Edmunds on Tesla trades & other parts of current EV market

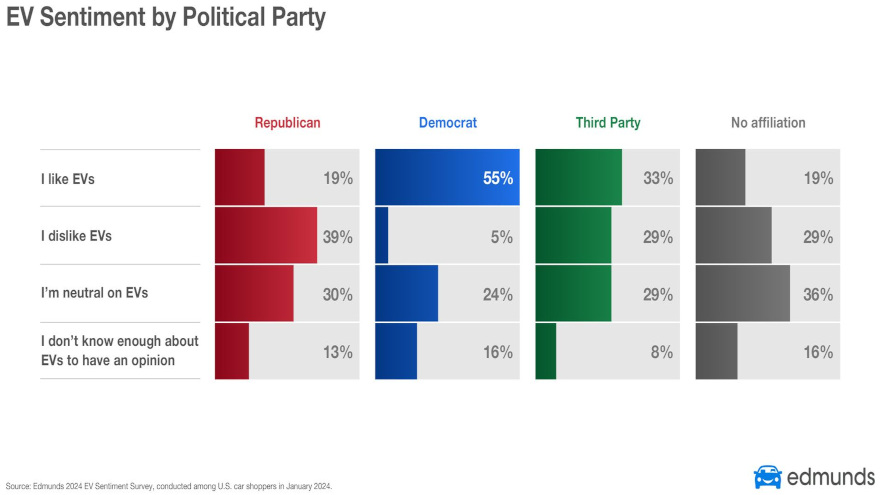

Chart courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Edmunds shared a wide array of electric-vehicle information on Tuesday, including insights about trade-in activities at dealerships involving a Tesla.

Perhaps of most interest to used-car managers, Edmunds said that its data through June showed 51% of all Teslas traded in to a dealership went toward a purchase or lease of a new ICE vehicle. That’s the lowest reading in Edmunds’ data set that went back to 2019.

Analysts explained its Tesla trade-in destinations refer to new-vehicle purchases or leases at a dealership involving a Tesla trade-in. Edmunds added that Tesla trade-in data only includes vehicles traded in to dealerships. It does not include direct-to-consumer sales.

| Year | ICE | EV | Hybrid | PHEV |

| 2019 | 71% | 10% | 18% | 0% |

| 2020 | 76% | 9% | 14% | 2% |

| 2021 | 72% | 13% | 8% | 7% |

| 2022 | 66% | 21% | 7% | 6% |

| 2023 | 55% | 29% | 8% | 8% |

| YTD 2024 (Jan-June) | 51% | 32% | 10% | 6% |

Source: Edmunds

Edmunds highlighted three other intriguing trends about the U.S. EV market, including:

—EV market share was 7.2% in June 2024, compared to 6.8% in May 2024 and 7.3% in June 2023.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—EVs sold in June 2024 took 76 days to sell on average, while their ICE counterparts took 54 days and hybrids took 26 days.

—The average transaction price of an EV in June 2024 was $58,213, down 0.5% from $58,487 in June 2023. That compares with an average of $47,681 for ICE vehicles and $47,616 for all vehicles in June 2024.

Edmunds pointed out that its EV pricing and days-to-turn data only includes vehicles sold through dealerships. It does not include direct-to-consumer sales.

And with the political world buzzing because President Joe Biden halted his reelection campaign, Edmunds head of insights Jessica Caldwell also delved into the politics of electric vehicles, explaining the latest data through the prism of Democrats and Republicans.

“EVs are supercharging political debates among Americans in 2024. According to Edmunds survey data from earlier this year, Democrats have an overwhelmingly more favorable opinion of EVs, with only 5% claiming to dislike EVs compared to 39% of Republicans,” Caldwell said in a news release the accompanied the data.

“As America’s partisan divides widen, Elon Musk’s very public support of former President Donald Trump has the potential to alienate Democratic-leaning consumers who are more likely to be EV buyers and could therefore pose a significant threat to Tesla’s bottom line,” she continued.

“The road ahead for Tesla is already laden with obstacles amid increasing global competition and an aging product lineup — and price cuts simply aren’t as effective as they once were in driving sales for the company. Giving prospective EV buyers any sort of political reason to avoid purchasing a Tesla is probably not what the company needs right now,” Caldwell added.

“Edmunds data reveals that a growing share of Tesla owners are more likely to purchase an EV over an ICE vehicle for their next purchase. Tesla should theoretically have the advantage of keeping such a large consumer base within the fold, but Musk’s outspoken political leanings could give other automakers an opportunity to crack into Tesla’s early and expansive EV buyer base,” Caldwell went on to say.