Suggestions for pushing EVs & AVs based on Ipsos’ latest Mobility Navigator Study

Chart courtesy of Ipsos.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

For years, Ipsos pointed out that automakers have talked about electric vehicles and autonomous driving as two connected parts of the future of vehicles.

But new research released by Ipsos on Thursday indicated that OEMs might be better off if they talked about these kinds of models separately.

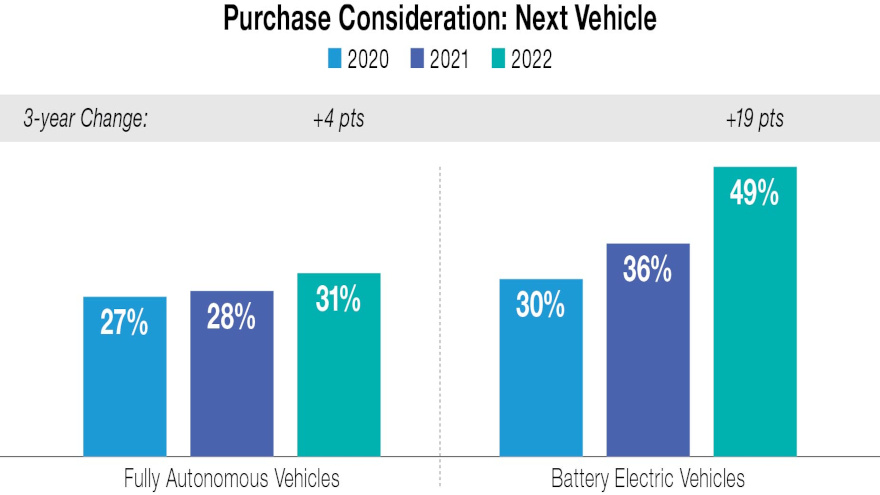

Ipsos’ latest Mobility Navigator Study showed that while almost half of drivers (49%) say they’re interested in an EV for their next vehicle, only 31% would be interested in a fully autonomous car.

And Ipsos determined people are growing more interested in EVs every year, while interest in self-driving cars remains stubbornly low.

“Combining electrification and autonomous as a bundled technology advancement may not be a match made in heaven,” said Chance Parker, vice president of U.S. automotive and mobility development at Ipsos. “Dedicated education about autonomous vehicles with a clear safety benefit can help reduce misconceptions and improve trial and acceptance across all generations.”

However, Ipsos isn’t implying people aren’t interested in any new driving technology to help them on the road.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

More than 60% of consumers in the study said they are interested in individual features like accident avoidance, night/all-weather vision and advanced driver assistance, which Ipsos noted as key advancements in driving technology.

Experts pointed out vehicles today offer more potential interactions for the driver, raising concerns over the level of driver distraction, and these worries are becoming a common issue.

In a U.S. poll of 1,000 adults conducted in 2021, Ipsos found that drivers believe they encounter a distracted driver in one of every two drives they take.

In addition to identifying which features and technology generate the most interest among consumers, the new Ipsos study results also reaffirm that the auto industry is facing a potentially sticky generation gap regarding these transformational technologies.

The latest Mobility Navigator data on electric vehicles shows a dramatic difference in attitudes toward electric vehicles by generation. Millennials and Gen Z consumers are much more positive about electric vehicles than their Boomer counterparts, according to Ipsos.

And when consumers are asked about autonomous driving technology, Parker noted the same gap emerges and may be getting worse.

“Differences in attitudes toward new technology between younger and older consumers are not new — but these technologies aren’t simply features than can be used or ignored as you see fit,” Parker said.

“Instead, both technologies completely change your relationship with your vehicle. Given the billions of dollars being poured into both technologies, the stakes are extremely high,” Parker continued

Ipsos mentioned another finding with far-reaching ramifications.

The study found that consumers ultimately want control of autonomous technology. Even those consumers who are pro-autonomous driving vehicles express that there is a time and place for it, since three out of four consumers who would consider autonomous technology say they would only want to use it in certain circumstances.

“This will also require more education for consumers, so they better understand and trust the technology,” Ipsos said. “And until full autonomy is embedded and accepted, it will mean that consumers need user-friendly controls and interfaces with which to control the autonomous tech in their vehicle.”

To learn more about the study, go to this website or watch an on-demand webinar.