Automotive Ventures involved in Lender Compliance Technologies raising $4.15M in Series A funding

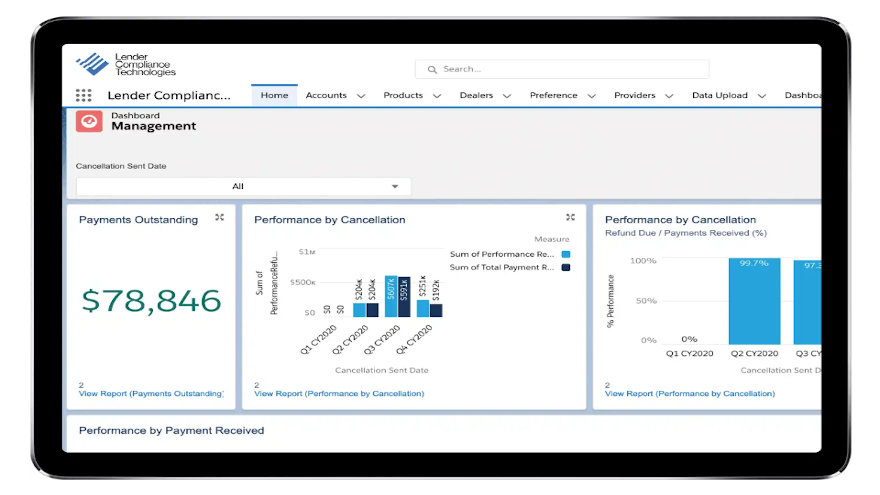

Screenshot courtesy of Lender Compliance Technologies.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

DALLAS –

It’s been an active month for Automotive Ventures.

Two weeks ago, chief executive officer and founder Steve Greenfield announced the final closing of the firm’s inaugural venture fund. Then according to a news release distributed on Wednesday, Automotive Ventures’ name surfaced again as it was involved with Lender Compliance Technologies (LCT) — a company that specializes in compliance solutions for automotive, RV, marine, and powersports finance companies — raising $4.15 million in a Series A funding round.

The round was led by a team of seasoned software entrepreneurs and joined by Automotive Ventures and Driven Capital Partners for the ongoing development of technology solutions to help finance companies mitigate regulatory risks.

This announcement comes on the heels of the launch of LCT’s Refund Control, a compliance-controlled compliance solution for F&I product cancellations and refunds, and the close of Automotive Ventures Fund I, an inaugural venture fund created by Automotive Ventures to support early-stage automotive technology companies.

“Banks, credit unions, and finance companies face increasingly stringent controls today,” Greenfield said in the news release. “Consumer F&I product cancellations and credits are tedious and if handled improperly, expose lenders to hefty fines and damaged reputations.

“Automotive Ventures, along with a syndicate of software entrepreneurs and Driven Capital Partners, invested in LCT because the company’s robust platform provides end-to-end services to simplify, automate, and streamline this process,” he continued. “With nearly 40 million F&I products purchased by consumers each year, the market is huge and the risks are significant. LCT helps mitigate these risks for lenders.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Lender Compliance Technology’s flagship product, Refund Control, was introduced in April and is currently in the pre-sales phase, with official U.S. rollout scheduled in a few weeks, according to LCT president Glenn Munro, of and a 20+-year financial services industry veteran,

Munro said Refund Control is just the beginning of technology-driven solutions to help finance companies remain compliant across various aspects of their business.

“There has never been a more important time for lenders to successfully manage and navigate the many consumer regulations they face,” said Munro, who has been an executive in financial services for more than 20 years. “Vehicle industries are challenged in the wake of the pandemic and lending professionals need every available resource to mitigate risk.

“This funding from our trusted investment partners enables us to develop a full compliance roadmap and accompanying software solutions,” he continued. “Our ultimate goal is to help lenders provide their industry clients and vehicle consumers with an unparalleled level of service that meets regulatory requirements at every turn.”

Last week, Greenfield appeared again on the Auto Remarketing Podcast to discuss the latest activities at Automotive Ventures. That episode is available in the window below.