Report shows Q1 used-car retail prices calm before a potential storm

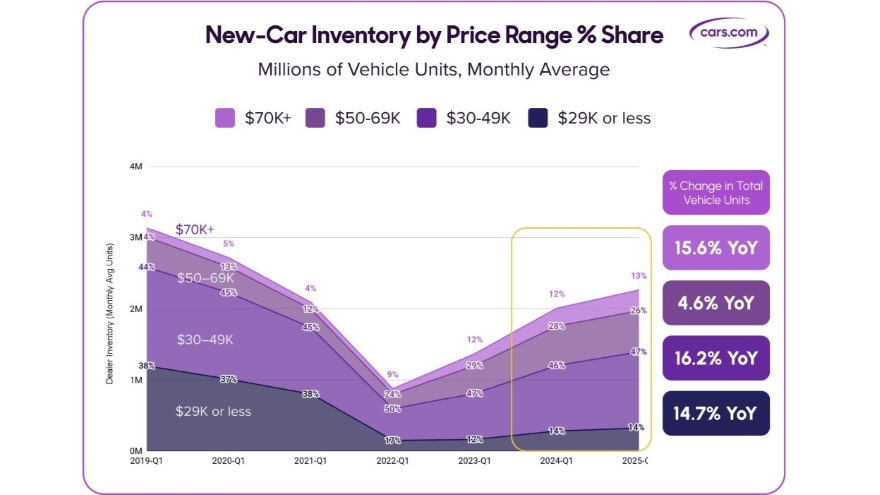

Cars Commerce's report showed just 14% of new-car inventory is priced less than $30,000, an affordability issue that is likely to fuel used-car demand. Image courtesy of Cars Commerce.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As the first quarter of 2025 ended, all was calm for used-vehicle retail prices.

But, Cars Commerce reported in its Q1 2025 Auto Market Review, that might have been the calm before the storm.

The report, based on data from the company’s Cars.com, Dealer Inspire and AccuTrade platforms, showed used-car list prices fell 0.9% in Q1 to an average of $28,497, a decline driven in part by the diminishing supply of higher-priced late-model vehicles as the COVID gap moves through the used market.

But with a 25% tariff on imported cars now on the scene and new-car prices expected to rise, Cars Commerce warned, “used prices could climb.”

An early indication might have come in the form of used-vehicle trade-in values, which in March rose 1.9% from the same month in 2024. The report said that marked the first March year-over-year increase since 2022, when inflation reached its peak.

On the other hand, the month-over-month increase was 0.15%, which the report noted was the smallest such gain in March since the initial pandemic disruption in 2020.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Typically, used-car values increase from February to March driven by tax returns and elevated consumer demand,” the report said. “Market uncertainty and delayed policy announcements likely kept some shoppers on the sidelines. But if tariffs send new-car prices higher, expect trade-in values to follow.”

Used-car supply shrank 0.6% in Q1, led by vehicles in the $20,000-$49,000 range, which average 3.8 years old, Cars Commerce said. Perhaps relatedly, used cars are taking longer to sell, with the average listing on Cars.com staying live 57 days — up 3.8% year-over-year.

The report said that suggests car buyers are hesitant to pull the trigger as they consider vehicles’ value, noting cars priced $20,000-$29,000 cost $10,000 more than cars in similar condition compared to just three to four years ago, while $10,000-$19,000 vehicles now average 7.6 years old and 82,000 miles.

Still, demand for used cars is likely to rise as new cars become less and less affordable, with the report showing cars priced less than $30,000 now make up 14% of new-vehicle inventory, down from 38% as recently as 2021.

While didn’t stop a frenzy of consumers rushing to buy new cars in March — sales soared 11% year-over-year and reached the sixth-highest March total since 1976, according to the U.S. Bureau of Economic Analysis — the lack of inexpensive new vehicles is expected to drive more customers to the used market.

“For many Americans, a car isn’t a luxury — it’s an essential part of daily life,” Cars Commerce industry analyst David Greene said. “The entry-priced vehicle category still hasn’t recovered from the chip shortages caused by the pandemic, and these new tariffs could stall further progress.”

One factor that was supposed to help with affordability was the interest-rate cuts by the Federal Reserve, which dropped its rates by 100 basis points between September and December 2024. But that didn’t help auto-loan APRs, which the report said climbed 19 basis points year-over-year during the first quarter as lenders tightened credit terms amid market uncertainty.

“Even with more vehicles on lots, the path to ownership is becoming more difficult,” Greene said, “especially for first-time buyers and those with tighter budgets.”

The full report is available here.