Lane watch: What only appreciating vehicle segment might be saying about market

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

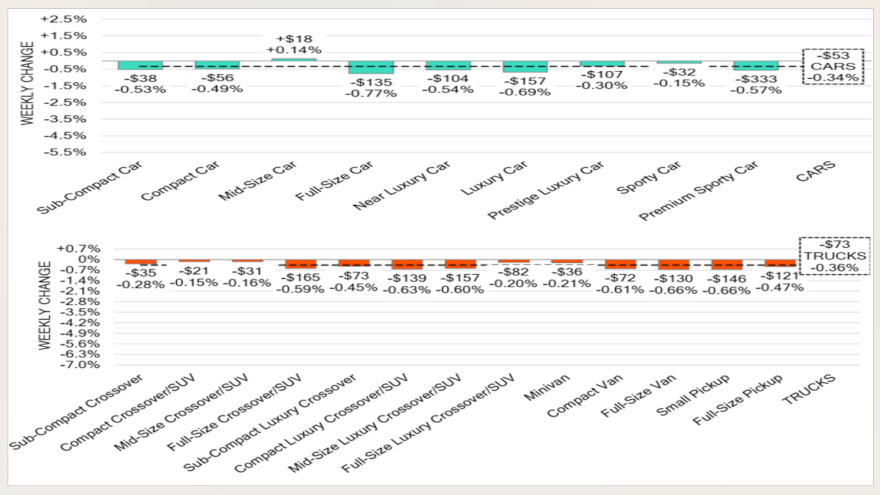

Perhaps it’s jumping to conclusions, but the only segment in Black Book’s tracking to squeeze out a wholesale value uptick last week might relate to vehicles in position to solve one of the pressing current challenges to get cars financed and retailed.

Cox Automotive chief economist Jonathan Smoke said last week that “retail vehicle demand remains resilient but clearly constrained by affordability.”

And Black Book noticed wholesale prices for vehicles that might be affordable — midsized cars — edged up 0.14% last week. Smoke made his observation when he reported the average rate for used-car financing booked so far this month has increased 29 basis points to 14.42%. That’s up 80 basis points year-over-year, according to data collected via Dealertrack.

Meanwhile, Black Book mentioned in its newest installment of Market Insights that analysts estimated that the used retail days to turn is still rising, currently sitting at roughly 53 days.

Maybe that’s why if dealers see a late-model Chevrolet Malibu or Hyundai Sonata in good shape crossing the block, hands are going up and clicks are happening because dealerships might have plenty of buyers for that specific vehicle.

Even though the other 21 vehicle segments sustained value decreases, Black Book pointed out in its report that the overall depreciation rate is resembling a reading analysts typically see during this time of year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book reported overall wholesale values softened 0.36%, which is less than half of what analysts pinpointed a week earlier and just 8 basis points more than the average recorded during the same week in 2017 through 2019.

“As July comes to a close, the depreciation rate is stabilizing. After experiencing significant declines over the past couple of weeks, last week’s depreciation rate slowed, aligning more closely with the typical rates for this time of year,” analysts said in their report.

Pacing the declines were full-size vans (down 2.59%), prestige luxury cars (down 1.28%) and full-size cars (0.77%). Black Book acknowledged the decreases for those first two vehicle segments were two of the largest single-week movements analysts have seen so far this year.

“The auction conversion rate remains high, with last week’s rate at 60%, up 2% from the previous week and just 1% below the highest conversion rate recorded this year,” Black Book said. “This indicates a strong performance in the auction market.

“As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insight,” Black Book added.