KBRA: Impact of federal stimulus on monthly payments continues to fade

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Kroll Bond Rating Agency (KBRA) highlighted how much federal stimulus money provided a positive bounce for maintaining monthly payments.

And according to the firm’s newest report, that bounce is losing its momentum, but the overall market still is solid as analysts said May remittance reports showed auto credit trends remained strong during the April collection period.

Analysts indicated early stage delinquencies — 30 to 59 days past due — in the KBRA Prime Auto Loan Index fell 8 basis points month-over-month to 0.60%, while late-stage delinquencies — 60 or more days past due — declined 1 basis points to 0.22%.

Meanwhile, KBRA said that within its Non-Prime Auto Loan Index that early stage delinquencies ticked up 3 basis points month-over-month while late-stage delinquencies dropped 17 basis points month-over-month, coming in at 5.21% and 2.76%, respectively.

The firm went on to mention that annualized net losses also trended lower in both indices during the month driven by favorable delinquency metrics and a “strong” used-car market, which has helped to keep recovery rates at elevated levels.

“Auto loan prepayment rates rose sharply during the March collection period but came down slightly in April, mirroring a similar trend we have observed in other consumer loan sectors,” analysts said in the report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“As we expected, the rise in prepayment rates was transitory,” they continued. “Based upon our dialogues with market constituents, borrowers used the extra cash received from the third round of stimulus and tax rebates to pay down some of their outstanding debt in March.

“As most of these one-time benefits have started to dissipate, prepayment rates began to fall in April,” KBRA added.

The firm pointed out that an analysis of May’s Reg AB II asset-level disclosures also reflected the its assertion about the normalization from temporary gains in March.

KBRA determined that the percentage of prime and non-prime contract holders who went from 30 days or more delinquent to current during May came in at 38.2% and 30.7%, respectively, representing a drop of 967 basis points in prime pools and 1,418 basis points in non-prime pools versus the previous month.

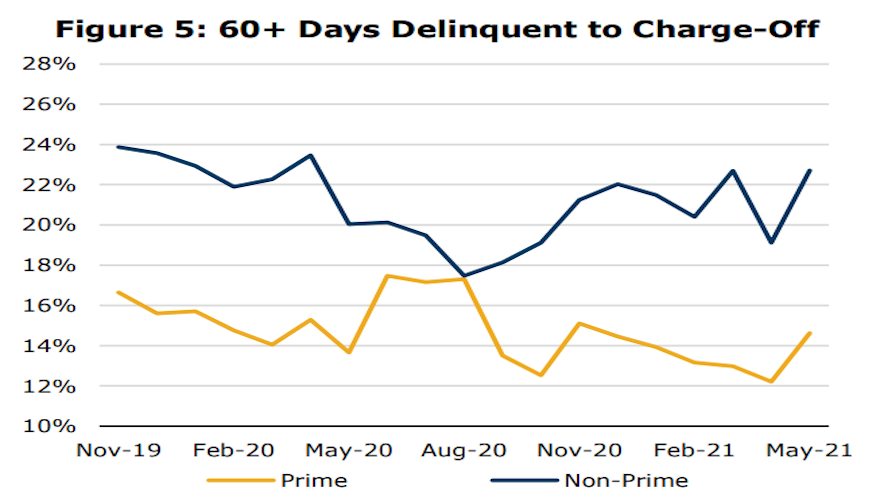

Furthermore, analysts said the percentage of prime contract holders who rolled from 60 days or longer past due to charge-off rose to 14.6%; that’s up 241 basis points month-over-month.

And the non-prime roll rate into charge-off increased 359 basis points to 22.7%

“As the one-time benefits were expended in March, the positive trends in both roll rates quickly reversed in April, returning to their pre-March levels: borrowers no longer had extra money to bring themselves back to current or less delinquent buckets as in March, so they were more likely to stay in their current delinquency buckets, become more delinquent, or enter charge-off,” KBRA said.