JD Power discovers advantage aftermarket service providers have over franchised dealers

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

J.D. Power made an assertion that might frustrate service advisors and managers at franchised dealerships.

Based on the J.D. Power 2022 U.S. Aftermarket Service Index (ASI) Study, vehicle owners say the ease of doing business with an aftermarket service facility is a key reason they choose them rather than a franchised dealer for some types of service.

However, J.D. Power also pointed out that dealer service facilities hold an advantage in consumer perception with one exception: customers say aftermarket service providers are easy to do business with, outperforming dealer service facilities specific to general maintenance, tire replacement and oil change services.

“During the depths of the pandemic, many dealers increased emphasis on their service business,” J.D. Power director of automotive retail Leonard Martin said in a news release. “To remain competitive, independent service providers must understand that it’s important to build on the competitive advantage of being easier to do business with — which is something franchise dealers typically fail to communicate to their sales and service customers.

“This facet of the business includes location, hours of operation, scheduling procedures and overall friendliness. Customers want to be acknowledged immediately and then served hassle-free,” Martin continued.

J.D. Power explained the study, now in its third year following its debut in 2019, measures customer satisfaction with aftermarket service facilities, providing a numerical index ranking of the highest-performing facilities in the U.S. aftermarket.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Performance in three segments — full-service maintenance and repair, quick oil change and tire replacement — is based on the combined scores for seven measures that comprise the vehicle owner service experience. These measures included:

—Ease of scheduling/getting vehicle in for service

—Fairness of charges

—Service advisor courtesy

—Service advisor performance

—Service facility

—Time to complete service

—Quality of work

J.D. Power highlighted three key findings of the 2022 study/

• Singular advantage: Across the measures of customer trust with a service provider, franchised dealers perform better than aftermarket service providers in seven of eight attributes, with the exception being ease of doing business. The franchised dealer average score in this measure is 6.11 (on a 7-point scale) compared with independent full-service maintenance and repair facilities (6.18); tire replacement facilities (6.20); and quick oil change facilities (6.28).

• Independents improve in fix it right the first time: Successfully completing work the first time is a critical key performance indicator (KPI) to increase customer satisfaction. When work is completed right the first time, customer satisfaction increases. Independent service providers improve on this important metric, climbing from already high scores in 2021.

The percentage of full-service maintenance customers who say their problem was fixed right the first time increased to 97% from 94% in 2021. Among quick oil change customers, the percentage increased to 98% from 97% and among tire replacement customers, the percentage increased to 96% from 94%.

“Given that both franchised dealers and independents are finding it more difficult to hire qualified technicians, this result is heartening,” Martin said. “It’s an indicator that the general level of service has improved despite labor challenges.”

• Price and convenience equally important: Some 39% of service customers cited the lower cost of service as a reason for choosing independent service providers.

In comparison, 38% cite ability to accommodate their schedule and 34% cite the perceived ease and speed of using the facility. Among Gen X, Gen Y, and Boomer respondents, prior experience with the service facility trumps price and convenience.

“As American consumers emerge from the pandemic, the demand for automotive service is on the upswing, and their service expectations remain high,” Martin said. “This research confirms that independent specialty service providers still have a strong place in the market, especially if they emphasize strengths that include convenient locations and ease of doing business.”

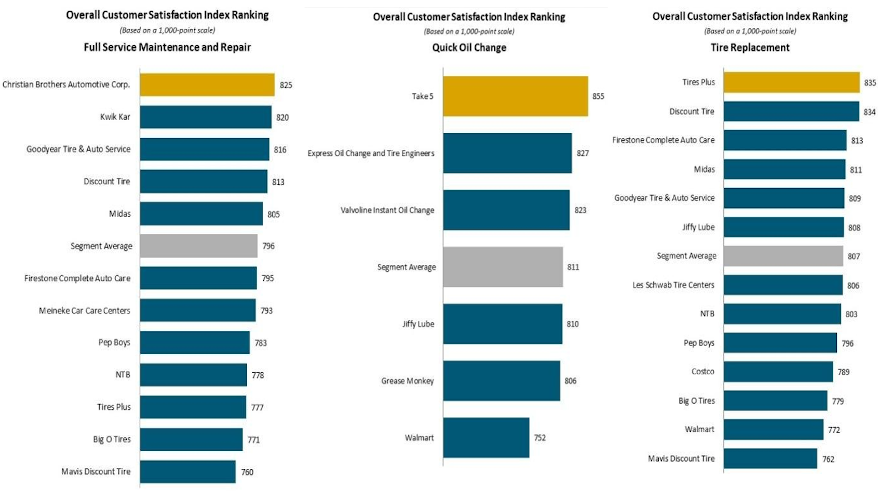

After compiling all the data and trends, J.D. Power determined Christian Brothers Automotive Corp. ranked highest in satisfaction for full-service maintenance and repair with a score of 825. Kwik Car (820) placed second and Goodyear Tire & Auto Service (816) came in third.

Take 5 ranked highest in satisfaction for quick oil change with a score of 855. Express Oil Change and Tire Engineers (827) landed in second and Valvoline Instant Oil Change (823) placed third.

Tires Plus ranked highest in satisfaction for tire replacement with a score of 835. Discount Tire placed second (834) and Firestone Complete Auto Care (813) came in third.

The 2022 U.S. Aftermarket Service Index (ASI) Study is based on responses from 9,979 vehicle owners. Survey data collection was conducted online between November and May. Survey respondents were initially selected from online consumer panels.

New for the 2022 study was the inclusion of geo-fencing data in which respondents were invited to take the survey after their cellphone location indicated they had recently visited a non-dealer service facility. Respondents were screened for having aftermarket service performed in the past 12 months.