COMMENTARY: Pre-owned sales might be the best indicator of EV market’s future

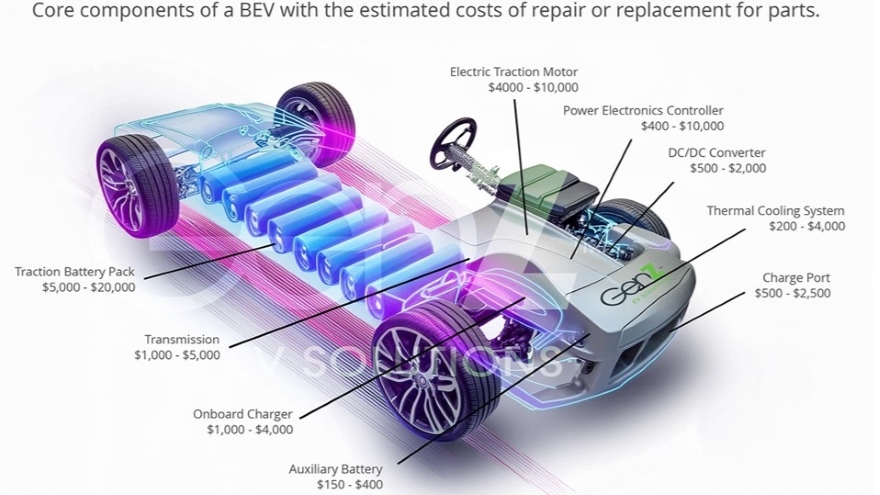

Source: GenZ Automotive internal data and market research. Image courtesy of GenZ EV Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In almost every conversation I’ve recently had regarding the future of the electric vehicle market — specifically, battery electric vehicles — there is a passionate stance for one side of the argument or the other.

Either, “Everyone will have one soon,” or, “It’s a fad and I’ll never have or sell an EV.”

The conversations are polarized with what seems like little room for a middle ground. But regardless of which side you’re on, it’s a conversation that tends to bring out a certain emotional response.

In many cases, those conversations are referring to the new EV market, the segment we focus on in most of the reported data. News regarding the future of the EV market tends to focus mainly on new manufacturer releases, product improvements and charging/growth initiatives in the new EV industry.

In reality, though, the pre-owned market might be the most critical aspect of the long-term viability of the EV/BEV market in the U.S.

According to data collected by Recurrent Auto, sales of used EVs are surging in the U.S. In 2023, nearly 400,000 used EVs were sold, a significant increase from 283,000 sold in 2022. Forecasts predict sales will continue to grow, reaching an estimated 560,000 in 2024.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

That stable growth is required to help bring costs down, improve profitability and ultimately allow new technology into the space as the returns become more attractive to future investors and EV adopters.

However, despite the growth, the challenge for many consumers remains giving a BEV a try when there are still so many questions about the long-term viability and value of their investment.

Consumers outside of early adopters aren’t confident in what the resale value of their BEV will be, or what happens as the battery degrades and range starts to drop.

Put yourself in the average customer’s mindset. Would you spend $30,000, $40,000 or even $50,000 (or more) on a new BEV when it’s unclear to you what the resale value will be in 3-5 years, all while wondering if the vehicle’s technology, charging capabilities, coverage options and range will become obsolete?

Those are the questions the used BEV market needs to address as the number of used BEVs sold, while steadily increasing, still only represents a small fraction of used vehicle sales in the U.S. In fact, a recent Pew Research Center study found only 29% of Americans surveyed would even consider buying an electric vehicle, a decrease of 9 percentage points year-over-year.

So while sales might be increasing, consumer confidence is not.

This is the core issue for the used EV market, and it differs greatly compared to the used market for traditional internal combustion engine vehicles.

You can purchase a certified pre-owned ICE vehicle from any manufacturer and have “like new” coverage with a very predictable and trackable resale value. Even without a manufacturer CPO program, you can buy and sell used ICE vehicles with a high level of confidence in their resale value, regardless of the age of the vehicle and the number of miles it has accumulated.

That resale value is particularly strong on models like trucks, SUVs and luxury vehicles, which last up to 200,000 miles. That’s a surprising trend, as only two decades ago consumers didn’t want to purchase a vehicle – or own one, for that matter – with more than 100,000 miles due to the risk of failure of major components or other repairs.

Now, due to economic factors, supply chain issues, the COVID pandemic, excellent coverage options and improved vehicle longevity, there is a rapidly growing market for ICE vehicles with more than 100,000 miles.

That’s backed up by a 2023 report from Edmunds showing values of used vehicles with 100,000-150,000 miles rose 40% in the previous four years, and cars with 150,000-200,000 miles were up 28% in that period. That indicates a significant rise in consumer acceptance and demand for high-mileage vehicles.

The issue with the used BEV market now is that a 3-5-year-old BEV with 30,000-50,000 miles is being treated the same as an ICE vehicle with more than 100,000 miles on the odometer was two decades ago.

According to the Pew study, conducted in May 2024, only 9% of Americans believe EVs are more reliable than gas vehicles, while 38% say they are comparably reliable and 50% say EVs are less reliable. That’s why the success of the preowned market and customer confidence are so critical to the growth and sustainability of the overall BEV market.

Some manufacturers have realized that and are incentivizing new buyers with lease programs.

That provides multiple benefits for the growth of the BEV market. One, it lets consumers “test drive” the BEV lifestyle for three years (or longer) with little to no risk involved. It helps them learn what it’s like to drive an EV and to have charging experiences and answer all the most common concerns about owning an EV.

Most of the drivers I know will never give their EVs up once they’ve owned one, so that’s a very important part of the process in easing customers into the space.

Another benefit of leasing for manufacturers is it helps increase volumes while providing valuable insights into real-world data on vehicle performance, reliability, range and longevity. And many of the leased vehicles will return to the automakers’ inventory and can be placed into their newly formed EV CPO programs, which helps the OEM increase resale value and, as a result, residual values for leasing.

That process, and additional EV converts who come through the leasing experience, allow manufacturers to cut back on the heavily incentivized leases used to bring new consumers in at the beginning of the cycle.

CPO programs adopting used EVs into their offerings is an important indicator of growing confidence in the preowned EV market. However, according to a 2023 study by the IMARC Group, even with an estimated 6% increase in overall CPO sales in 2023, the CPO market still only represents 6%-7% of the 35-40 million used vehicles sold in the U.S. annually.

That means the core market and greatest opportunities for used BEV sales fall to franchise and independent dealerships that add them to their current offerings.

We are now seeing a growing number of independent dealerships embracing BEV models and using them to differentiate themselves from dealers still hesitating to enter the EV market. Pre-owned Teslas are the main driver of that market, but other early models are also starting to show up at auctions and in more and more independent dealers’ inventories.

“The future of the used BEV market is exciting, but addressing consumer concerns on the vehicle’s longevity is paramount to the industry’s success,” said GenZ EV Solutions CEO Jose Valls, the former CEO and chairman of Nissan North America. “New solutions, such as EVSC programs, can enable independent dealers to offer comprehensive coverage similar to manufacturer CPO programs, showcasing the growing competitive edge for independent dealers in the quickly growing pre-owned EV market while increasing the total resale value and trust in the segment.”

Indeed, the industry is starting to respond to consumer concerns by introducing tailored electric vehicle service contracts like the ones consumers are familiar with in the ICE vehicle market. An EVSC can give the same type of comprehensive coverage to the consumer on critical components, including batteries, electric motors and complex components unique to BEVs that are not typically covered by the standard VSCs sold in F&I departments today.

Selling a BEV with that coverage not only helps dealers give consumers confidence in the vehicle, it also helps increase margins on the vehicle and in the F&I department.

If used-vehicle dealers (mainly independent from franchises) can make good margins and keep the resale value high for pre-owned BEVs, it will help raise the value and long-term viability of the entire industry.

New BEV sales will increase due to consumers feeling confident about resale value and the need for leasing residual support will diminish as values increase, creating a natural residual value. The future will see continuing rapid expansion of charging infrastructure across the country, while new BEV technology will continue to improve ranges and reduce charging session times.

Even the harshest skeptics will start to hear more about positive consumer and retail experiences as profits and satisfaction increase in equal measure, and that will start to bring a few over from the late majority into the early minority as we start to see healthy growth across all segments of the BEV market.

Bill Bieser is chief operating officer of GenZ EV Solutions, which works with GenZ Automotive to provide turnkey solutions in both F&I products and EV charging infrastructure solutions. He has more than 30 years of automotive experience, including automotive retail and developing partnerships with OEMs.