Report: 70% of consumers plan to buy a car within next 2 years

Charts courtesy of Open Lending.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

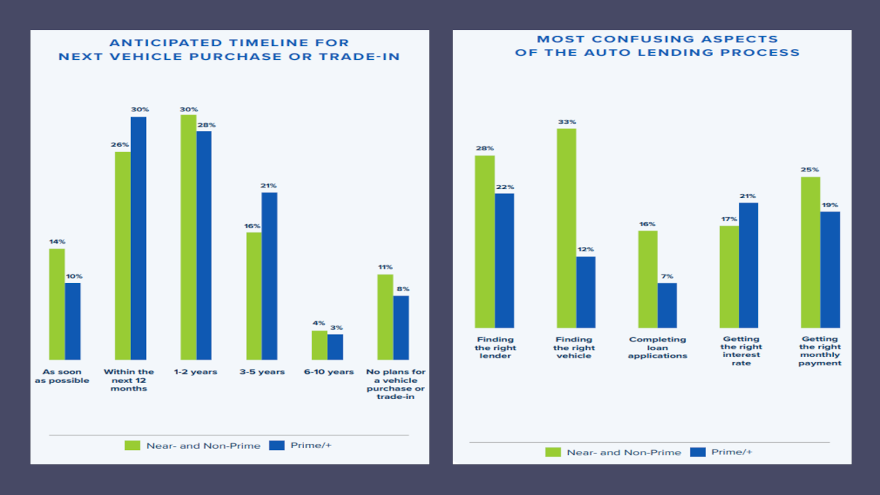

If your finance company chooses to book contracts with near- and non-prime consumers, you’re likely to have a notable pool of potential customers in the next 24 months.

According to the 2025 Vehicle Accessibility Report from Open Lending, 70% of near- and non-prime and prime consumers are planning to buy within the next two years.

“While prime and super prime consumers demonstrate slightly lower intent at 58%, the market remains robust,” Open Lending wrote in the report.

“Lower interest rates are a significant purchase motivator, with 78% of near- and non-prime and prime consumers and 64% of prime and super prime consumers indicating an increased purchase likelihood if interest rates were to lower further,” the provider of automotive lending enablement and risk analytics solutions for financial institutions continued in the finished project released on Friday.

Open Lending explained that these findings and more via survey results from 1,001 U.S.-based adults across generations and credit segments.

And many of those survey participants are leery about the auto-financing process.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The survey pointed out five potential pitfalls consumers see when trying to acquire their next vehicle, with near- and non-prime being especially apprehensive about finding the right vehicle, lender and monthly payment they can handle.

“The auto lending process presents significant challenges for consumers, particularly in navigating complexities like finding the right lender and securing favorable terms,” Open Lending wrote in the report. This confusion “is exacerbated by their lower trust in financing arranged through the dealership across all borrower segments.

“This underscores the critical need for lenders to build strong, trusting relationships with borrowers, regardless of credit score. If banks and credit unions solely focus on attracting prime and super prime consumers, they may overlook the existing trust and loyalty of near- and non-prime consumers, potentially losing market share to competitors,” Open Lending continued.

Released on the heels of the 2024 winners of its second annual Economic Vehicle Accessibility Awards (EVAAs), Open Lending highlighted other key findings from the 2025 Vehicle Accessibility Report, including:

—The cost of vehicle ownership has risen across the board. Underserved consumers are being hit hard. Near- and non-prime borrowers have seen a 56% increase in the median monthly payments for new vehicles from pre-pandemic (2017-2019) to today (2023-2024).

—Consumers who receive a loan decision in seconds are more likely to return to the same lender, with Gen Z consumers showing higher loyalty than any other generation. Resarchers said 71% of those who received instant loan decisions said they were highly likely to return to the same lender for future financial needs. One-third of Gen Zers prefer financing through their home bank or credit union compared to 30% of Millennials and 26% of Gen X and older respondents.

—Early loan payoff remains a key financial goal for vehicle owners, motivated by stability and upgrade potential. The report indicated 61% of vehicle owners plan to pay off their loans early, and 84% believe early loan payment improves their ability to upgrade or replace their existing vehicle.

“Automotive lenders are facing a delicate balancing act to meet rising consumer demand while addressing affordability challenges,” Open Lending senior vice president of marketing Kevin Filan said in news release. “At the same time, consumers’ priorities are changing with more borrowers focusing on paying off their loans early, improving their credit scores, and establishing long-term financial stability.

“For financial institutions, this is an opportunity to build trust and loyalty through a focus on fast, fair, flexible and flawless lending,” Filan continued. “Using lending enablement solutions and technology like our Lenders Protection platform allows lenders to make faster, smarter decisions, helps them provide greater access to more affordable financing and is critical to creating lasting customer relationships that drive sustainable business growth.”

You can access the full 2025 Vehicle Accessibility Report here.