Is Chrysler IPO on Hold?

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TURIN, Italy –

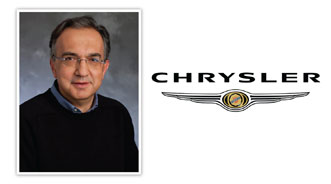

Could Chrysler’s initial public offering be delayed? At least one report coming out of Fiat’s annual shareholders meeting has top executive Sergio Marchionne saying as much.

During the shareholders meeting, he apparently told reporters that the IPO would be dependent upon the cash needs of Chrysler and the United Auto Workers health care trust. The trust holds significant ownership in Chrysler.

"If those two needs are not there, then the IPO of Chrysler may or may not become relevant," Marchionne told reporters.

However, he carefully went on to say, "It is rational, maybe reasonable, to expect that there will be an IPO. It can’t be done very quickly. We just filed with the SEC, we’re still working our way through the comments. We have to get ready to be a public company again, and issuing securities takes time. We should do it properly."

This appears to be much more cautious language than when he previously spoke on an IPO, indicating it could likely be before the end of the year.

In the official report out of the meeting, the company revealed, “The Shareholders of Fiat S.p.A., which met today in an ordinary general meeting, approved the 2010 statutory financial statements and distribution of a gross dividend of 0.09 Euro per ordinary share, 0.31 Euro per preference share and 0.31 Euro per savings share, payable from April 21 with the coupon detachment on April 18.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Moreover, the company said shareholders renewed authorization for the purchase and disposal of own shares, including through subsidiaries, at the same time revoking the authorization given at the general meeting on March 26, 2010.

Officials explained, “The authorization is for the purchase of a maximum number of shares for all three classes not to exceed the legally established percentage of share capital, inclusive of existing reserves (289 million Euro) for shares. As already announced, the buy-back program is on hold and buy-backs are not obligatory. The authorization allows shares to be purchased over the next 18 months in accordance with the terms and procedures established by law and the purchase price must be within 10 percent (above or below) of the reference price reported by the Stock Exchange on the date prior to the purchase.”

Finally, shareholders appointed Reconta Ernst & Young as independent auditors for the nine-year period of Jan. 1, 2012, to Dec. 31, 2020.