Edmunds finds ‘mismatch’ between customer wants and market realities

Image courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Electric vehicles have been the hottest topic in the automotive industry for years now. In that time, consumers have seen and heard a seemingly endless stream of messaging regarding EVs.

But a recent survey conducted by Edmunds found there is still a disconnect between what consumers want and what is currently available in the EV market.

In her analysis of the 2024 Edmunds EV Sentiment Survey, conducted in January, head of insights Jessica Caldwell said the results show “a significant mismatch between car shopper preferences and the realities of today’s EV market that could be reflective of current market challenges.”

Those large gaps show up in three areas consumers say are critical EV purchase considerations: price, brand trust, vehicle body type and driving range.

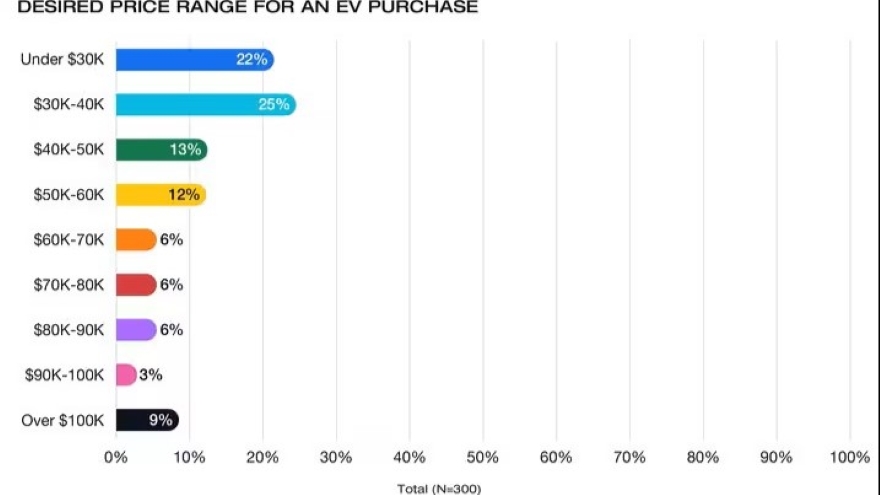

When it comes to cost, the survey found 47% of the respondents who indicated they’re considering an EV for their next vehicle purchase said they’re looking for something at less that $40,000, and 22% want an EVs priced less than $30,000.

Caldwell pointed out there are no new EVs available with an average MSRP of less than $30,000, and only four — the MINI Hardtop 2 Door, Nissan Leaf, Fiat 500e and Hyundai Kona Electric — priced less than $40,000.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Edmunds data shows the average EV transaction price in 2023 was $61,702, almost $15,000 more than the average for all other vehicles ($47,450).

“It’s worth noting that the consumers who are most comfortable with the idea of purchasing a new EV might also not be in a financial position to afford one,” Caldwell said in the analysis, citing survey results showing 90% of 18- to 24-year-olds and 83% of 24- to 34-year-olds said they’re open to an EV as their next purchase.

Caldwell pointed out another disconnect between the types of vehicles EV buyers want and the vehicles being emphasized by automakers.

According to the Edmunds survey, drivers of pickup trucks are least likely to consider an EV for their next purchase, with 39% saying they would not consider one. Meanwhile, just 10% of all respondents who are interested in an EV purchase said they’d be interested in a truck, compared to 43% for cars and 42% for SUVs/crossovers.

The market reality, Caldwell said, is different.

“The electric truck market appears bloated — Rivian R1T, Ford F-150 Lightning, GMC Hummer EV and Tesla Cybertruck, with possibly the Chevrolet Silverado EV, GMC Sierra EV and RAM 1500 Rev arriving in the not-so-distant future,” she said.

“It’s not surprising that the Detroit automakers moved swiftly to protect their top money-making products from the threat of EV startups, but at least for now it appears this fear was unwarranted, as EV pickup trucks are still largely niche products with a limited consumer base.”

The results of the survey’s questions about range yielded interesting results that Caldwell said imply a “knowledge gap” among consumers.

Asked what they desire regarding the range for an EV they’d consider buying, 46% of respondents said they’d be comfortable with 200 miles or less. And 24% said 99 miles or less.

The fact is, those are very low figures. Edmunds’ EV range test found the vast majority of EV models on the market can go 200 miles or more before recharging, and, Caldwell said, “the significant percentage of respondents who indicated they were comfortable with a range below 100 miles signals a potential knowledge gap surrounding realistic range expectations.”

Edmunds said its data shows sales of EVs rose to 6.9% of new vehicle market share in 2023, up from 5.2% in 2022. But the company’s analysts predict the rate of growth will slow through 2024.

“The electric vehicle market is growing,” Caldwell said in her analysis, “but consumers have enough reservations about the current options and charging infrastructure challenges to limit more significant growth in the short term.”