KBRA and S&P Global Ratings review latest payment performances

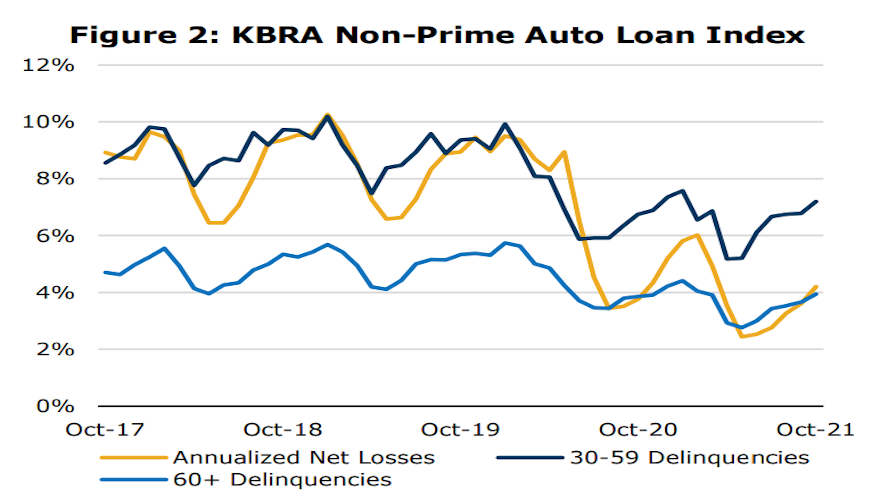

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Kroll Bond Rating Agency (KBRA) and S&P Global Ratings each shared their latest observations of contract performance based on metrics collected through the auto ABS market.

Analysts at both firms spotted similar patterns.

Beginning with S&P Global Ratings, the firm said through a news release that U.S. prime auto ABS saw “strong” results in September, with even lower monthly annualized losses year-over-year due to high recovery rates.

S&P Global Ratings indicated prime month-over-month performance was relatively stable, while subprime performance results were “less favorable but still quite positive relative to historical metrics.”

Analysts determined subprime losses increased year-over-year but were still only about 50% of the September 2019 loss level.

Subprime delinquencies and losses also rose month over month, while recoveries declined, according to S&P Global Ratings.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Both segments are reporting very low static pool cumulative net losses for the first-quarter 2020 though first-quarter 2021 vintages,” S&P Global Ratings analysts said.

The firm went on to mention “significant” year-over-year changes in the prime pool composition through September included the average FICO score declining slightly to 750 from 760 and used vehicles increasing to a record 63% from 59%.

Analysts added that the used-vehicle composition also increased in subprime pools.

“Of the 25 transactions we reviewed in October, we lowered our loss expectations on 19 and maintained them on six. These reviews resulted in 51 upgrades and no downgrades,” S&P Global Ratings analysts said.

Turning next to KBRA’s analysis of October activity, the firm discovered that early-stage delinquencies (30 to 59 days past due) in KBRA’s Prime Auto Loan Index increased 4 basis points month-over-month to 0.84%, while late-stage delinquencies (60 days or past due) rose 1 basis point to 0.29% .

Furthermore, analysts said early- and late-stage delinquencies in KBRA’s Non-Prime Auto Loan Index were up 42 bps and 29 bps month-over-month, respectively, at 7.2% and 3.94%.

“Annualized net losses (ANL) trended somewhat higher in our prime index versus the previous month but remained relatively flat in our non-prime index. However, net loss rates remained well below pre-pandemic levels, as elevated used vehicle values have continued to support loan recovery rates,” KBRA experts said in their newest report.

“It is likely that securitized auto loan credit performance will continue softening into early next year, keeping in line with seasonal trends as holiday spending weighs on borrower finances,” they continued. “Moreover, the termination of extended federal unemployment benefits in early September 2021, coupled with the phasing out of other COVID-related safety net programs like federal student loan forbearance in January 2022, will likely create additional headwinds to consumer credit performance in 2022.”

KBRA closed its updated by noting the percentage of prime and non-prime contract holders who transitioned from current to 30 to 59 days delinquent totaled 0.5% in its prime index and 4.4% in its non-prime index.

Finally, the firm said the percentage of prime consumers who rolled from 60 days or more past due to charge-off equaled 12.5%, which was down 162 basis points month-over-month, while the non-prime roll rate into charge-off decreased 20 basis points to 19.3%.