Experian: Stronger credit consumers opting for shorter terms

Charts courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It’s not uncommon for consumers with softer credit scores to seek the longest contract terms possible to get a manageable monthly payment.

Conversely, Experian is seeing consumers with strong credit scores ask for shorter terms to offset rising interest rates.

That’s one of the highlights of Experian’s State of the Automotive Finance Market Report: Q1 2023 released on Thursday. Analysts found that the average term for a new vehicle for near prime, prime and super prime consumers decreased by as much as one month.

With the average interest rate for a new vehicle reaching 6.58% in Q1 — up from 4.10% a year earlier — Experian explained much of the growth in shorter term contract was experienced in the 1- to 48-month segment (where it increased from 9.53% in Q1 2022 to 12.47% in Q1 2023).

Similarly, analysts noted the percentage of new-vehicle contracts with 49- to 60-month terms increased from 16.55% to 17.37% over the same period.

Meanwhile, the percentage of new-vehicle financing with 73- to 84-month terms booked in Q1 decreased from 35.56% to 31.56%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Oftentimes when consumers shop for a vehicle the main priority is securing a low monthly payment, but it’s also important to assess the total cost of the loan, particularly amid rising interest rates and vehicle prices,” said Melinda Zabritski, Experian’s senior director of automotive financial solutions.

“While shorter term loans are usually accompanied by lower interest rates, right now OEMs seem to be offering additional incentives on shorter term loans, which is driving much of the growth in the 48-month segment,” Zabritski continued in a news release.

Elsewhere in the new report, Experian noticed increases in average amounts financed continued to taper off during Q1.

Analysts noticed the average amount financed for new vehicle delivered in Q1 came in at $40,851, increasing by only $1,213 from a year ago. That’s compared to the $4,255 increase from Q1 2021 to Q1 2022.

And how about this trend? Experian noticed the average amount financed for a used vehicle delivered in Q1 actually dropped by $1,590 year-over-year to settle at $26,420.

Despite the increase in the average amount for new vehicles continuing to level out, Experian said many prime and super prime consumers returned to the used vehicle market in Q1.

Prime consumers made up 42.41% of used vehicle financing during the quarter, up from 40.97% the previous year, while the percentage of super prime consumers increased from 11.43% to 13.60% over the same period.

“The industry continues to keep a watchful eye on some of the inventory challenges and rising vehicle prices, as it’s impacted consumer purchasing behavior,” Zabritski said. “We’re seeing consumers bring more cash and trade-in value to the transaction in hopes of minimizing the amount of interest they’d have to pay on their loans.

“Additionally, with the combination of fewer new vehicles on dealership lots and high prices, in-market consumers are choosing used vehicles as another way to control vehicle costs,” she went on to say.

Experian highlighted five other findings from Q1, including:

—Outstanding balances grew 8.40% year-over-year, reaching $1.4 trillion.

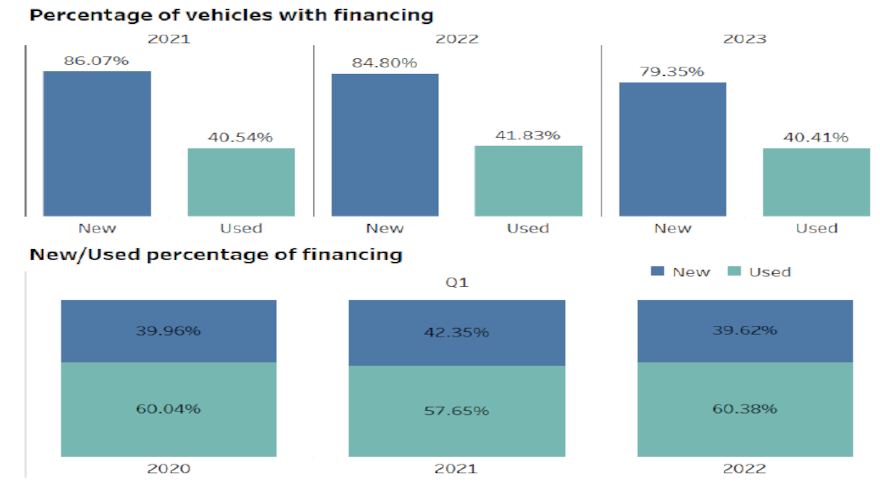

—The percentage of new vehicles with financing in Q1 2023 was 79.35%, down from 84.80% the previous year, while the percentage of used vehicles with financing was 40.41%, down from 41.83% over the same period.

—Captives (26.59%) secured the largest share of total financing in Q1 2023, followed by banks (26.03%), credit unions (24.53%), finance companies (12.11%) and BHPH/others (10.74%).

—The average monthly payment for a new vehicle was $725, up from $650 the previous year, while the average monthly payment for a used vehicle was $516, up from $505 over the same period.

—30-day delinquencies reached 1.89%, up from 1.60% a year ago, while 60-day delinquencies increased from 0.62% to 0.76% over the same timeframe.

Experian elaborated even more about the Q1 data in this online webinar.