Consumer interest in buying EVs falls for first time since 2020, EY survey says

Image courtesy of EY.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

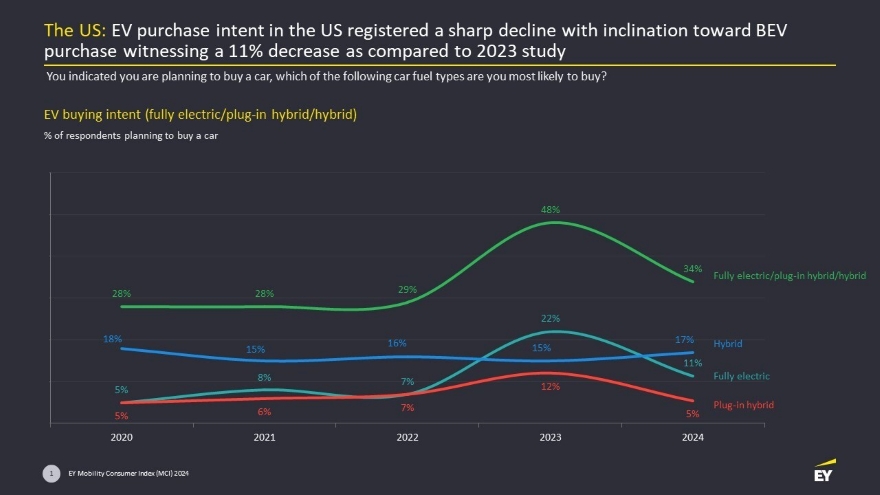

U.S. consumers’ interest in buying an electric vehicle has dropped in 2024, according to the latest research by EY — the first time that has happened since the survey began in 2020.

The EY Mobility Consumer Index, a global survey of 19,000 consumers from 28 countries, found 34% of Americans said they intend to purchase an EV as their next car. That’s 14 percentage points less than the 2023 survey, when a record 48% said they were on board with buying an EV.

“While we’ve seen substantial increases in interest and purchasing of EVs since 2020, this year’s MCI shows dips in demand for the first time,” EY Americas automotive leader Steve Patton said. “This decrease is due partly to a lack of consumer education around the long-term value of an EV and maintenance requirements vs. traditional internal combustion engine vehicles.”

The survey showed consumer confidence in EV range and charging infrastructure has risen in the past year, which EY attributed to “cross-sector collaboration and investments in both education and charging stations.” Just 24% of the 1,500 U.S. respondents cited EV range as their top concern, down from 30% in last year’s survey, and 23% named finding charging stations, which marked an 11-point decrease from two years ago.

The latest hot issues for Americans about EVs are battery life and maintenance fees. EY said expensive battery replacement surpassed lack of charging stations as the No. 1 concern cited in the survey for the first time, especially among potential first-time EV buyers, 27% of whom expressed that concern, compared to 23% of current EV owners.

“Over the past five years, we’ve seen tremendous progress around easing the barriers for EV adoption, from curbing reliability and accessibility concerns to instilling charging confidence among U.S. consumers,” EY Americas power and utilities eMobility leader Marc Coltelli said. “To keep momentum and make EV ownership appealing, it’s imperative to educate and create a seamless customer experience from the dealership to the charge point, throughout the ecosystem and lifecycle of an EV.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Now U.S. consumers are expressing heightened concerns over maintenance and battery replacement costs, when really it costs less to maintain an EV compared to ICE vehicles.”

The biggest flip from the 2023 survey is in consumers’ preference for hybrids over battery electric vehicles. A year ago, interest in BEVs more than tripled, from 7% in 2022 to 22%. This year, they fell back to earth to 11%, while hybrids gained two percentage points to 17%, retaking their place as the most popular EV type.

This year, 26% of U.S. consumers said they like the security of a hybrid engine. The survey also found 21% said they prefer a gradual transition from an ICE vehicle to a fully electric vehicle, and EY said hybrids can make sense to those consumers as a “bridge vehicle” between gas cars and BEVs.

“It’s no surprise hybrid vehicles are rising in popularity, especially with many potential EV buyers pointing to environmental concerns as their motivation to purchase,” EY Americas aerospace, defense and mobility leader Raman Ram said. “With many still hesitant to go all in with EVs, hybrids offer an easier to swallow solution: the security of ICE with the advancements of EV technology and performance.

“For those who are looking to transition due to the environment, hybrids allow owners to lessen their reliance on fuel, and they create options for batteries and parts. For many, it’s a win-win.”