While auto credit loosened in March, deeper details tell different stories

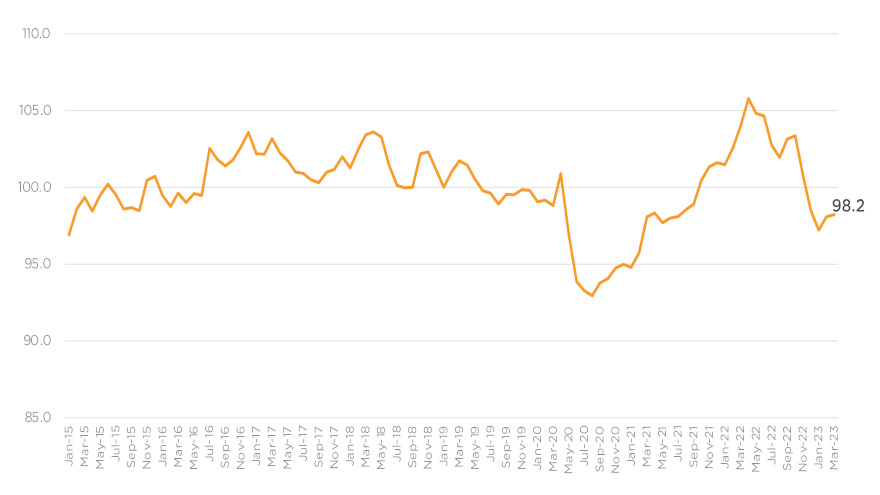

Dealertrack Credit Availability Index for March. Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Along with examining the employment scene, Cox Automotive tried to decipher how easily dealerships could get contracts bought in March by their networks of finance companies.

According to the Dealertrack Credit Availability Index, access to auto credit loosened slightly in March, which included the failure of multiple banks.

Cox Automotive reported the index increased 0.2% to 98.2 in March, reflecting that auto credit was easier to get in the month compared to February. But analysts noted that access was tighter by 5.5% year-over-year. And compared to February 2020, access was tighter by 1.0%.

“The aggregate measure masked varied moves happening in vehicle channels and by lender,” Cox Automotive said in its commentary that accompanied the index update.

“Movement in credit availability factors was mixed in March,” analysts continued. “Yield spreads widened and average terms shortened, and those moves limited credit access for consumers. However, the approval rate increased, and the subprime share increased, and those moves expanded credit access for consumers. Other factors were little changed from February.

“Within the month, credit had tightened more initially following the failure of Silicon Valley Bank, most notably with yield spreads widening even more. However, by the end of the month, yield spreads narrowed some, and more variation in approach by lender and by channel became more significant,” analysts went on to say.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive indicated that for the full month, the average yield spread on auto paper expanded by 55 basis points, so rates consumers agreed to on their installment contracts signed in March were less attractive in March relative to bond yields.

In fact, Cox Automotive discovered the average interest rate on contract booked in March increased by 43 basis points month-over-month. And at the same time, the five-year U.S. Treasury note declined by 12 basis points, resulting in a wider average observed yield spread, according to Cox Automotive.

A few other notable data points from Cox Automotive included that the approval contract rate increased by 0.5 percentage points in March but softened 1.9 percentage points year-over-year.

Analysts said the subprime share rose to 13.4% from 11.9% in February but was off by 1.0 percentage points year-over-year.

Cox Automotive also noticed the share of contract with terms longer than 72 month declined 0.3 percentage points month-over-month and 0.5 percentage points year-over-year.

Beyond the numbers, Cox Automotive spotted differences in moves involving new-model financing versus the used-vehicle financing.

“The differences in the new-vehicle market compared to the used-vehicle market and comparing banks and captives to credit unions and finance companies suggest shifts in risk strategy may be behind the contrasting moves,” Cox Automotive said. “Captives and banks play a much larger role in the new market than in the used market. The credit profile in the new market also skews to higher credit quality consumers.

“While yield spreads widened for all types of loans and for all lenders, they widened the least in new loans. By lender, captives widened the least, and all other lender types widened yield spreads substantially,” analysts continued.

“The varied moves reflect the benefits of having a large, diversified and professional auto credit market in the United States. No type of lender dominates the market, so when economic and financial market circumstances change, differing strategies and perspectives can lead to some lenders pulling back. In contrast, other lenders see opportunities to grow. The fact that yield spreads widened suggests that most lenders are being compensated for taking on more risk,” Cox Automotive went on to say.

Cox Automotive reiterated each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.

A look at the job market

Earlier this week, Cox Automotive chief economist Jonathan Smoke dissected the latest employment data from federal officials in his weekly blog.

Smoke said the economy created 236,000 jobs in March, topping the expectation of 230,000 new positions with leisure and hospitality and education and health services posting the largest gains.

Smoke also noted auto dealers shed 600 jobs in March, which left employment at dealers down 38,500 or 4.1% below the February 2020 level. Total payrolls now exceed February 2020 payrolls by 3.2 million or 2.1%.

All told, Smoke said the overall unemployment rate came in at 3.5% in March.

“The latest employment report presented another mixed view of the labor market. Job growth in March decelerated again, but the unemployment rate increased, and wage growth decelerated. Goods-related industries are shedding jobs while services add jobs. The labor market is cooling down, but likely not enough for the Fed,” Smoke said.

“Jobless claims are higher than previously reported this year. Continuing claims are now up from a year ago and compared to pre-pandemic levels. However, relative to the job base, claims remain low,” he continued.

“The labor market is not as strong as it was a year ago, and we are seeing more deterioration in the jobless claims data. However, jobless claims remain at historically low levels relative to the job base,” Smoke went on to say.