NY Fed spots spike in auto finance rejections

Chart courtesy of the Federal Reserve Bank of New York.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It’s the heat of summer nationwide, but perhaps you could make the argument that things are frozen when considering auto financing and interest rates.

Evidence of how frosty things might be within auto financing surfaced from the most recent findings of the Survey of Consumer Expectations (SCE) developed by the Federal Reserve Bank of New York.

According to the June SCE Credit Access Survey, the overall rejection rate for credit applicants increased to 21.4% in June, up from 18.7% in February. Officials said the increase was broad based across age and credit score groups.

The New York Fed also noted the application rate for any kind of credit over the past 12 months decreased to 41.2% in June, down from 43.4% in February.

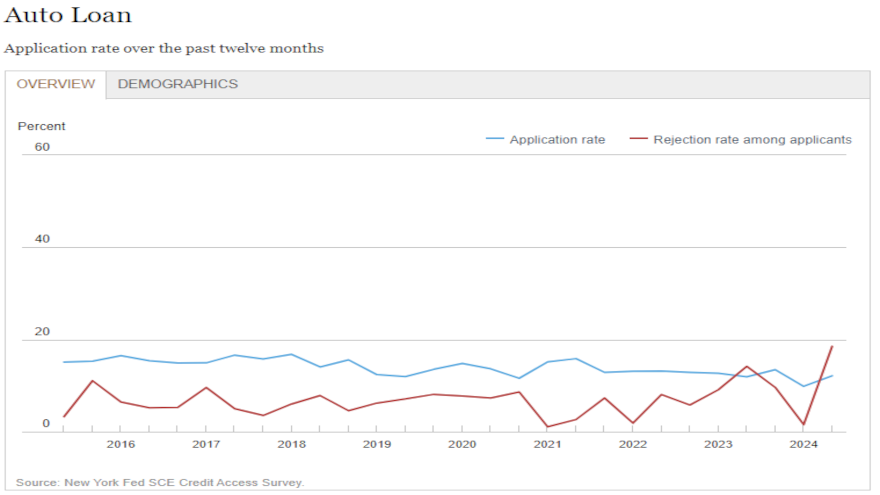

Looking closer at the auto data showed an even chillier landscape.

The New York Fed found that the average reported probability of a credit application being rejected came in at 29.4% for auto financing.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Furthermore, researchers discovered the rejection rate among auto finance applicants spiked to 18.5% in June, up from the February reading that was just 1.5%.

The New York Fed’s database showed this specific metric stood at 14.2% last June and remained below 10% from February 2016 through October 2020.

And before thinking the February reading was an anomaly, that database also indicated the auto finance rejection rate was 1.9% in February 2022 and 1.1% in February 2021.

The New York Fed mentioned the average reported probability of a loan application being rejected moved to 29.1% for credit cards, 34.8% for credit limit increases, 39.6% for mortgages and 29.4% for mortgage refinancing.

Looking ahead, officials said the proportion of respondents who are likely to apply for one or more types of credit over the next 12 months declined slightly in June, slipping to 22.2% from 22.9% in February.

Might credit conditions thaw a bit starting this week when the Federal Reserve has its next meeting and can modify interest rates? Comerica Bank chief economist Bill Adams and senior economist Waran Bhahirethan do not see rate-reduction sunshine arriving until fall.

“The Fed is expected to hold interest rates steady at their July 31 monetary policy decision, but signal to expect a rate cut at the next decision on Sept. 18. Last week’s solid GDP report reassured the Fed that there is no urgency for an immediate rate cut,” Adams and Bhahirethan wrote in an analysis distributed on Monday morning.

“Payrolls growth likely slowed a bit in July from June and registered slightly above the second quarter’s 177,000 monthly average increase. The unemployment rate is expected to hold steady near 4%, indicating a normal margin of slack has returned to the job market. Average hourly earnings likely grew modestly from June and registered the slowest year-over-year increase since 2021,” Adams and Bhahirethan continued.

“The latest Job Openings and Labor Turnover Survey, released at a one-month lag to the jobs report, will likely show churn in the job market was minimal in June. Employers are cautious about hiring, but not making big layoffs either, and far fewer workers are quitting jobs for external opportunities than in 2021 or 2022,” Adams and Bhahirethan went on to say.