TransUnion: Affordability concerning as originations sag

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

After sifting through the latest quarterly data, one finding became clear to Satyan Merchant, who is senior vice president and automotive and mortgage business leader at TransUnion.

“Affordability remains an issue in the used-vehicle market,” Merchant said in a news release as TransUnion shared its Q4 2023 Quarterly Credit Industry Insights Report (CIIR) on Thursday.

Reiterating that originations are viewed one quarter in arrears to account for reporting lag, TransUnion reported the industry sustained a 4% year-over-year decline as booked contracts totaled 6.3 million.

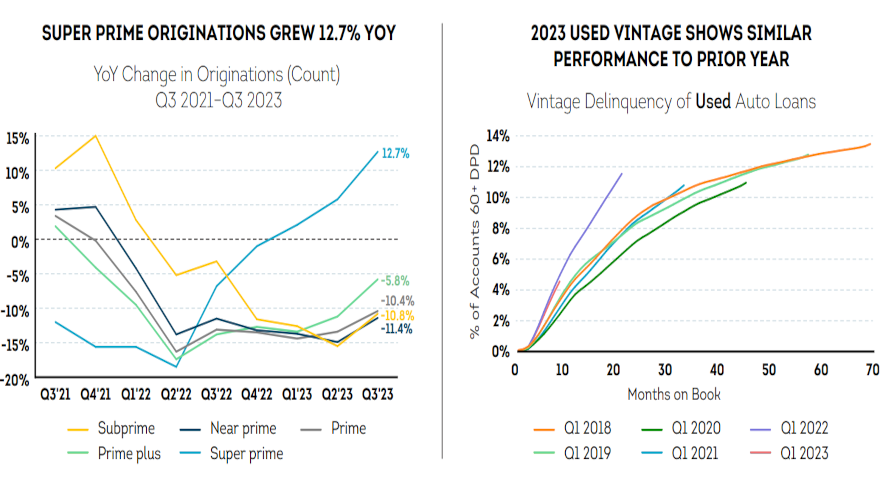

Among risk tiers, TransUnion noticed originations rose 13% year-over-year among super prime buyers, but were down among all other risk tiers.

Furthermore, analysts pointed out originations are off “significantly” when compared to pre-pandemic levels in 2019.

TransUnion determined the new-versus-used share continues to slowly trend back down toward pre-pandemic levels, with used cars representing 58% of vehicles financed in Q4.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While still well below pre-pandemic levels, analysts mentioned the leasing market continues its slow recovery, driven in part by more normalized inventories.

TransUnion said 22% of newly registered vehicles were leased in Q4, up from 17% one year prior.

Analysts determined the average amount financed declined year-over-year for both new and used vehicles.

The average amount financed for a new vehicle dropped 3.0% year-over-year to $40,665, while the average amount financed for a used car decreased 3.3% to $26,557.

And perhaps pointing to that affordability issue, TransUnion indicated monthly payment amounts rose 1.8% for new vehicles and 1.1% for used cars.

As far as portfolio health, TransUnion spotted another rise in the 60-day delinquency rate as it came in at 1.61% to close 2023. That’s up from 1.43% at the end of 2022.

“New vintages continue to show consistent delinquency performance when compared to the pre-pandemic periods of 2018-2019,” TransUnion said.

What do the trends and data mean for your operation?

Here again is Merchant, who also can be heard in an upcoming episode of the Auto Remarketing Podcast recorded in Las Vegas at this year’s Vehicle Finance Conference hosted by the American Financial Services Association.

“New-vehicle inventory continues to see recovery from pandemic-era lows, although some brands still face lingering shortages,” Merchant said through Thursday’s news release. “These inventory recoveries will likely be followed by ongoing increases in consumer incentives, which should help mitigate affordability challenges in the new-vehicle segment.

“Affordability remains an issue in the used-vehicle market and for below prime consumers as we continue to see higher interest rates and the effects of inflation and used vehicle values remain elevated,” he continued. “While originations remain down YoY, the growth by super prime borrowers may be an early indicator of pent-up demand for vehicles, and that additional inventory and incentives may drive origination growth among additional risk tiers moving forward.”

Examining personal loans

Looking at a business line that some finance companies have in tandem with their auto department, TransUnion reported that total unsecured loan balances grew for the 11th consecutive quarter to a record of $245 billion in Q4, representing a year-over-year increase of 10.5%.

Analysts indicated balance growth was seen across all risk tiers, led by super prime at 35% growth year-over-year.

TransUnion found that the average account balance grew by 6.2% year-over-year to a record $8,704, led by increases in subprime (11.4%) and followed by super prime (7.6%).

Analysts noticed originations fell by 10.3% year-over-year from record levels in 2022, and that was reflected in new account balances, which were down 14.6% year-over-year to $33 billion.

TransUnion said all risk tiers except for super prime sustained declines in new account balances.

While balances and originations rise, analysts pointed out that 60-day delinquency improved year-over-year, ticking down to 3.9% in Q3 2023 from 4.1% a year earlier, saying the development was “reflecting an originations mix shift to lower-risk borrowers due to lender tightening over the past several quarters.”

On a vintage basis, TranUnion indicated performance for the Q4 2022 new account vintage (through November 2023) improved versus the Q4 2021 cohort over a similar time period but still had an elevated 60-day delinquency rate at the account level compared to earlier vintages.

Liz Pagel, senior vice president of consumer lending at TransUnion, elaborated about the latest data and trends.

“With interest rates eventually lowering over the course of 2024, there could be a gradual thaw in the unsecured personal loans market,” Pagel said in the news release. “However, lenders and investors will be watching delinquency rates closely, and will hope to see continued improvements in overall and vintage performance. In the meantime, lenders will continue to compete for lower risk consumers.”

TransUnion is hosting a free webinar to expand on more findings. Registration for the session can be completed here.