Deloitte survey shows hybrids poised to pounce on ‘EV inertia’

Image courtesy of Deloitte.

U.S. consumers seeking a more fuel-efficient and cost-effective alternative to traditional gas-powered cars are now looking at hybrids rather than battery electric vehicles, according to a new study by Deloitte.

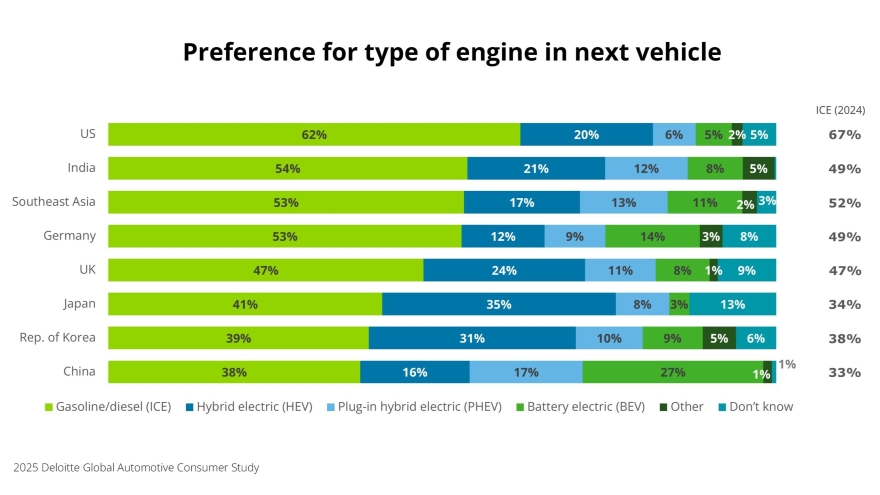

The accounting/consulting firm’s 2025 Global Automotive Consumer Study found American consumer intent to purchase a hybrid or plug-in hybrid for their next vehicle rose 5 percentage points from the 2024 survey to 26% of respondents. Not coincidentally, intent to buy a gas vehicle fell — you guessed it — 5 percentage points to 62%.

EV intent, meanwhile, remained relatively flat at 5% of the respondents, down 1%, signaling what Deloitte called “BEV inertia”, leading consumers seek a “best of both worlds solution for reducing fuel costs and emissions.”

The survey showed lowering fuel costs to be the No. 1 reason among U.S. consumers for buying an EV, cited by 56%, ahead of environmental considerations (44%) and the driving experience (36%).

Available battery driving range remains a major concern 49%, along with the time required for charging (46%) and cost (44%). But Deloitte said range anxiety might be overstated by consumers based on other survey results.

For one, 35% of those surveyed said they travel 60 or more miles from their home just once or twice a month, and 23% said they never travel that far. And 79% of EV intenders plan to charge their vehicle at home.

Deloitte said that indicates calls for public charging infrastructure development might be exaggerated given the reality of charging intentions, driving distances and increasing EV range. On the other hand, 58% of EV intenders currently do not have access to a dedicated EV charger, which Deloitte said shows a need to focus on making it easy and affordable for drivers to install a home charger.

The survey also showed a decline in brand loyalty among U.S. car owners, with 54% saying they intend to switch to another brand for their next vehicle — up from 51% last year. Some 47% of Americans previously owned a car of the same brand as their current vehicle.

While that’s far more than the 31% of Japan in the global survey, it’s also far less than China, which led all nations with 74% saying they’re ready to defect to a new brand, as well as India (72%), Southeast Asia (71%), Korea (63%) and the U.K. (56%). All eight of the regions surveyed saw a drop in brand loyalty.

Regardless of which brand they choose, 86% of U.S. consumers said they need to interact with the vehicle in person and take a test drive before buying.

“Powertrain intent and brand affinity are two decisive battlegrounds for industry stakeholders across the value chain,” Deloitte Consulting managing director of global automotive Jody Stidham said. “Interest in full hybrids and range-extender technologies reflects a growing desire for pragmatic, cost-effective solutions that lower emissions without requiring a robust charging infrastructure.

“Simultaneously, brand loyalty is being tested, with rising defection rates across several markets signaling the importance of cultivating strong relationships, particularly in emerging markets with a high proportion of first-time buyers.”

Other findings included:

Autonomous anxieties: As driverless technology gains traction, more than half (52%) of U.S. consumers said they’re concerned about self-driving robotaxi services operating where they live.

Younger drivers rethink car ownership: Among consumers aged 18-34, 44% said they’re interested in mobility-as-a-service solutions rather than owning a vehicle.

“The U.S. automotive industry is navigating a period of profound transformation, shaped by evolving mobility trends, shifting consumer preferences and diverse ownership models,” Deloitte vice chair and U.S. automotive sector leader Lisa Walker said. “Considering last year’s slowdown on EV intent, the rise in hybrid adoption may serve as a practical bridge between legacy and alternative powertrains for U.S. consumers as infrastructure and cost realities persist in the near term. Autonomous vehicle technology is also regaining attention, but safety concerns remain a significant hurdle to success.”

The study’s results are available here.