Experts see mixed observations when examining latest auto ABS data

Charts courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The latest analysis about the health of contract payments and the auto asset-backed securities market from Kroll Bond Rating Agency and S&P Global Ratings showed mixed observations from company experts.

Beginning first with the update from S&P Global Ratings, analysts examined the U.S. auto ABS sector’s performance for the first quarter and discovered losses declined for the third straight month aided by a seasonal improvement in recovery rates.

S&P Global Ratings reported prime and subprime losses are slightly up on a year-over-year basis at 0.14% and 3.46%, respectively, but are still approximately 67% and 48% lower than pre-pandemic levels.

“April’s recovery rates remain high, still above the seven-year average for April,” S&P Global Ratings said in a news release mentioning full report availability. “Delinquencies (60-plus-day) increased for the month, with prime late payments being consistent with pre-pandemic levels while subprime delinquencies remained below April 2019’s levels.

“We expect subprime delinquencies to continue to normalize and approach pre-COVID-19 pandemic levels, especially as inflationary pressures continue to negatively affect consumers’ take-home pay,” S&P Global Ratings continued.

“However, so far, extension rates across nearly three dozen issuers continue to indicate that consumers need fewer accommodations on their auto debt than prior to the pandemic,” the firm went on to say.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

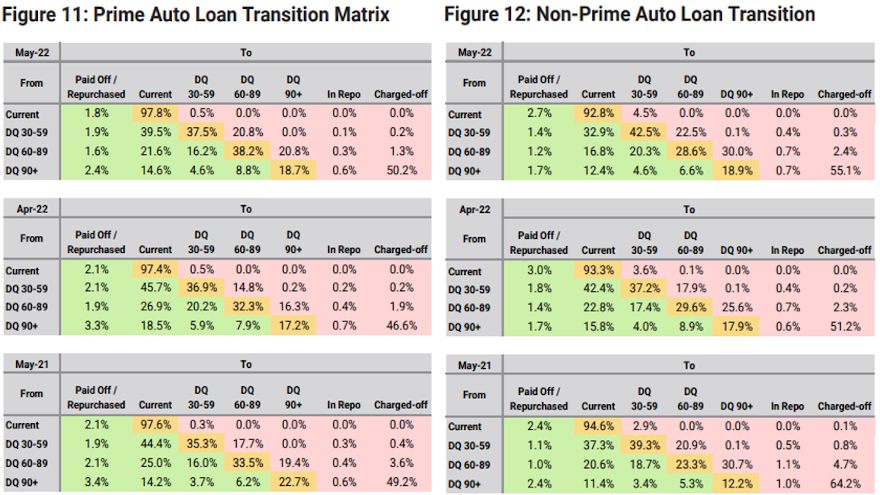

Meanwhile, KBRA indicated May remittance reports showed that credit performance was mixed across securitized prime and non-prime auto pools during the April collection period.

Analysts said annualized net losses in KBRA’s prime auto loan index fell 6 basis points month-over-month to 0.10%, while the percentage of prime contract that were more than 60 days past due increased a “modest” 2 basis points to 0.30%.

However, KBRA determined annualized net losses and 60-day delinquency rates in its non-prime index improved at a much faster clip, falling 37 bps month-over-month to 3.62% and 11 basis points month-over-month to 3.95%, respectively.

“Losses and delinquencies were up across both indices versus year-ago levels, as the benefit of stimulus in 2021 and inflationary pressures in 2022 have challenged year-over-year comparables,” KBRA said in its newest report.

“The MoM improvement in both indices is consistent with typical seasonal trends as borrowers receive tax refunds, providing an additional source of cash to catch up on past due loan payments,” analysts continued.

“We expect these seasonal tailwinds to dissipate next month and for inflationary pressures to place upward pressure on loss and delinquency rates as we enter the summer months,” analysts added.