Cox survey finds dealer sentiment stable – at a pessimistic level

Image courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In the face of uncertainty in the automotive market, the American economy in general and the nation’s political future, the outlook of car dealers remains remarkably steady, according to the latest Cox Automotive Dealer Sentiment Index.

Of course, that’s not necessarily a good thing.

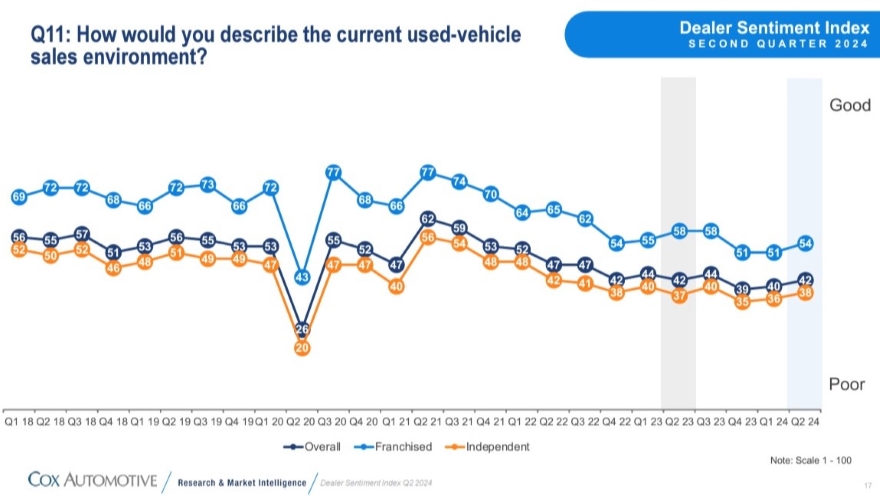

The index for the second quarter of 2024 was virtually unchanged from the previous quarter and has varied little since falling below 50 in late 2022 — but that level indicates a prevailing perception of a weak market.

The overall dealer score of 42 for the current new- and used-vehicle market is well below the threshold of 50 that marks the dividing line between a strong and weak market. The used-vehicle sales environment score actually showed a slight uptick, but the increase from 40 to 42 is still decidedly on the “poor” end of the spectrum.

The outlook among independent dealers is more pessimistic than that of franchised dealers. While franchises rated the overall market at 49 – just below threshold – independents gave it a 40. Likewise, independents’ 38 score for the used-car sales environment (up from 36 in Q1) was far worse than the franchises’ hopeful index of 54.

In addition, expectations for the market over the next three months took a tumble, with the overall index dropping from a slightly optimistic 51 the previous quarter to a hoping-for-the-best 44. Independents showed the largest fall, from 50 to 41, while franchised dealers remained above the 50 mark at 52.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive’s analysts noted the second quarter typically shows a decline in market expectations, a trend that this year was influenced by a weaker-than-normal tax refund season and ongoing political and economic uncertainty.

“There is a lot of uncertainty in this market,” chief economist Jonathan Smoke said, “leaving consumers and dealers alike unsure of the road ahead. On top of uncertainty about interest rates, we’re heading into an election season, and this one is especially breeding more concern.

“In the auto business, uncertainty is the enemy — it negatively impacts sales, hurts consumer sentiment and leaves auto dealers feeling troubled.”

Dealers’ perception of their costs hits all-time high

The report also showed dealers saying used inventory is on its way down, especially among franchised dealers, among whom the index dropped from 53 – indicating growing supply – to 48, on the declining side of the threshold. Independent dealers’ score fell from 42 to 40.

Meanwhile, dealers said expenses and the pressure to lower prices continue growing, with the operational cost index rising to 76 – matching the record high set in Q2 2022 – while price pressure rated at 65, slightly down from Q1 but up from 58 year-over-year.

Still, Smoke said, hidden in the overall dealer pessimism are some positive signs, notably the profit index, which, while it only reached 36 overall, rose for the first time since Q3 2021. And dealer perception of both online and in-person customer traffic improved from Q1, though it also remained well short of the 50 threshold.

“Overall, dealer sentiment is likely worse than actual market conditions,” Smoke said. “While profits are down from all-time highs, we still believe the dealer business is healthy.

“Retail vehicle sales have been fairly consistent so far this year, inventory has returned to reasonable levels and we believe interest rates have likely hit a ceiling. With a good job market, the market is not collapsing and we believe weak current market sentiment is more about uncertainty than actual performance.”

Politics rising among dealer concerns

Dealers identified interest rates (cited by 59% of dealers), the economy (57%) and market conditions (41%) as the three biggest factors holding back their business, with the political climate (36%) edging past expenses and credit availability for consumers (both at 31%) from Q1 to take the fourth spot as the November elections approach.

Among independent dealers, though, expenses and credit availability were still greater concerns than politics.

Limited inventory, which was the No. 1 factor seen as holding back business two years ago, has dropped to No. 7 among all dealers at 29%.

“In many ways,” Smoke said, “the political climate is a surrogate for ‘uncertainty.’ Many dealers and consumers believe the election outcome will impact the economy and the auto market in some way – either good or bad – and that expectation of change is causing paralysis in the market and hurting sentiment.”

Sentiment about electric vehicle sales fell to a new low in Q2, dropping to 41 when dealers were asked how EV sales compare to a year ago – the fourth consecutive quarterly decline. And while expectations for the next three months were up from Q1, the score of 39 suggests most dealers think the EV market will be declining, not growing.

Methodology

The Q1 2024 Cox Automotive Dealer Sentiment Index is based on a survey of 1,026 U.S. auto dealer respondents, comprised of 550 franchised dealers and 476 independents. The survey was conducted from April 23 to May 7, 2024.

Dealer responses were weighted by dealership type and sales volume to represent the national dealer population.

For each aspect of the market surveyed, respondents are given an option related to strong/increasing, average/stable or weak/decreasing, along with a “don’t know” opt-out.

Indices are calculated by creating a mean score in which:

Strong/increasing answers are assigned a value of 100.

Average/stable answers are assigned a value of 50.

Weak/declining selections are assigned a value of 0.

Respondents who select “don’t know” at a particular question are removed from the related index calculation.

The full results can be downloaded here.