Surge in wholesale prices signals start of tariff-fueled ‘roller coaster ride’

Image courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Hold on tight, folks. It’s going to be a bumpy ride.

A surge in wholesale used vehicle prices in the past two weeks signals the beginning of what could be a wild and unpredictable year of ups and downs in the market.

The “roller coaster ride” predicted by Cox Automotive chief economist Jonathan Smoke is underway.

In a conference call this week announcing the results of the Manheim Used Vehicle Value Index for the first quarter, Cox analysts noted the early “spring bounce” in used vehicle values that sprouted during the first half of March was seemingly withering away – until the reality of a 25% auto tariff was looming on the horizon.

The MUVVI, which measures wholesale values on a mix-, mileage- and seasonally adjusted basis, was actually down overall in March, as the rise in prices was less than typical for the season.

“But in the last week of the month, we saw week-to-week price gains re-accelerate, and that’s not normal,” senior director of economic and industry insights Jeremy Robb said. “That was the week before the tariff announcement and we saw stronger gains in that week versus the prior week.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

That acceleration not only continued after the tariff announcement — it intensified. Robb said the index for 1-to-10-year-old vehicles jumped by 1.2 percentage points during the first week in April, a number 10 times higher than the typical increase of 0.1%, while auction sales conversion rates, which hit 65.6% in the last week of March, rose again during the first full week of April.

“That was the strongest move we had seen going back to spring of 2021,” he said. “So we’ll need to watch and see what trends transpire over the next month as activity in the used market increases.”

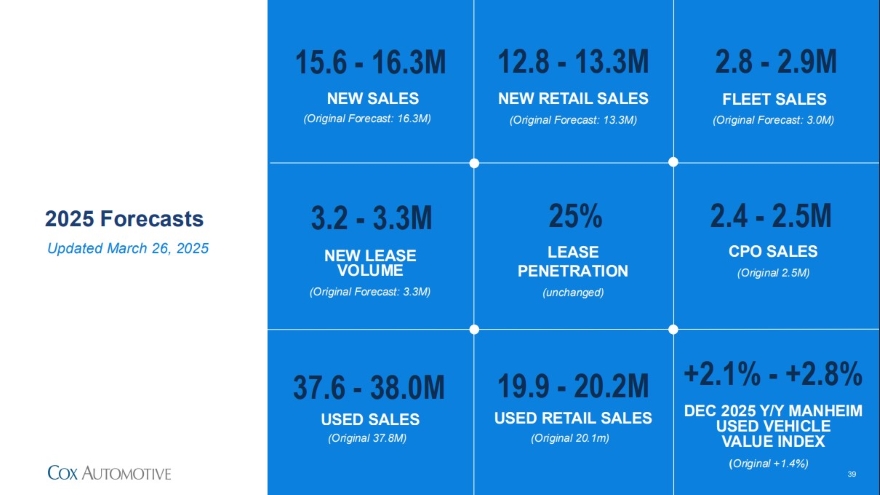

Exactly what that activity will look like is far from clear. Indeed, Cox’s Q1 updates to its 2025 forecasts have shifted from a single number in each category to “ranges of scenarios,” Robb said, because “there are a lot of unknowns out there.”

But while the forecast for new-car sales ranges from a potential low of 15.6 million units to as high as the original projection of 16.3 million, the used-vehicle range is narrower, from 37.6 million to 38.0 million, with the original estimate of 37.8 million smack in the middle of that range.

“Used should be much more stable as consumers opt for lower-priced used units with tariffs applying to new vehicles,” Robb said. “The used vehicle values are likely to be stronger than we see in a normal year.”

That stability doesn’t necessarily apply to used vehicle prices, especially on the wholesale side. Cox’s original forecast had the Manheim Used Vehicle Value Index rising 1.4% over 2024’s year-end value. The updated version now projects it to increase by at least 2.1% to as much as 2.8% by the end of the year.

Cox’s analysts said those increases won’t reach the level of the skyrocketing prices resulting from the COVID pandemic and supply-chain problems that followed it.

“Our context for the used car market in particular is very different than it was in 2021,” Smoke said. “Back then, we had what became $4.1 trillion of stimulus pushed through the economy. Consumers had excess cash. … Obviously, this year, we don’t have any stimulus going on. Consumers are greatly tapped out. The credit conditions are tighter. Rates are at 25-year highs when they were flirting with the lowest rates we’d ever seen on used vehicle loans back in 2021. So we don’t think that demand is likely to be sustained.”

And that, he said, will create the roller coaster effect.

“We do think we’ll see some weeks just like this past week that are going to deliver price appreciation like what we experienced in 2021, which was effectively no declines in prices as they moved higher,” he explained. “We’re expecting a more normal experience for the used vehicle market, and that is when prices see an abnormal increase, they typically don’t stick. They typically come back down.”

Some of that, Smoke said, depends on how used-car price relate to new car prices, which will be elevated by the tariffs. And while that impact is expected to be a 10% increase at most, far less than that of the pandemic, it will still reduce demand for vehicles.

“And it’s that demand component that I think really keeps a lid on what we’re likely to see with used vehicle price appreciation,” Smoke said. “We’re thinking there’s a possibility of more significant price increases, but they just don’t last. And that’s why the net effect is lower than you might think, especially when our most recent experience through the pandemic delivered something we had never seen before.”

For now, the Cox analysts said, demand remains up and sales remain brisk. How long that lasts is the million-dollar question.

“What we’re seeing in our data suggests we could see roughly the same level of demand persisting through the month of April.” Smoke said. “But our view of the demand is it’s not going to be sustainable against prices rising. The key is going to be when we exhaust the pre-tariffed inventory, which was definitely less than two months of supply once we had that surge at the end of March.

“So all eyes on what exactly happens with discounting, with incentive levels and with actual price increases that probably will start to be more apparent as we work our way through April, but certainly will be the case as we get into the month of May.”

Assuming the tariffs remain in place, he said, later this year the used- and new-car markets could find themselves faced with a “double whammy” of rising prices and shrinking supply from production declines and tighter inventory levels that effectively limit how much can be sold.

All of this, of course, is subject to change as political realities shift and markets react. For now, though, the one thing that’s clear is things are changing.

“We are indeed in the midst of a major transformation in the auto market and the broader economy driven by radical policy changes to trade,” Smoke said. “Tariff announcements altered demand right at the end of the quarter and altered the path for what is likely to come in the months ahead.”