Brand loyalty bounces back as inventory, return-to-market rise

Image courtesy of S&P Global Mobility.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Brand loyalty is back.

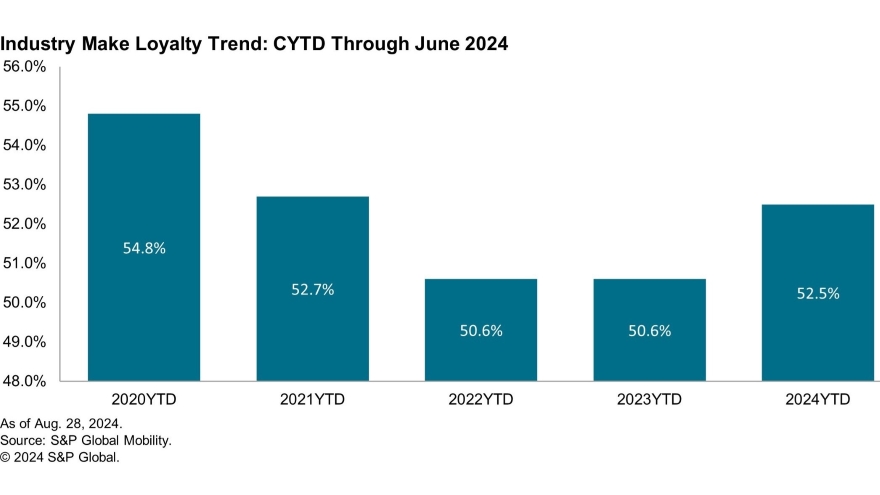

After three years of declines or zero growth, auto industry brand loyalty rates rose in the first half of 2024, according to S&P Global Mobility’s latest analysis of new vehicle registration data.

The study showed the loyalty rate through June was 52.5%, up 1.9 percentage points from the first half of 2023 and the first year-over-year increase since 2020.

In a news release, S&P called it “a positive sign for the industry” following four years of after several down years due to inventory shortages and post-pandemic recovery.

Loyalty for more than half of automotive brands were up 1 percentage point or better from 2023, with mainstream brands rising 1.9 percentage points on average and luxury brands up 1.4.

S&P Global Mobility associate director of loyalty product management Vince Palomarez said growing inventory levels and a strong pipeline of return-to-market households were the primary factors in the loyalty gains.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Last year we saw a big jump in the number of households returning to market for a new vehicle, but the inventory was lacking,” he said. “This year, return-to-market volume remains consistent but inventory levels are up more than 40%, so households have more opportunity to remain loyal to their previous brand.”

Tesla again led all brands in customer loyalty in the first half of 2024, with 67.8% of Tesla owners returning for another Tesla. All of the EV manufacturer’s models retained more than 60% of their previous owners, led by the Model 3 at 72.1%.

“Tesla has historically been a brand with strong loyal ties among its consumer base, despite a limited product portfolio,” Palomarez said. “Changes in BEV prioritization among other OEMs along with Tesla’s directive to cut pricing when needed have kept households from defecting.”

General Motors led all multi-brand manufacturers at 67.7%, while Jaguar, Land Rover and Lincoln had the largest year-over-year gains, improving their loyalty rates by more than 6 percentage points.

One result of the increase in brand loyalty was a drop in conquest sales. Mainstream brands fell 1% and luxury brand conquests were down 6.4% from the first half of 2023, when that sector’s conquests soared by 18%.

“The positive jump in loyalty came at the expense of conquests,” S&P Global Mobility associate director for loyalty solutions and industry analysis Tom Libby said. “Past years have shown that increases in both loyalty and conquests are possible if the pool of return-to-market rises as well. The first half of 2024 showed little to no change in return to market, so either loyalty or conquest were going to be affected.”