Lane watch: The numbers battle involving full-size pickups

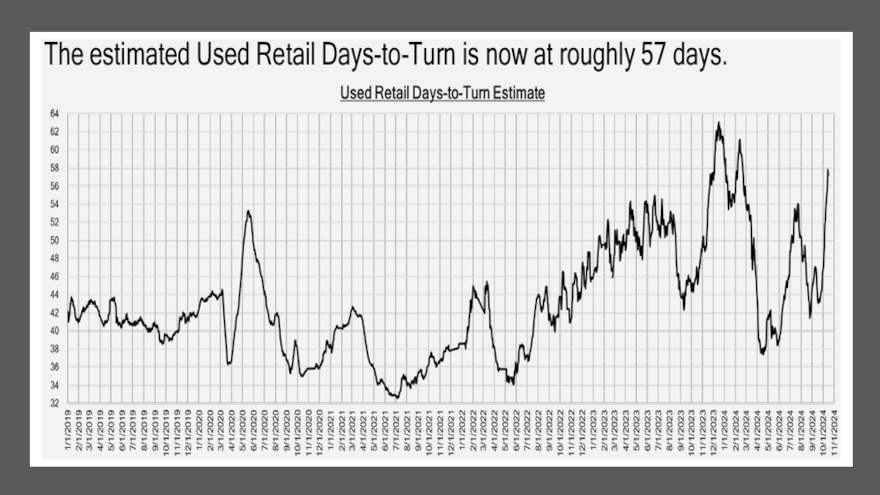

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Sending a full-size truck to auction appears to be as much of a heartburn-triggering situation for franchised dealers as seeing that new model sitting in inventory and on the store floorplan for 100 days or more.

Data from Black Book, Cox Automotive and J.D. Power showed the numbers crunch unfolding that might again be pitting the used-car department versus the new-car division.

As Black Book reported overall wholesale prices dropped another 0.35% last week, analysts also revealed in their latest installment of Market Insights that prices for full-size pickups posted their largest drop since the penultimate week of July.

Last week, Black Book watched 12 of the 13 truck segments decline in value, with the full-size pickup segment leading the way at 0.42%. That’s the highest rate of depreciation for the segment since that previously mentioned week in July when Black Book tracking pegged it at 0.47%.

“On the truck side, there was a sharper decline observed specifically in the 2024 model year 1500 series trucks,” Black Book said in the report released on Tuesday. “This trend could be attributed to rebates and other incentives available on new trucks sitting on dealers’ lots.”

Previously, J.D. Power indicated average incentive spending per unit on trucks in September was expected to be $3,243, up $1,296 from a year ago.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

And Cox Automotive reported last week that overall new-vehicle days’ supply stood at 81 at the start of October, just one day more than the 80 days analysts noticed October 2019.

And perhaps reinforcing Black Book’s observations about 1500 series pickups, Cox Automotive determined Ram new-model inventories began October at 142 days, trailing only Jaguar, Lincoln and Alfa Romeo.

Cox Automotive also mentioned GMC, which has its stable of 1500 series pickups, too, had a new-model inventory level of 88 days to start October.

While there might be a truck conundrum, Erin Keating, an executive analyst and senior director of economic and industry insights at Cox Automotive said in a Data Point that “things look remarkably ‘normal’ in the recent new-vehicle inventory and sales data. According to an analysis of vAuto Live Market View data, sales volume and days’ supply at the start of October look to be getting back on track with the last year we all recall as ‘normal,’ 2019.”

So, are things “normal” in the used-car world now?

Well, Black Book said on Tuesday that the estimated used retail days to turn is now at roughly 57 days.

And the auction conversion rate slipped to 56% a week ago, down 1% from the previous week.

“Typically, the used vehicle wholesale market experiences seasonal declines, but last week’s reduction was less pronounced than what we usually observe,” Black Book said. “We are vigilantly monitoring auctions for potential flood-damaged vehicles to ensure they are correctly identified as outliers in the valuation process, thus maintaining pricing accuracy.”

CARFAX is estimating that upwards of 138,000 vehicles were flood damaged by Hurricane Helene, which caused destruction in at least six Southeastern states.

If dealers have customers who need another vehicle because the storm destroyed their previous one, stores might be able to find a deal for them with a full-size car. Black Book said wholesale prices for full-size cars that are less than 2 years old dropped by 0.65% last week.

Other potential options for storm-impacted buyers could be sub-compact cars (which had a 0.51% wholesale price drop last week) and sub-compact crossovers (which had a 0.73% wholesale price decline a week ago).

One other note from the wholesale market. Black Book said prices for premium sporty cars rose for the second week in a row, ticking up 0.03% following a 0.07% increase during the previous week.

What might happen next in wholesale and retail?

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book said.