Near- and Non-Prime Consumer Update reiterates ongoing affordability challenges

Charts courtesy of Open Lending.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Open Lending Corp. shared more research on Tuesday reinforcing the affordability dilemma many consumers are facing when securing reliable transportation, especially individuals who fall in the near- and non-prime credit tiers.

Using AutoCreditInsight data, Open Lending compiled another Near- and Non-Prime Consumer Update, continuing its quarterly report series on automotive financing trends among near- and non-prime consumers.

The report covers vehicle sales volume, interest rates, payment trends and consumer preferences in the first quarter of 2024.

In addition to national data, this research offers findings on regional near- and non-prime automotive financing.

In the used-vehicle market, Open Lending indicated, low inventory and high prices are disproportionately impacting near- and non-prime consumers nationwide.

In the first quarter, vehicle registrations among prime and super-prime consumers increased by 3% for used and 7% for new compared to Q1 2023.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Meanwhile, vehicle registrations among near- and non-prime customers decreased by 6% for used and climbed just 1% for new, according to Open Lending’s research.

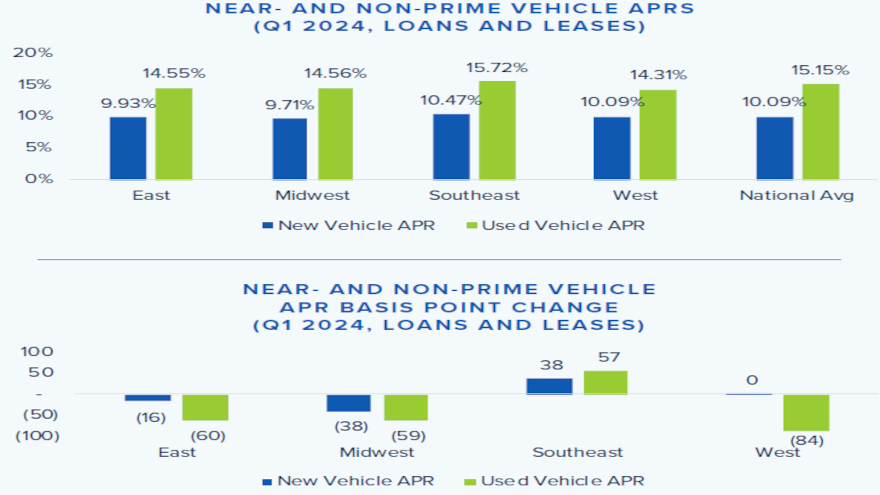

Researchers also found that near- and non-prime consumers are facing regional differences in vehicle affordability.

“March marked the first time in 2024 that new and used vehicle interest rates declined for near- and non-prime consumers. While this is a positive sign, interest rates remain a significant hurdle,” Open Lending said in the report. “Compared to Q1 2023, used vehicle interest rates are still 111 basis points higher, and new vehicle interest rates are 57 basis points higher.”

“The Southeast is experiencing a more pronounced increase in interest rates for new and used vehicles compared to the national average,” Open Lending continued. “Used-vehicle interest rates for near- and non-prime consumers jumped by 125 basis points, surpassing the national rise of 111 basis points. This steeper increase in the Southeast may be contributing to the decrease of used vehicle registrations there.

“In fact, the average interest rates for used and new vehicles in the Southeast are notably higher than the national averages for Q1 2024, which are 57 basis points and 38 basis points, respectively,” the company added.

Open Lending determined average used-vehicle prices are up 6% in Southeast, and average new vehicle prices are up 5% in the West, while the rest of the country has remained relatively flat for new and used models.

“With new vehicle inventories up, new-vehicle registrations for both near- and non-prime consumers, as well as prime, are approaching pre-COVID normalcy. However, the used-vehicle market remains constrained with low inventory and high listing prices that aren’t coming down as fast as one would hope, disproportionately impacting near- and non-prime consumers,” Open Lending said in the report.

“Higher interest rates on used vehicles are pushing these consumers out of the market, widening the gap between near- and non-prime versus prime consumers in a segment they traditionally rely on,” continued the company that offers enablement and risk analytics solutions for financial institutions.

Open Lending also mentioned the Honda Civic remains the top-registered new vehicle and Ford F-Series the top-registered used vehicle among near- and non-prime consumers.

“Across the United States, compact utility vehicles reign supreme as the most popular choice for both new and used vehicles,” Open Lending said in the report. “This trend holds true in all regions. In the East and West, drivers also show a strong preference for upper mid-size and subcompact plus utility vehicles as their second option for new vehicles. The Midwest adds full-size half-ton pickups, making them the second most popular choice for used vehicles.

“While compact cars are another popular choice for new vehicles in the Southeast and West, full-size half-ton pickups take the crown for used vehicles in the Southeast,” the company went on to say.

No matter these metrics involving prices, rate, vehicle preference, Open Lending senior vice president of marketing Kevin Filan said finance companies must be equipped to serve near- and non-prime consumers.

“Although the automotive market shows signs of stabilizing, near- and non-prime consumers remain challenged in the used vehicle market. This is due to tightening availability of credit, persistently high interest rates and vehicle prices, and increased ownership and insurance costs,” said Filan, who is among the experts set to appear during Used Car Week, which begins on Nov. 18 in Scottsdale, Ariz.

“Regardless of credit score, most Americans need reliable vehicles to access good jobs, care for their families, and climb the credit ladder. The automotive lenders who use alternative data, advanced risk analysis and default insurance are better equipped to identify the reliable, underserved near- and non-prime borrowers who will happily exchange their loyalty for more personalized loan pricing,” Filan went on to say.

To access the full report, go to this website.