KBRA: Delinquency seasonality could be coming later this year

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

A day after S&P Dow Jones Indices and Experian reported that auto defaults sunk to a new all-time low in June, Kroll Bond Rating Agency (KBRA) released its latest indexes based on performance in the securitization market, illustrating how the metrics likely are on the path to notable changes during the rest of the year.

KBRA discovered that June remittance reports showed securitized auto financing exhibited higher delinquencies during the May collection period.

According to its latest report posted on Wednesday, analysts indicated early-stage delinquencies (30 to 59 days past due) in KBRA’s Prime Auto Loan Index climbed 14 basis points month-over-month to 0.73%, while late-stage delinquencies (more than 60 days past due) rose 1 basis point to 0.23%.

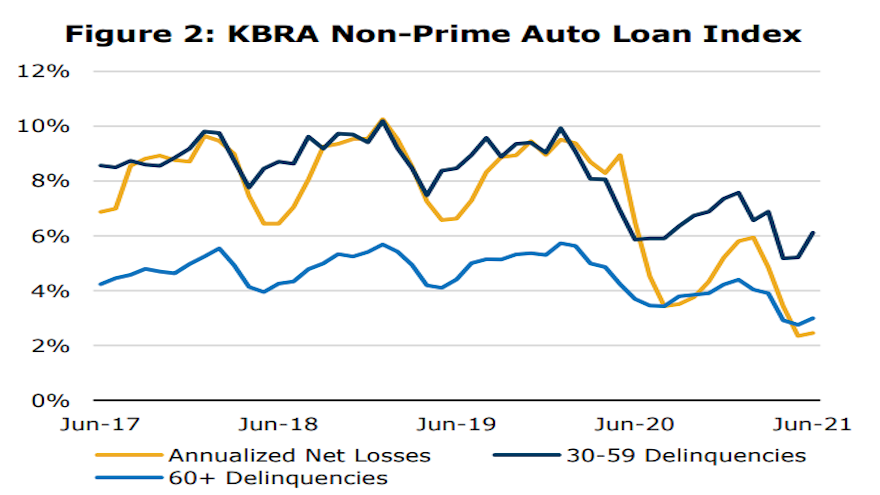

Meanwhile, the firm said early- and late-stage delinquencies in KBRA’s Non-Prime Auto Loan Index jumped month-over-month by 91 basis points and 24 basis points, respectively, coming in at 6.12% and 3%.

KBRA pointed out that annualized net losses held relatively steady in both indices and remain well below their year-ago levels.

“The decline in net loss rates over the past year was driven by favorable delinquency metrics and a strong used-car market, which has helped to keep recovery rates at elevated levels,” analysts said in the report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“We expect credit performance to deteriorate in both indices through the remainder of the year, which is a return to normal seasonal patterns,” they continued.

And if they haven’t been discontinued already, KBRA pointed out that enhanced unemployment benefits are set to expire for all states by Sept. 6.

“The impact of spring tax refunds will fade into the rearview mirror, and summer travel and normal consumer spending will likely weigh on borrower finances in the coming months,” analysts said. “Additionally, net loss rates will lose the positive impact of record-high auction prices as production delays and inventory shortages, which have caused this condition continues to ease.

“Auto loan prepayment rates rose sharply during the March collection period but have trended down since April, mirroring a similar trend we have observed in other consumer loan sectors,” analysts went on to say. “For many of the reasons described earlier, we also expected prepayment rates to normalize in the coming months.”

KBRA also mentioned that its analysis of June’s Reg AB II asset-level disclosures also reflected the aforementioned normalization from temporary gains in March and seasonality as the industry entered the summer.

Analysts found that the percentage of prime and non-prime contract holders who went from 30 days delinquent to current in June came to 31.7% and 29.1%, respectively, down 647 basis points in prime pools and 167 bps in non-prime pools versus the previous month.

Furthermore, KBRA determined the percentage of prime contract holders who rolled from more than 60 days past due to charge-off declined to 13.9%, down 69 basis points month-over-month, while the non-prime roll rate into charge-off decreased 103 basis points to 21.7%.

“As tax refunds and stimulus checks have been expended and people are spending money on their summer vacations, the positive trends in 30 days delinquent to current roll rates kept dropping in May, returning to their pre-March levels,” analysts said.

“However, borrowers in deeper delinquencies were able to avoid the negative credit implications of rolling to charge-off by benefiting from a recovering economy and better employment conditions,” they added.