Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

CFPB hits Toyota Motor Credit with $60M penalty for refund & credit reporting misconduct

Monday, Nov. 20, 2023, 11:13 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) made serious allegations against Toyota Motor Credit Corp., and ordered the captive on Monday to pay $60 million in consumer redress and penalties. The bureau said Toyota Motor Credit received these penalties for operating ... [Read More]

Tekion & Service Payment Plan partner to boost dealer success in F&I

Friday, Nov. 17, 2023, 10:38 AM

SubPrime Auto Finance News Staff

Tekion wants to make F&I easier for dealerships to complete while generating more potential profit. This week, the provider of a cloud-native platform serving the entire automotive ecosystem, announced a partnership with Service Payment Plan (SPP), a provider of 0% ... [Read More]

Allied Solutions’ latest partnership to help credit unions in capital markets

Friday, Nov. 17, 2023, 10:37 AM

SubPrime Auto Finance News Staff

This week, Allied Solutions further expanded its industry relationships and portfolio of growth-focused solutions for credit unions. The latest partnership is with Rhyze Solutions, a newly formed credit union service organization (CUSO) to support lending and capital market operations. Allied ... [Read More]

COMMENTARY: 34% of dealers still lost concerning certain key components of Safeguards Rule compliance

Wednesday, Nov. 15, 2023, 03:58 PM

Ken Hill, 700Credit

Over the last few years there has been plenty of chatter about the new Safeguards Rule that went into effect earlier this year. As has been widely reported, the law requires auto dealerships to obtain clear and informed consent from ... [Read More]

10 operators to serve on new NextGear Dealer Advisory Board

Wednesday, Nov. 15, 2023, 11:06 AM

SubPrime Auto Finance News Staff

NextGear Capital wants to make sure the dealer voice is heard when it comes to floor-planning and other company activities. Last week, building on the success of its inaugural DRIVE Dealer Advisory Board (DRIVE) launched in 2021, NextGear announced members ... [Read More]

KPA and Reynolds forge partnership to boost F&I compliance

Wednesday, Nov. 15, 2023, 11:05 AM

SubPrime Auto Finance News Staff

KPA and Reynolds and Reynolds now are working together to help dealerships comply with state and federal financing requirements. On Wednesday, the companies announced a strategic partnership to provide dealerships greater access to Reynolds’ LAW F&I Libraries across all 50 ... [Read More]

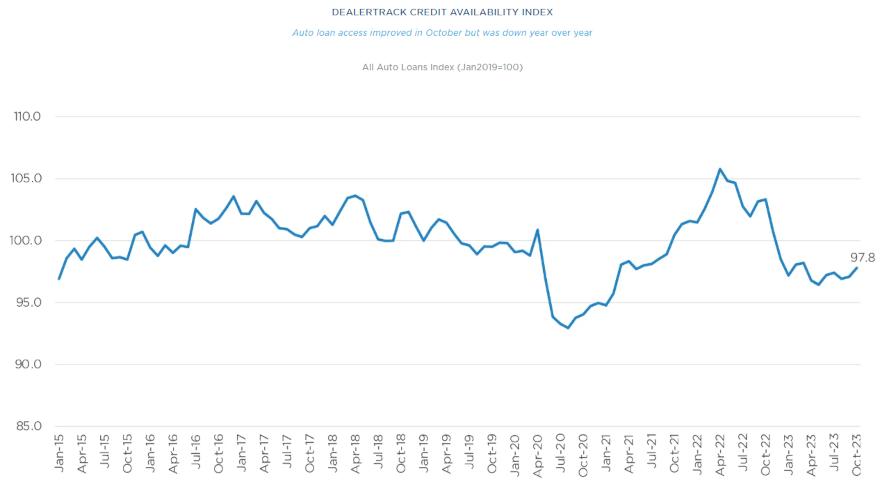

Credit access improves again, but approvals drop near lowest point in 3 years

Tuesday, Nov. 14, 2023, 11:11 AM

SubPrime Auto Finance News Staff

As its experts shared updated trends associated with new-vehicle prices, Cox Automotive also posted its Dealertrack Auto Credit Availability Index for October. Perhaps helping if a non-prime consumer aspires to secure a new vehicle, analysts discovered access to auto credit ... [Read More]

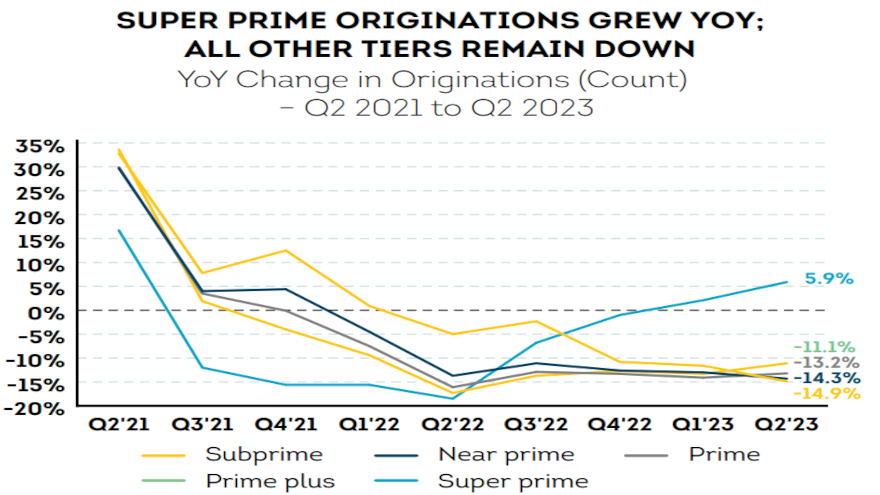

TransUnion spots continued softening of subprime originations as delinquencies jump

Monday, Nov. 13, 2023, 11:54 AM

SubPrime Auto Finance News Staff

The subprime space is continuing to lose momentum as 2023 reaches the short rows of potential originations for dealerships and finance companies. What is gaining steam, however, are delinquencies. For the second consecutive quarter, originations softened across most risk tiers, ... [Read More]

Resolvion partners with AKUVO to boost repossession efficiency

Monday, Nov. 6, 2023, 12:00 PM

SubPrime Auto Finance News Staff

Resolvion, a provider of national repossession management, skip-tracing, remarketing, license plate recognition, and heavy equipment and specialty recovery, announced on Monday a partnership with AKUVO. As an integrated repossession service provider, the partnership will provide Resolvion the opportunity to serve ... [Read More]

Crédito Real USA Finance rebrands as FinBe USA

Friday, Nov. 3, 2023, 09:48 AM

SubPrime Auto Finance News Staff

Crédito Real USA Finance gained new ownership in April. This week, the finance company that specializes in the Hispanic segment got a new brand name. The operation launched its new brand as FinBe USA, what executives explained as representing “a ... [Read More]

X