Subprime softens even more in new-car world

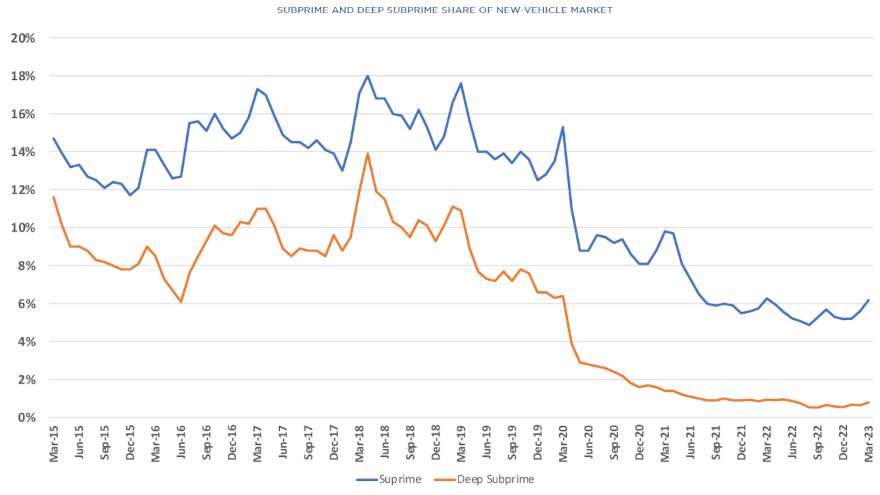

Subprime and deep subprime share of new-vehicle market. Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Dealerships and auto finance companies already were not completing many deliveries and installment contracts for new vehicles with consumers who fell into the subprime and deep subprime credit tiers.

Now following the significant jump in interest rates, Cox Automotive pinpointed just how small the lowest credit tiers constitute in the new-model market.

In 2018, Cox Automotive said subprime buyers “routinely” made up more than 14% of new-vehicle sales, while deep subprime buyers were close to 10% of the market.

“That began shifting in 2019, and in the spring of 2020, when the pandemic hit with full force. Buyers with lower credit scores began to fall out of the market,” analysts said in a Data Point posted last week.

Now with the Federal Reserve pushing the federal funds rate to 5%, Cox Automotive said subprime buyers account for roughly 6% of new-vehicle sales with deep subprime consumers representing less than 2%.

“High auto loan rates have drastically reduced the number of subprime and deep subprime shoppers closing deals each month in the new-vehicle market,” analysts said. “In turn, as fewer low-credit-score buyers enter the market, the automakers continue to tilt their product portfolios to more profitable, higher-revenue products targeting who’s left: High income, high-credit-score buyers.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.