Lane watch: Black Book’s forecast for rest of 2024

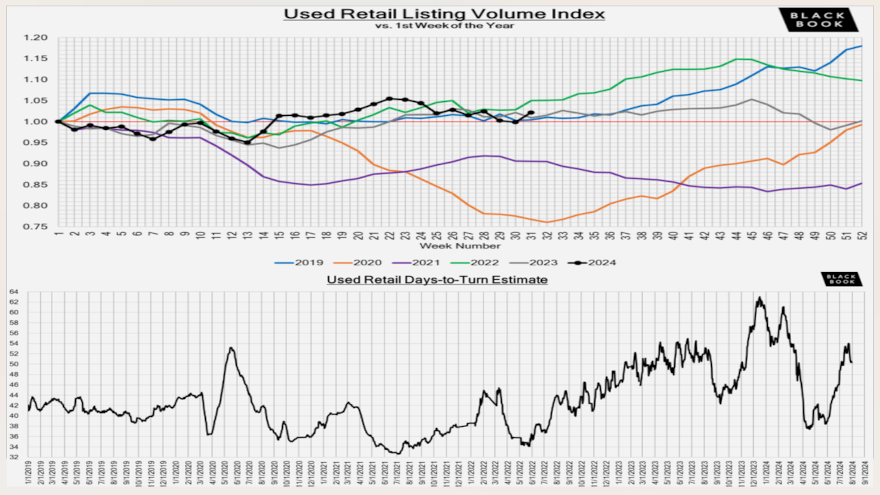

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Full acknowledgement that a good portion of the data-driven updates Cherokee Media Group published on Tuesday contained negative subjects, with a discussion about the possibility of a recession already happening as well as another notable increase in bankruptcy filings.

Well, here’s some more upbeat news courtesy of Black Book, which shared its expectations on Tuesday for what the wholesale market might be like for the rest of the year.

“The second half of 2024 is forecasted to remain stable,” Black Book said in its latest installment of Market Insights.

“Following some volatility earlier this summer, possibly linked to the CDK outage, the market is now stabilizing, with depreciation returning to typical seasonal patterns. Auction attendance remains strong, and conversion rates are consistently solid,” Black Book continued while noting last week’s conversion rate stood at 59%.

Black Book also mentioned its estimated used retail days to turn also is stable at roughly 50 days.

All of those factors added up to send overall wholesale prices lower by just 0.33% last week, which was 3 basis points less than a week earlier, according to Black Book tracking.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The overall stability of the wholesale market at the beginning of the month is a positive sign as the rate of change is now only marginally higher than pre-COVID seasonal norms,” analysts said in the report.

Among specific vehicle segments, a couple of car value movements likely pointed to the ongoing search for affordability by potential dealership customers.

Black Book noticed midsize cars appreciated again, ticking up 0.06%, following the previous week’s increase of 0.14%.

And analysts said compact cars depreciated by only 0.19%, marking the smallest weekly value decline for the segment since May.

Furthermore, while prestige luxury car sustained the largest price decline last week at 0.47%, Black Book pointed out that’s only a fraction of what those vehicles experienced three weeks ago when values for those units dropped by 1.28%.

Meanwhile, Black Book reported all 13 truck segments sustained a value decline last week, paced by compact vans that decreased by 0.83%.

During the past three weeks, analysts said compact vans have averaged a weekly depreciation of 0.75%.

Black Book added small pickups also have depreciated for three weeks in a row, averaging a value loss of 0.93% each week.

One other note in the truck department. Black Book said prices for full-size vans slipped only 0.17%, representing the smallest weekly decline for those workhorses since the middle of May.