Haig: Dealerships remain hot properties even as profits and values decline

Image courtesy of Haig Partners LLC.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While demand for dealerships remained strong in the fourth quarter of 2023, dealership profits and blue sky values fell significantly year-over-year, according to research from Haig Partners.

The Q4 Haig Report, which tracks trends in auto retail and their impacts on dealership values, showed 528 dealerships changed hands in 2023 — the third-highest annual volume on record, but down from a record 707 in 2021 and 566 in 2022.

That included two record-setting sales, the report said. Al Hendrickson Toyota sold for the highest price ever paid for a dealership of any kind at the time, and Lake Norman Chrysler-Dodge-Jeep-RAM set the record for a Stellantis store, according to Haig Partners, which advised on both deals.

The company also advised on the sale of South Motors/Vista Motors early this year, which it said set records the highest prices paid for BMW and Honda dealerships.

Profits per dealership for publicly traded retailers were down an estimated 23% in 2023, and Q4 2023 average profits per store plummeted 31% from Q4 2022. Haig Partners said dealers believe profits will decline again through 2024 to as much as 15% below current levels.

Still, Q4 profits remained an estimated 78% higher than they were in Q4 2019, just before the COVID pandemic, which Haig Partners said is helping keep buyers and investors attracted to auto dealerships.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“We are seeing mixed trends in auto retail today, which are pushing down dealership profits and dealership values,” Haig Partners president Alan Haig said. “Sharply rising inventories and floorplan expense are pushing down profits at most stores. At the same time, vehicle prices and loan rates for consumers are far higher than before the pandemic, and that is suppressing the pent-up demand we believe exists in the market.

“But even with this decline in profits, dealers are still making far more than they were before the pandemic.”

The estimated blue sky value per publicly-owned dealership at the end of last year dropped 14% from 2022, but are still more than twice pre-pandemic levels. The report said that decline was less than the decline in profits because buyers had already factored in their expectations of falling profits.

Haig Partners said it believes blue sky values for most dealerships will continue to decline in 2024 as their profits continue to moderate.

“Estimated average blue sky per dealership has fallen from a peak of $25 million in 2022 to $21.4 million in 2023,” Haig said. “But even at these lower values, dealerships are still far more valuable today than in the past.

“Life is getting harder for auto dealers, but it’s still pretty darn good.”

Other highlights from the Q4 2023 Haig Report include:

—Approximately 90% of dealerships sold were acquired by private dealers or investors.

—Public company spending on domestic auto dealership acquisitions reached $2.8 billion in 2023, up 50% from 2022 and the second-most on record.

—The average publicly-owned dealership made $5 million in fiscal year 2023, a 23% drop from year-end 2022.

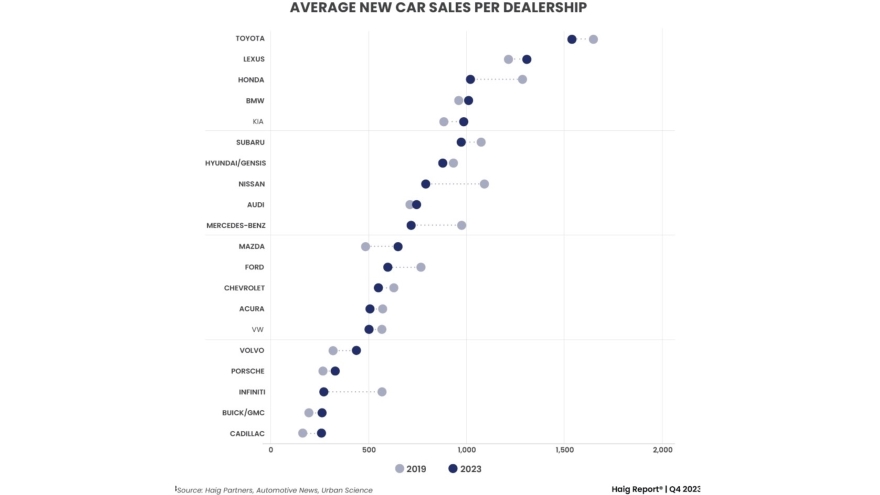

—Since the pandemic, some brands, such as Mazda and Kia have performed very well, while others, like Honda and Infiniti, have struggled, which has affected dealership profits and values for those brands.

—The buy-sell market is expected to remain very active in 2024.

Publicly traded auto retailers were in acquisition mode throughout 2023, spending 52% more than the previous year on U.S. auto dealerships, with two of them — Asbury and Lithia — spending a combined $2 billion on platforms. Haig expects public retailers to continue aggressively acquiring dealerships in 2024.

To subscribe for the full Haig Report, click here.