A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

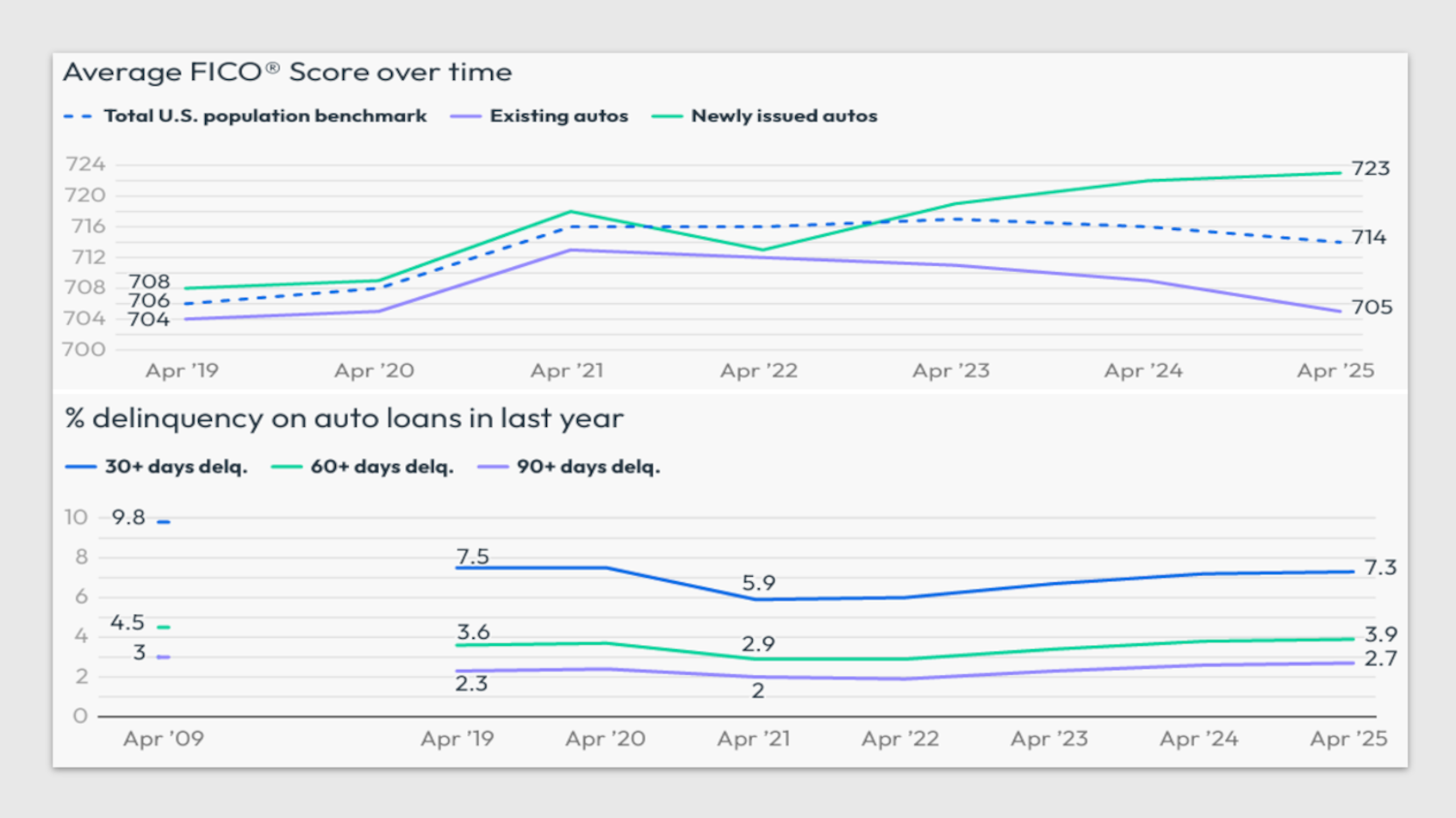

New FICO report shows deterioration of scores among consumers already in auto portfolios

Friday, Sep. 19, 2025, 10:34 AM

SubPrime Auto Finance News Staff

The FICO Score Credit Insights report — a new analysis offering a detailed look at how consumer credit behaviors are evolving across the United States — contained some notable trends about auto financing, especially associated with the consumers already in ... [Read More]

Implications for auto finance as Fed ‘is in a pickle’

Thursday, Sep. 18, 2025, 10:18 AM

Nick Zulovich, Senior Editor

The Federal Reserve “is in a pickle.” That’s the summation from Comerica Bank after the Federal Open Market Committee cut the federal funds target rate a quarter percent to a range of 4.00% to 4.25% on Wednesday. The move by ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Arra Finance closes acquisition of Crescent Bank’s auto-finance division

Wednesday, Sep. 17, 2025, 11:37 AM

SubPrime Auto Finance News Staff

Arra Finance announced via social media on Tuesday that it has closed its acquisition of Crescent Bank’s auto-finance division in a move originally revealed in June. When Arra Finance first announced the acquisition, the subprime auto finance company said Crescent ... [Read More]

Safe-Guard opens expanded facility in SC

Wednesday, Sep. 17, 2025, 11:34 AM

SubPrime Auto Finance News Staff

Safe-Guard Products International now has more brick-and-mortar resources to house its platform for private label protection products for the automotive, RV, marine, and powersports industries. On Tuesday, Safe-Guard said it has opened an expanded call center in Greenville, S.C. Located ... [Read More]

Experts anticipate rate cut, but benefits to automotive still tough to project

Tuesday, Sep. 16, 2025, 09:20 AM

Nick Zulovich, Senior Editor

Experts agree the Federal Reserve’s Federal Open Market Committee (FOMC) will trim interest rates by 25 basis points on Wednesday. How long it will take for that cut to lift the fortunes of dealerships and finance companies is much less ... [Read More]

Fallout from Tricolor bankruptcy intensifies throughout subprime space

Monday, Sep. 15, 2025, 10:48 AM

Nick Zulovich, Senior Editor

Subprime auto financing is getting much more complex, from underwriting to securitizations. Likely connected with fallout from last week’s Tricolor Holdings’ Chapter 7 bankruptcy, Credit Acceptance filed a Form 8-K with the Securities and Exchange Commission on Monday morning, addressing ... [Read More]

KPA elevates CFO to be CEO

Friday, Sep. 12, 2025, 10:40 AM

SubPrime Auto Finance News Staff

On Thursday, KPA promoted one of its top executives to be CEO. The provider of environment, health, and safety and workplace compliance solutions announced the appointment of Michael Bruns as chief executive officer. KPA highlighted Bruns brings more than 30 ... [Read More]

Latest acquisition by APCO Holdings expands footprint into NY

Friday, Sep. 12, 2025, 10:24 AM

SubPrime Auto Finance News Staff

APCO Holdings got back into acquisition mode this week. The provider of F&I products and dealer solutions has acquired the assets of Lawley Automotive Dealer Solutions. The company said this acquisition demonstrates APCO’s commitment to protecting “what moves dealers” and ... [Read More]

PODCAST: Experian on how much auto refinancing is gaining traction

Thursday, Sep. 11, 2025, 09:54 AM

SubPrime Auto Finance News Staff

Melinda Zabritski, Experian’s head of automotive financial insights, said consumers are looking for ways to secure more favorable vehicle financing terms, especially with interest rates leveling out and perhaps a cut coming next week from the Federal Reserve. The base ... [Read More]

ARA committee identifies technology pain points & offers possible remedies

Wednesday, Sep. 10, 2025, 12:01 PM

SubPrime Auto Finance News Staff

The technology committee of the American Recovery Association didn’t just pinpoint what it believes are five of the primary challenges repossession agents face. The group also offered 15 recommendations to help smooth those challenges to foster what it called “a ... [Read More]

X