Lane watch: Favorable trends for dealers starting to gain stronger foothold

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book highlighted a trio of trends in its latest installment of Market Insights that could be favorable for dealers as they navigate the last 45 days of 2024.

Analysts said wholesale prices softened another 0.54% last week, while the auction conversion remained stable at 58% for the third straight week.

Furthermore, Black Book noticed its estimated used retail days to turn dropped for the fourth week in a row and is now at roughly 48 days.

“Over the past three weeks, the overall conversion rate has remained stable, though transaction prices are beginning to soften, causing an increase in the market’s overall depreciation rate,” Black Book said in the new report released on Tuesday. “The car segments saw a deceleration in depreciation, significantly influenced by the reduced rate of decline in the budget-friendly compact car category.

“Additionally, there was a noted rise in auction inventory compared to the prior week,” analysts added.

“Following the election, there is considerable discussion in the industry regarding how the change in administration might affect the sector, particularly concerning the future of electric vehicles,” Black Book said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

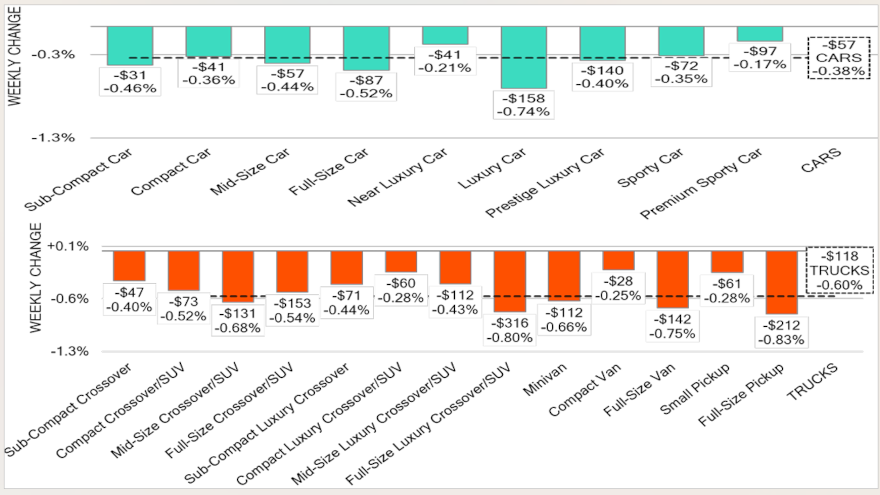

Looking at some individual vehicle segments, Black Book mentioned one from the car side and another from the truck world making notable movements.

Analysts said luxury cars paced the depreciation readings among cars, sliding by 0.74%. Black Book indicated the car segment has had an average weekly value decline of 0.65% during the past six weeks.

Analysts also found that prices for full-size pickups dropped by 0.83% last week, representing the largest single week’s decline for those units since the middle of July. And Black Book said values for full-size pickups between 8 and 16 years old tumbled by 1%.

All told, prices decreased for all 22 car and truck segments that Black Book tracks.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book said.