‘Important turning point’ for credit availability arrives in June

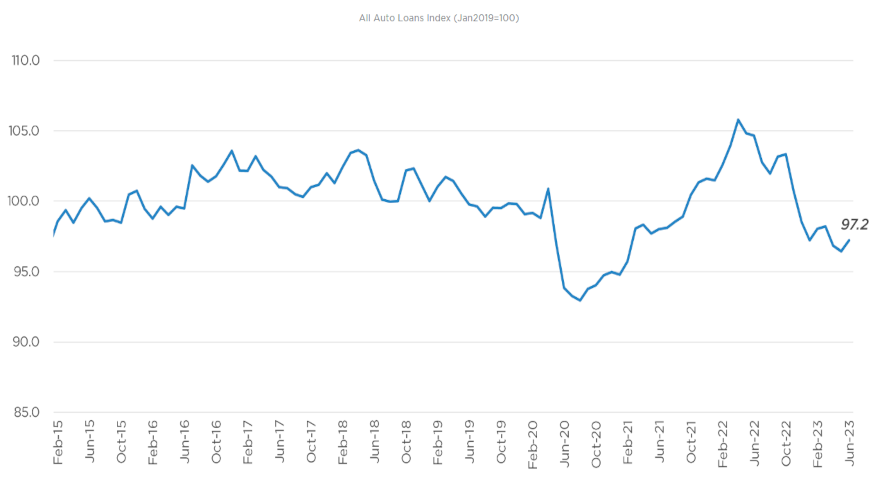

The Dealertrack Credit Availability Index for June. Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive said “June marked an important turning point” in connection with credit being available to consumers to acquire vehicles.

But the subprime segment remains on a downward trend.

The Dealertrack Credit Availability Index for all types of auto financing indicated access to auto credit improved in June after hitting a two-year low in May.

However, Cox Automotive acknowledged credit access remains tighter than a year ago and is stricter than before the pandemic for many channels.

Furthermore, experts pointed out the subprime share fell to 10.5% in June from 11.0% in May, dropping by 1.3 percentage points year-over-year.

All told, the latest index reading came in at 97.2 in June, which was the highest reading since March and reflected that auto credit was easier to get than in April and May

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Despite the 0.8% increase in June, Cox Automotive explained in a Data Point that access was tighter by 7.1% year-over-year. And compared to February 2020, experts added access was tighter by 2.0%.

Cox Automotive went on to elaborate that movement in credit availability factors was mixed in June.

“Yield spreads narrowed, average terms lengthened, and down payments declined, and those moves improved credit access for consumers,” experts said. “However, declines in the approval rate, subprime share, and negative equity share hurt consumer credit access.”

Cox Automotive delved into more data to explain last month’s credit availability trends.

Experts said the average yield spread on auto financing in June narrowed by 40 basis points, so rates consumers saw on auto financing were more attractive in June relative to bond yields.

Experts added that the average auto finance rate declined by 4 basis points in June compared to May, while the five-year U.S. Treasury increased by 36 basis points, resulting in a narrower average observed yield spread.

Despite more credit available to book paper, Cox Automotive said the contract approval rate declined by 20 basis points in June, softening 2.1 percentage points year-over-year.

Experts also noted the share of contracts with terms longer than 72 month increased 0.2 percentage points in June but edged 0.4 percentage points lower year-over-year.

“Credit availability also increased in June across all lender types,” Cox Automotive said in its index update. “Auto-focused finance companies loosened the least, while captives loosened the most. On a year-over-year basis, credit access was tighter across all lender types, with auto-focused finance companies having tightened the least and credit unions having tightened the most.”

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.

Meanwhile, if finance companies are booking any subprime deals for new vehicles, a separate Cox Automotive report showed how retail prices continue to be high for new models.

Cox Automotive reported the average listing price — or asking price — bounced around some throughout June, ultimately winding up somewhat higher than where it started.

At the opening of June, experts said the average listing price was $47,487. As the month closed, experts noted the average listing price edged up to $47,571.

By the time June finished, the average new-vehicle listing price was only 3% higher than a year ago, according to Cox Automotive.

Experts then calculated the average transaction price (ATP) — the price paid — for a new vehicle came in only 1.6% higher in June than a year ago, the smallest year-over-year price increase since the start of the global pandemic, according to Kelley Blue Book.

The ATP in June was $48,808, a month-to-month increase of 0.3% ($150) from a revised May ATP of $48,658. Incentives increased for the ninth consecutive month in June to the highest level since October 2021, averaging $2,048, or 4.2%, of the average transaction price.

With some brands and segments experiencing excessive inventory and demand softening slightly, discounts and incentives have increased and will continue to do so, according to Cox Automotive senior economist Charlie Chesbrough.

“Sales of new vehicles closed the first half of 2023 surprisingly strong,” Chesbrough said in the separate report. “Pent-up demand from individuals and businesses that could not find their product or a price they were willing to pay last year was unleashed.”