Uncertainty to stifle EV market share growth in 2025, J.D. Power projects

Image courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While market share for battery electric vehicles rose in 2024, uncertainty is now dominant in the EV landscape.

In its 2025 U.S. Electric Vehicle Experience Ownership Study, J.D. Power cited data showing BEV market share reached 9.1% at the end of last year, a 0.7-percentage point increase fueled in part by the growing number of mass market BEV models entering the market.

But because of the Trump Administration’s push to eliminate or reduce EV tax incentives and public charging infrastructure funding, the research firm is projecting EVs’ share of retail sales to remain flat in 2025.

J.D. Power said updates to the Inflation Reduction Act more than doubled the amount of EV owners who indicated they received a federal tax credit/rebate, and more than half of BEV buyers cited tax credits as a reason for purchasing their vehicle.

“The elimination of EV tax incentives and public charging funding has the potential to affect two critical barriers to EV adoption: public charging availability and vehicle prices,” said Brent Gruber, executive director of J.D. Power’s EV practice. “This temporary slowdown in market share growth for EVs creates a unique challenge for the industry as manufacturers forge ahead with new vehicle introductions.

“The EV market will be faced with expanded product offerings and flat share, creating increased competition.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

That said, the study found EV owners remain intensely loyal, with 94% saying they’re likely to consider purchasing another BEV for their next vehicle, and first-time buyers matching that percentage. J.D. Power said that rate has been very steady, ranging from 94% to 97% for the past several years. And just 12% of BEV owners said they’re likely to consider replacing their EV with gas-powered vehicle with their next purchase.

“With five years of conducting this study and surveying thousands of EV owners,” Gruber said, “it’s apparent that once consumers enter the EV fold, they’re highly likely to remain committed to the technology.”

Other findings include:

Customer education: 69% of first-time BEV buyers said they received some form of education or training on aspects of EV ownership from dealership or manufacturer staff when buying their vehicle. But exposure to specific topics ranged a high of 46% for how specific features work to a low of 12% for the total cost to own an EV. Gruber said the education EV buyers need “to shorten the learning curve just isn’t happening often enough.”

Mass market quality: Owners of mass market BEVs again experienced fewer problems than owners of premium BEVs, though the gap has narrowed. Seven of the 10 BEV models with the fewest reported problems in the study are in the mass market segment.

Plug-in hybrids: In previous years, the J.D. Power study found plug-in hybrid owners were much less satisfied than BEV owners, but the new study added premium PHEV segment, which averaged 741 on a 1,000-point scale for satisfaction – better than the average for mass market BEVs (725) and mass market PHEVs (632) and just shot of the 756 average for premium BEVs.

Public charging: The gap between premium and mass market BEV owners in satisfaction about public charger availability is narrower than ever before. Satisfaction among mass market BEV owners soared 86 points year-over-year to a still low 396 as infrastructure buildout continues and brands benefit from the opening of the Tesla Supercharger network. For premium BEV owners, public charger availability scored 551.

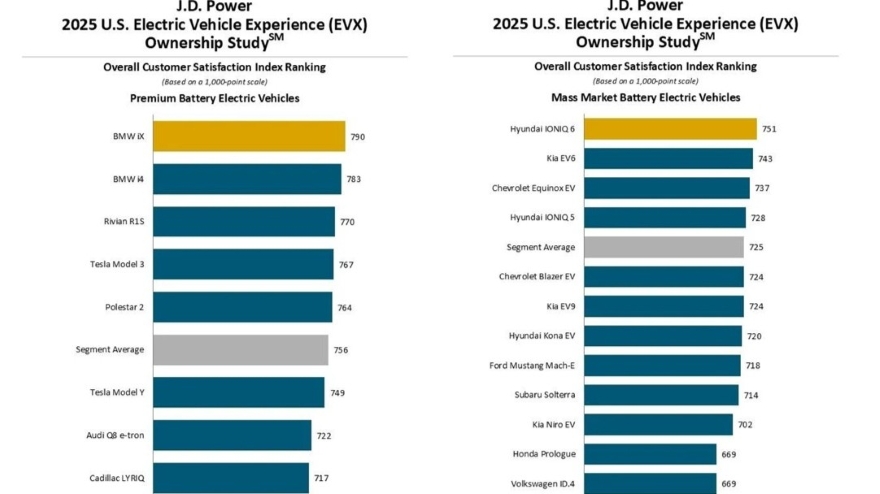

Satisfaction rankings: The BMW iX topped all models and the premium BEV segment with a satisfaction score of 790, followed by fellow premium models BMW i4 (783) and Rivian R1S (770). The Hyundai IONIQ 6 took the mass market title at 751, outpacing the Kia EV6 (743) and Chevrolet Equinox EV (737).

The U.S. Electric Vehicle Experience Ownership Study, conducted in collaboration with PlugShare, focuses on the first year of ownership, using 10 factors to determine its owner satisfaction score: accuracy of stated battery range, availability of public charging stations, battery range, cost of ownership, driving enjoyment, ease of charging at home, interior and exterior styling, safety and technology features, service experience and vehicle quality and reliability.

The study, conducted from August through December, surveyed 6,164 owners of 2024 and 2025 model-year BEVs and PHEVs.