TransUnion: Originations soften as new average balances jump 15%

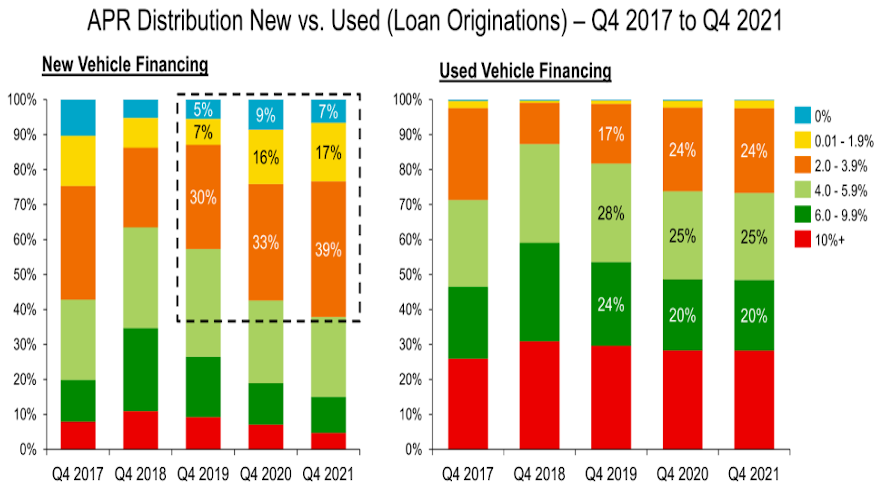

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The automotive portion of TransUnion’s newly released Q1 2022 Quarterly Credit Industry Insights Report (CIIR) gave context from the financing side about how tight vehicle inventories are impacting the entire industry.

TransUnion said on Thursday that origination volumes in Q4 2021 dropped to 6.5 million, representing a decrease of 3.0% year-over-year.

Despite that drop, analysts acknowledged those available vehicles are moving off dealer lots at a quick rate. TransUnion explained these issues also have continued to erode vehicle affordability with the average balance of newly originated contracts reaching $28,415 in Q1 2022, marking year-over-year increase of 15.2%.

TransUnion calculated that this rise has pushed the average monthly payment of vehicle purchases (including both new and used vehicles) to $556, an increase of approximately $100 over a four-year period.

Satyan Merchant, senior vice president and automotive business leader at TransUnion, pointed out in a news release that dealer inventory continues to remain tight and has been further impacted by international pressures on the supply chain, including the war in Ukraine and COVID-19 lockdowns in China.

“Supply shortages have driven up vehicle prices and the shutdown of international factories will lead to a growing lack of inventory throughout the remainder of the year,” Merchant said in the news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“On top of the increasing prices of vehicles, rising inflation will also have an impact on consumer purchasing power,” he continued. “To help keep monthly payments in check, we anticipate some lenders may offer consumers options such as lengthened loan terms to offset affordability challenges.”

Q1 2022 Auto Loan Trends

|

Auto Lending Metric |

Q1 2022 |

Q1 2021 |

Q1 2020 |

Q1 2019 |

|

Number of Auto Loans |

81.5 million |

83.3 million |

83.8 million |

82.2 million |

|

Borrower-Level Delinquency Rate (60+ DPD) |

1.63% |

1.52% |

1.37% |

1.32% |

|

Prior Quarter Originations* |

6.5 million |

6.7 million |

6.9 million |

6.7 million |

|

Average Monthly Payment** |

$556 |

$492 |

$465 |

$458 |

|

Average Balance of New Auto Loans* |

$28,415 |

$24,664 |

$22,752 |

$22,117 |

|

Average Debt Per Borrower |

$21,517 |

$19,980 |

$19,256 |

$18,826 |

*Note: Originations are viewed one quarter in arrears to account for reporting lag.

**Data from S&P Global MobilityAutoCreditInsight, viewed one quarter in arrears.

Source: TransUnion

Update on personal loans

A financial solution sometimes used by subprime consumers, the new TransUnion report showed that despite an uptick, personal loan delinquencies remain below pre-pandemic levels

Analysts reported that the serious delinquency rate (60 days or more past due) at the borrower level moved higher slightly in Q1 2022, increasing from 2.68% to 3.25% year-over-year.

“This growth was predominantly due to the growing share of balances held by below prime consumers,” TransUnion said. “However, delinquency rates remain at healthy levels and are below pre-pandemic highs.”

Analysts discovered total balances reached a milestone high of $178 billion in Q1 2022 and grew 23.8% year-over-year, the fastest rate of growth since Q2 2016.

TransUnion explained this growth was driven by a 12.2% year-over-year increase to the average balance per consumer, which reached $9,896 in Q1 2022.

Analysts added the number of consumers carrying a balance also grew for the third consecutive quarter, landing at 20.4 million in Q1 2022 and just below the peak of 20.9 million consumers in Q1 2020.

“Lenders are cautiously expanding back into the non-prime segment of the market with Q4 origination risk tier distribution very closely resembling the levels seen pre-pandemic,” Liz Pagel, senior vice president and consumer lending business leader at TransUnion. Inflation is putting pressure on all consumers which will likely drive continued growth across risk tiers, as consumers seek credit to finance specific purchases or for debt consolidation.

“While investor demand is still driving growth, rising interest rates and uncertainty about the economy could dampen some of this growth,” Pagel continued in the news release. “Lenders will continue to monitor performance of subprime and near prime consumers across their portfolios for signs of deterioration as they continue to lend in this segment.”

Q1 2022 Unsecured Personal Loan Trends

|

Personal Loan Metric |

Q1 2022 |

Q1 2021 |

Q1 2020 |

Q1 2019 |

|

Total Balances |

$178 billion |

$144 billion |

$159 billion |

$139 billion |

|

Number of Unsecured Personal Loans |

23.9 million |

20.8 million |

23.5 million |

21.4 million |

|

Number of Consumers with Unsecured Personal Loans |

20.4 million |

19.0 million |

20.9 million |

19.3 million |

|

Account-Level Delinquency Rate (90+ DPD) |

2.01% |

1.76% |

2.35% |

2.48% |

|

Borrower-Level Delinquency Rate (60+ DPD) |

3.25% |

2.68% |

3.41% |

3.50% |

|

Average Debt Per Borrower |

$9,896 |

$8,817 |

$8,820 |

$8,363 |

|

Prior Quarter Originations* |

5.7 million |

4.2 million |

5.2 million |

5.0 million |

|

Average Balance of New Unsecured Personal Loans* |

$6,656 |

$5,155 |

$5,548 |

$5,332 |

*Note: Originations are viewed one quarter in arrears to account for reporting lag.

Source: TransUnion

Overall credit trends

In addition to consumer spend approaching pre-pandemic levels, TransUnion said consumer liquidity remains stable.

Analysts explained aggregate excess payment (AEP) — the excess amount a consumer makes over the minimum amounts due on all their credit accounts — is typically an indication of a consumer’s ability to manage their overall debt payments.

In Q1 2022, TransUnion reported average AEP was $328, remaining relatively flat from the $326 observed in Q1 2021. The current level remains above the average AEP levels seen pre-pandemic.

“Compared to a year ago, the price of everything from filling a gas tank to buying a carton of eggs has increased due to inflation. Since wages of many consumers have not kept up with inflation, people are spending more to get less,” said Michele Raneri, vice president of research and consulting at TransUnion.

“However, there are several positives to note, including low unemployment, lenders increasing access to credit, and strong consumer performance,” Raneri continued. “These are all indications that consumers are well positioned as the economy continues to find its footing from the financial volatility of the pandemic.”

Raneri mentioned another sign that consumer credit health remains healthy.

TransUnion’s Credit Industry Indicator (CII) increased to 116 in Q1 2022 – up from 115 in the previous quarter and 105 one year ago.

Raneri explained the CII offers a comprehensive view of consumer credit health through aggregated credit data, including supply, demand, usage and performance, to show the overall picture of whether the credit market is improving or deteriorating. It also provides a view of the impact of economic market events, including inflation, on consumers.

In addition to consumer credit health maintaining a healthy level, there has not been a material impact to consumer performance. TransUnion pointed out that serious delinquency rates across mortgage, auto, credit card and personal loans have stayed relatively flat in the wake of expired forbearance programs or rolled back accommodation programs.

“Consumers are continuing to perform well on their credit and debt obligations — even when faced with several macroeconomic factors that are influencing affordability,” Raneri said.

“Factors such as rising interest rates could affect the monthly payment amounts for some consumers, but we are currently seeing that they are continuing to make payments, sometimes even in excess, of what is required,” she went on to say.

For more information about the report, register for the Q1 2022 Quarterly Credit Industry Insights Report webinar via this website.