Lane watch: Both auction conversion rates & retail days to turn on steep upward trajectories

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

According to Black Book’s tracking, dealers are buying more vehicles at auction nowadays, but they’re also needing almost two additional weeks to get those cars retailed.

Among two of the most interesting parts of the newest installment of Market Insights, Black Book reported the auction conversion rate increased last week to 61%, representing a 3% rise from the previous week.

Meanwhile, analysts said the estimated used retail days to turn is rising and is now at 50 days. That’s up from approximately 38 days that Black Book recorded in the middle of April.

What have those trends done to wholesale prices?

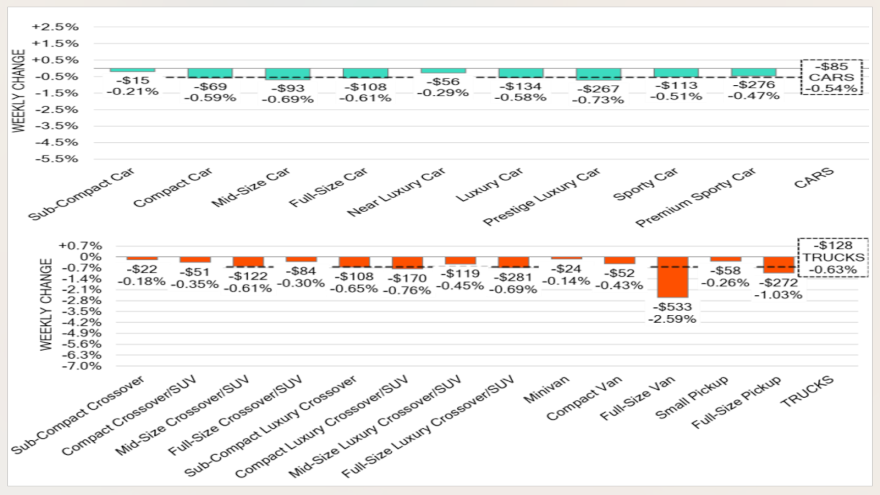

Black Book determined values tumbled another 0.60%, which is nearly double the average decrease analysts noticed during the same weeks in 2017 through 2019.

After rattling off the overall trends, Black Book pinpointed a few other specific data points dealers also might find interesting.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book said prices for 8- to 16-year-old cars decreased 0.72% last week, marking the steepest decline for those specific units since the last week of December.

Analysts explained that movement came in part because values for midsize cars dropped 1.12%.

Among trucks, Black Book watched prices for full-size vans drop by 2.59%, representing the largest decline this year for those workhorses.

“The increase in used cargo vans in auction lanes over the past five months has contributed to the downward pressure on prices,” analysts said in the report.

All 22 of Black Book vehicle segments posted overall value declines a week ago, with some notable decreases involving prestige luxury cars (down 0.73%) and premium sporty cars (0.47%). For the latter category, it was the largest single week price decline since early March.

Analysts dug deep into their data to find a couple of value upticks within very specific categories. They included minivans and small pickups less than 2 years old that generated price rises of only 0.09% and 0.12%, respectively.

“As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insight,” Black Book said.