Cox Automotive: Q4 dealer sentiment below pandemic readings

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Dealers are not feeling optimistic as the year finishes.

Dealer sentiment in the fourth quarter dropped to the lowest level since the start of the COVID-19 pandemic, according to the Cox Automotive Dealer Sentiment Index (CADSI) released Wednesday.

Cox Automotive reported the current market index is below the threshold of 50, coming in at 43 and indicating that more dealers view the current auto market as weak than strong.

The index dropped 6 points quarter-over-quarter and 17 points year-over-year to settle well below the pre-pandemic average of 48.

Cox Automotive pointed out the current market index peaked at 67 in Q2 2021 and has been losing momentum every quarter since.

Dealers attributed their negative view of the market is influenced by the economy, higher interest rates and low inventory, according to Cox Automotive.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“High interest rates and a generally slowing economy are clearly weighing heavily on U.S. auto dealers right now,” Cox Automotive chief economist Jonathan Smoke said. “Dealers are normally optimistic, so the drop in the three-month outlook to a new low in our survey history is particularly noteworthy.

“As the year began, dealers were telling us about one obvious problem: Inventory. Now, as 2022 comes to a close, it’s all about the economy and interest rates,” Smoke continued.

Cox Automotive determined the three-month, forward-looking market outlook index dropped from the previous quarter and, at 41, is now at a record low and well below the 64 at the start of the year.

Additionally, the company said its economy index decreased for the second consecutive quarter to 43, down from 45 in the prior quarter and below the positive threshold, indicating a majority of dealers feel the economy is weak.

Costs stay high as profits soften

Delving into more parts of the CADSI, the overall profit index saw a decline to 44, down from 50 last quarter and down significantly from 57 a year ago.

However, Cox Automotive pointed out the profit index remains higher than the average recorded in the three years prior to the COVID-19 pandemic, which was 41.

Experts said the profit index continues to be driven by franchised dealers, who believe profits remain particularly strong, at 67. Independent dealers, conversely, now see profits as weak, with an index score of only 37.

The cost index for the fourth quarter — specifically what Cox Automotive classifies as the cost of running a dealership – dipped 3 points quarter-over-quarter to 72 and decreased 4 points from the record high level posted during the second quarter.

After reaching a record low in Q2 2020 of 51 at the height of the pandemic, Cox Automotive noted the cost index has been steadily increasing.

“Overall inflation in the U.S. economy is clearly contributing to this view,” Cox Automotive said, which also acknowledged that the economy is the leading concern right now,

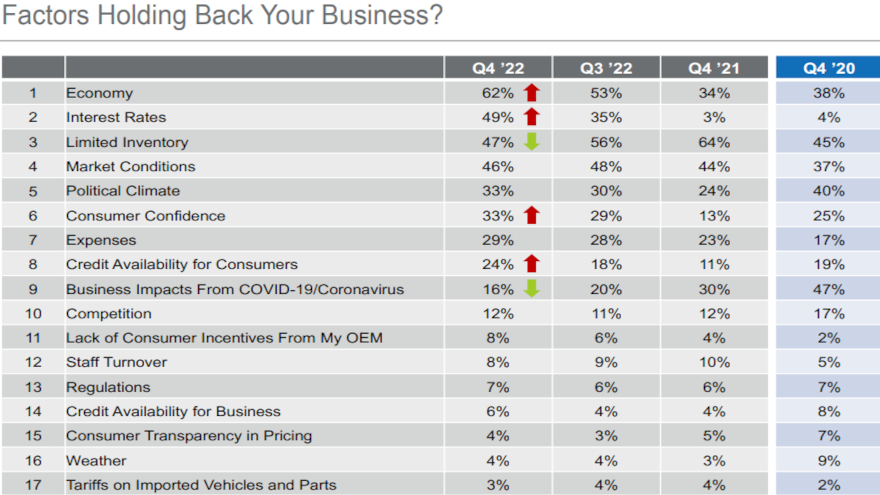

In fact, 62% of dealers cited the economy as a factor holding back business, up from 53% in Q3, with interest rates (49%), limited inventory (47%), market conditions (46%) and political climate (33%) rounding out the top five.

Improved inventory but not sales

While still historically low, Cox Automotive reported the new-vehicle inventory index improved for franchised dealers in the fourth quarter and is up significantly from one year ago.

The index stood at 14 in the fourth quarter of last year after hitting an all-time low of 13 in the prior quarter.

Now at 53, the new-vehicle inventory index indicates more dealers feel their inventory is growing, not declining. Importantly, the index is above the 50 threshold for the first time since the onset of the pandemic, according to Cox Automotive.

Experts said the new-vehicle inventory mix index has been increasing for a year as well, but remains historically low at 41, indicating that the new-vehicle inventory mix is poor.

In Q4 2019, Cox Automotive recollected that the new-vehicle inventory mix index came in at 73.

“Overall, both new-vehicle inventory indexes continue to improve from their nadir one year ago, when inventory levels hit all-time lows at dealerships across the country,” Cox Automotive said.

Experts discovered the used-vehicle inventory index increased as well in Q4, rising to 42, which was 6 points higher than the previous quarter and 13 points higher than a year ago.

Among franchised dealers, the used-vehicle inventory index improved by 14 points year-over-year to reach the threshold of 50.

The index for independent dealers saw a 7-point gain to 39.

Cox Automotive noticed the used-vehicle inventory mix index slightly improved quarter-over-quarter and year-over-year to land at 49.

“Overall, franchised dealers continue to be far more positive about inventory compared to independent dealers, but, consistent with last quarter, Limited Inventory ranks as one of the top three factors holding back business for dealers in Q4,” experts said.

While new-vehicle inventory sentiment improved significantly in Q4, Cox Automotive explained the view of new-vehicle sales improved only slightly, increasing from 51 to 52, meaning dealers remain marginally more optimistic about the current new-vehicle sales environment.

One year ago, experts noted the index score was 45, meaning that more dealers saw the market as poor versus good.

The new-vehicle incentives index rose by 3 points quarter-over-quarter to 25 and has remained relatively stable since Q3 2021, according to Cox Automotive, which explained the index reading indicates dealers view OEM incentives as small as opposed to large.

For comparison, the incentive index was at 49 in Q4 2019.

On the other hand, the used-vehicle sales index declined to 42.

For franchised dealers, the used-vehicle sales index decreased by 8 points to 54 in Q4 and is now 16 points below year-ago levels. For independent dealers, the index fell 3 points from the previous quarter to 38 and is down 10 points from a year ago.

“Overall, most dealers view used-vehicle sales as poor,” experts said.

More views on interest rates and the economy

Notably, the market outlook for the next three months decreased to an all-time low of 41, down from 44 in Q3 and 60 one year ago.

“The lower score indicates that more dealers feel that the outlook for the next three months is weak, not strong,” Cox Automotive said. “In fact, the Q4 market outlook index is significantly lower for both franchised and independent dealers year-over-year and 4 points below the index score from Q2 2020, at the height of the global COVID-19 pandemic.”

Experts pointed out that the quarter-over-quarter decrease in market outlook, however, was driven more by franchised dealers, with an 11-point drop to 48.

Independent dealers’ already-gloomy outlook dropped another point quarter-over-quarter to 39. The year-over-year decrease totaled 18 points.

Overall, the economy is now the top factor holding back business, according to the CADSI.

“The factors saw major changes from last quarter, with the top five shifting more toward economic and financial factors,” Cox Automotive said. “In fact, in Q4 2022, interest rates jumped to the second position in the list. Limited inventory was in the third position, but its score dropped 9 points quarter-over-quarter from 56% to 47%, a sign that inventory is improving but still a concern.

“Market conditions and political climate rounded out the top five,” experts added.

Survey methodology

Cox Automotive recapped that the Q4 2022 CADSI is based on 1,034 dealer respondents, comprising 604 franchised dealers and 430 independents. The survey was conducted from Oct. 25 to Nov. 7.

Dealer responses were weighted by dealership type and sales volume to represent the national dealer population.

For each aspect of the market surveyed, respondents are given an option related to strong/increasing, average/stable, or weak/decreasing, along with a “don’t know” opt-out. Indices are calculated by creating a mean score in which:

Strong/increasing answers are assigned a value of 100.

Average/stable answers are assigned a value of 50.

Weak/declining selections are assigned a value of 0.

Respondents who select “don’t know” at a particular question are removed from the related index calculation.