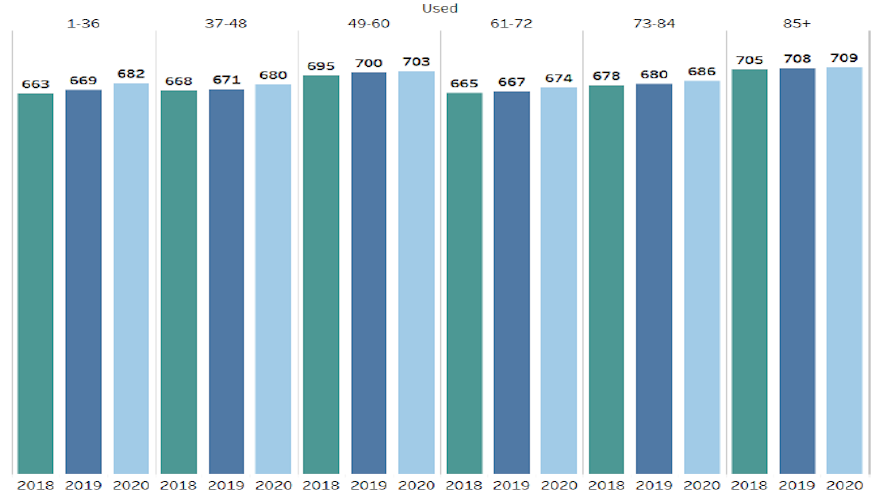

This chart shows the average consumer credit score by contract term for used-vehicle financing booked during the fourth quarter of 2018, 2019 and 2020. Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

SCHAUMBURG, Ill. –

The auto-finance industry’s appetite for the highest-risk paper declined to close 2020.

According to Experian’s Q4 2020 State of the Automotive Finance Market report, analysts discovered deep subprime originations of all contracts booked in a quarter dipped below 2% for the first time. The fourth-quarter level came in at 1.98%.

Experian classifies deep subprime as consumers with credit scores between 300 and 500.

The latest level of deep subprime originations is considerably lower than what Experian recorded in a closing quarter of a year going back to 2016. The report shared these metrics for deep subprime booked during the fourth quarter of the year:

2016: 4.32%

2017: 3.77%

2018: 4.27%

2019: 3.39%

The subprime segment — consumers with credit scores between 501 and 600 — is softening, too, according to Experian’s newest report released on Thursday.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts said subprime originations made up 14.35% of all contracts booked in Q4. That’s down from 16.53% of all contracts falling into subprime during Q4 of 2019 and 18.68% during Q4 of 2018.

Meanwhile, what Experian classifies as non-prime — individuals with scores between 601 and 660 — is generating originations at nearly a steady pace.

The report indicated non-prime originations constituted 17.30% of all Q4 contracts; the same level as what analysts recorded in the last quarter of 2019. The segment had similar readings to close three other years as noted in the report:

2018: 17,56%

2017: 17.61%

2016: 17.82%

Though affordability remains a concern in the automotive industry, Experian found consumers with strong credit are shifting away from used vehicles, back into financing new vehicles.

Experian determined 44% percent of super prime consumers selected used vehicles in Q4 2020, down from 47.03% in Q4 2019. Similarly, 60.38% of prime consumers chose used, compared to 63.75% during the same period last year.

“The events of 2020 disrupted the automotive industry and we’ve seen some consumers shift away from patterns that have been cemented over previous quarters such as opting for used vehicles,” Experian’s senior director of automotive financial solutions Melinda Zabritski said in a news release.

“While we can likely attribute some of the change to stimulus checks, carry-over incentives and tight inventory, we find ourselves in uncharted territory,” Zabritski continued. “Leveraging data to better understand patterns and trends will help lenders and dealers make the most strategic decisions in the days to come.”

Overall, Experian observed similar trends and patterns to previous quarters. Total originations for prime and super prime consumers increased in Q4, reaching 44.24% and 22.13%, respectively.

Analysts also pointed out that average amounts financed and monthly payments continue to rise, likely driven by consumers continued preference for larger vehicles such as pickups and SUVs.

In fact, Experian said more than 50% of new vehicles financed in Q4 were small and mid-sized SUVs.

According to the report, the average amount financed for a new vehicle increased nearly $2,000 year-over-year to reach $35,228 in Q4, while the average monthly payment increased $13 to $576 over the same period.

Similarly, analysts discovered the average amount financed for used vehicles grew from $20,824 to $22,467 year-over-year, while average monthly payments increased $18 to surpass $400 for the first time, reaching $413 in Q4.

“With the increases in average loan amounts and payments, affordability will continue to be an important topic to pay attention to, particularly as market conditions continue to develop in 2021,” Zabritski said.

“To keep the industry moving forward, lenders and dealers need to rely on data to ensure that they have the right options to fit consumers’ needs,” she went on to say.

Experian highlighted a few additional findings for Q4, including:

• Total open automotive finance balances grew 2.8% year-over-year, reaching $1.27 trillion in Q4.

• Average contract terms continued to increase for both new and used vehicles in Q4, rising to 69.68 months for new vehicles and 65.58 for used vehicles.

• Interest rates dropped in Q4. The average interest rate for a new-vehicle contract dropped from 5.25% in Q4 2019 to 4.31% in Q4 2020, while the average interest rate for used vehicles dropped from 9.05% to 8.43% in the same time frame.

• Captive finance companies saw the largest amount of growth in Q4 2020, from 26.22 % in Q4 2019 to 30.14% in Q4 2020.

Experian plans to delve into the entire Q4 2020 State of the Automotive Finance Market report during a webinar. Registration for the session can be completed here.