J.D. Power research reinforces bind of EV owners to OEM apps

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

We can use smartphone apps to listen to music, track our spending and waistlines and reconnect with family and friends.

And J.D. Power said electric vehicle owners are leaning more on apps than ever.

Researchers shared on Wednesday that usage of manufacturers’ mobile apps continues to increase as 90% of EV owners say they use these apps. That’s up from 88% in 2023 and 81% in 2022, according to the J.D. Power 2024 U.S. OEM EV App Report.

J.D. Power said 67% of EV owners use their brand’s app at least half of the time they drive. Experts explained that highlights the importance of a well-executed EV mobile app that prioritizes owners’ primary needs related to overall charging capability, vehicle status and remote control functionality.

“The overall experience and performance of electric vehicle mobile apps has improved year over year, as manufacturers continue to identify areas of opportunity, including feature contenting, usability and overall connectivity,” said Jason Norton, director of benchmark consulting at J.D. Power. “However, a continued focus on the specific needs of EV owners is needed to further improve the user experience and trust.”

J.D. Power mentioned a quartet of key findings of the 2024 report, including:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

App connectivity focused

Although the percentage of EV owners who experienced a connection problem (38%) is flat year over year, experts noticed the experience between non-Tesla and Tesla owners is more revealing.

While 40% of non-Tesla EV owners say they experienced a connection problem — down from 44% a year ago — J.D. Power reported 35% of Tesla owners say they experienced a connection-related problem — up from 30% in 2023 and 20% in 2022.

“This problematic trend may suggest that increasing app usage is straining Tesla’s app network capacity,” J.D. Power said.

Feature driven

The report showed that top-performing brands are addressing the needs and features desired by owners. Examples include the ability to accurately monitor an active charge, set charging preferences (such as maximum state of charge, charging schedules, departure timers); and plug and charge integration for an enhanced public charging experience.

Of the 25 most common app features, J.D. Power indicated 20 are cited as desirable by more than 70% of EV owners, with all but one charging-related feature having higher desirability than in previous years.

Continuing effect on EV shoppers

J.D. Power determined nearly two-thirds (62%) of Tesla owners say availability of a smartphone app had at least a moderate effect on their purchase decision, up from 59% in 2023.

Among non-Tesla owners, researchers found only 34% say a smartphone app had at least a moderate effect on their purchase decision.

Furthermore, J.D. Power reported 21% of Tesla owners say it had a major effect versus just 8% among non-Tesla EV owners.

“This suggests that OEMs must do a better job of communicating the availability and feature content of their smartphone apps to help attract interested EV shoppers,” J.D. Power said.

Dealership effect on satisfaction

J.D. Power also mentioned nearly three-fourths (72%) of EV owners say they received some type of assistance from the dealership with the app, an increase of 2 percentage points from 2023.

Researchers found nearly 88% of premium brand owners (excluding Tesla) say they received dealership support versus 74% of mass market EV owners.

“Owners who received assistance from their dealership are more likely to use the app and to be satisfied with it than those who did not,” J.D. Power said.

Which OEMs are doing well in the app department?

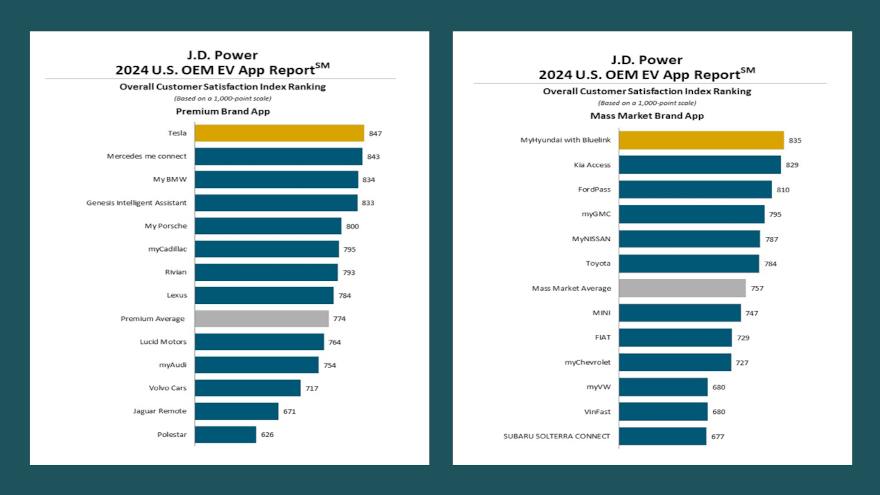

J.D. Power highlighted that Tesla ranked highest overall and highest in the premium brand segment of EV mobile apps, with a score of 847 (on a 1,000-point scale). Mercedes me connect (843) came in second and My BMW (834) placed third.

Researchers said MyHyundai with Bluelink ranked highest in the mass market segment of EV mobile apps, with a score of 835. Kia Access (829) placed second and FordPass (810) landed in third.

The U.S. OEM EV App Report, now in its fourth year, gauges EV owners’ experience with their brand’s mobile app. Insights are derived from surveying EV owners and an assessment of the most relevant EV mobile apps.

J.D. Power said Results are based on a standardized assessment approach relying on more than 350 best practices for vehicle apps that include more than 70 EV-specific attributes.

The report includes apps from the top 25 award-eligible brands that sell EVs in the United States; 10 profiled EV brands in China; and nine profiled EV brands in Europe.

Additionally, researchers said almost 1,300 EV owners in the United States were surveyed in April and May to gather insights on app usage; feature desirability; and app overall execution for the 2024 report.