Report shows consumers ‘speaking with their wallets’ on affordability concerns

Image courtesy of CarGurus.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The car-buying public has a message for the used-car industry, and it’s this: We don’t want to pay too much for a vehicle.

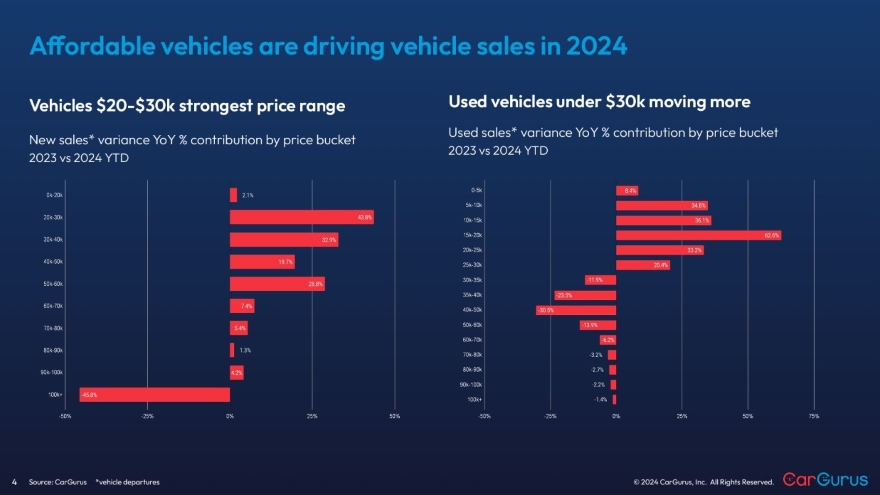

That message was clearly conveyed in CarGurus’ latest Quarterly Review, which found sales of lower-priced used cars rising and high-end vehicle sales falling.

“As we near the end of 2024, it’s clear that consumers are speaking loudly with their wallets,” CarGurus director of economic and market intelligence Kevin Roberts said. “After years of post-pandemic revenge spending, consumers are becoming more prudent as they face economic uncertainty, still-high interest rates and vehicle prices that remain elevated.

“As a result, we’re seeing concentrated demand for more affordable cars.”

That’s evident in the numbers, with sales of vehicles priced from $15,000 to $20,000 in the first nine months of 2024 up 62.6% accounting from the same period last year, accounting for 59% of the used-car market’s annual sales growth, Roberts said.

The report, based on CarGurus’ data, broke down price tiers in $5,000 increments. Among used vehicles, sales for every price tier up to $30,000 increased, while every price tier above $30,000 decreased.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In addition, used vehicles priced less than $35,000 are turning in an average of 42 days, four days faster than those priced higher, whose average days-to-turn is up two days from 2023.

There was good news on the affordability front last month, when the Federal Reserve lowered interest rates by 50 basis points.

But the CarGurus report said consumers will need to pump the brakes on any expectations that the rate cut will have a significant impact on car prices in the near future, noting, “For consumers to have relief going forward, we’ll likely need to see more interest-rate cuts as well as more price reductions.”

In a recent appearance on the Auto Remarketing Podcast, Roberts issued a reminder that the rate cut announced was for the federal funds rate, which doesn’t automatically apply to auto financing.

“That doesn’t mean it’s immediately going to trickle through and get into used vehicle financing rates,” he said. “I don’t think it’s going to have as large of an impact as what you might kind of think on the headline numbers.”

While acknowledging “coming down from multi-decade highs in interest rates is absolutely a welcome change for the environment,” Roberts added even when the half-percentage-point drop does make it to the auto market, it won’t make as large dent in the cost and monthly payment as car buyers might think.

“Average used finance rates tend to be 12% to14%, depending on what kind of source you’re looking at,” he explained. “Obviously, a 50-basis-point decrease is helpful, but if you’re looking at interest rates at 12%-14% going down to 11.5% or 13.5%, it’s still going to be a rather high interest rate. So, it’ll help reduce that monthly payment, but I don’t think it’s going to lead to demand massively increasing.”

The report showed a decrease of a half percentage point for used car rates of 12.5%-17% reduces monthly payments by an average of $8, and pointed out it would take a 3.5% rate cut to the total cost by $2,500, which would reduce the monthly payment by $59.

The report also addressed issues in used-vehicle supply — notably the gap in the market caused by low new-car production, sales and leasing during the COVID pandemic.

CarGurus listings of 1-year-old used vehicles were down 21% compared to the pre-pandemic average from 2017-2019, and 2-3-year-old vehicle listings dropped 12%. Those cars are selling faster, too, with listings for 1-year-old (average of 63.9 days on market) and 2-3 year-old (58.5 days) vehicles, going considerably quicker than 4-5-year-old vehicles (71.7 days).

“We’re just starting to deal with some of the aftershocks, hangover, pick your terminology, of what happened on the new vehicle side of the market,” Roberts said during his podcast. “Right around May, supply of vehicles in those particular model years has been trending down [in terms of] what’s available on lots across the country. What you’re starting to see there is that overall lack of production, lack of sales is starting to work its way through there. So, in the near term, it’s more difficult to find 2020 and 2021 model years.

“Over the next several years, anything that’s a late-model-year used vehicle is going to be a bit more challenging to find, and that has a range of implications. Certified pre-owned, a segment that really depends on those off-lease vehicles … it’s going to be challenging to find younger CPO vehicles for the next several years. If you like younger used vehicles, you’re probably going to be paying higher prices on that front.”

That said, Roberts explained, that situation isn’t all bad.

“That’s going to be somewhat of a positive for the environment, as that will kind of stabilize used vehicle prices across the board,” he said. “So, I think we’re going to get the ‘used-vehicle factory’ back up and running full speed this year, but it’s going to take a number of years to kind of work its way through to flow into the used vehicle market.”

The full Quarterly Review is available for download here.