Work Truck Solutions: Q2 used sales rise as average price for new models sets new record

Chart courtesy of Work Truck Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Work Truck Solutions released its Q2 2024 commercial vehicle market analysis on Tuesday, highlighting that the sales of used units increased for the first time since Q1 2023.

While its data pinpointed a 2.9% lift quarter-over-quarter, Work Truck Solutions pointed out that used sales are still off by 17.6% year-over-year.

Within the new market, Work Truck Solutions said Q2 sales rose 4.8% quarter-over-quarter and 7.3% year-over-year.

Fueling those new sales figures are hybrid/electric work trucks and vans. Work Truck Solutions said sales of new hybrid/electric work trucks and vans spiked 35.0% quarter-over-quarter and 28.6% year-over-year.

What about what buyers are paying for commercial vehicles? Work Truck Solutions shared its data on that front, too, describing the significantly different scenes happening in used versus new.

According to the report, the average price for a commercial vehicle retailed in Q2 was $33,804, which is 1.7% lower quarter-over-quarter and 6.1% lower year-over-year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Meanwhile, Work Truck Solutions said the average price for a new commercial vehicle sold in Q2 set a new record, climbing 0.6% quarter-over-quarter and 6.8% year-over-year to reach $58,470.

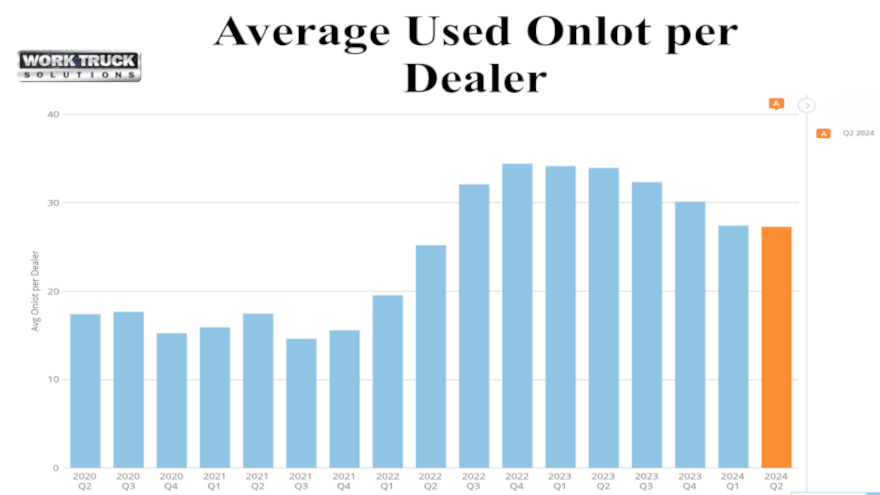

And when looking at inventory levels, Work Truck Solutions said dealers’ used commercial vehicle inventory remained stable in Q2, but the level was 18.5% lower year-over-year.

While setting retail sales price records, Work Truck Solutions also mentioned that dealer inventory of new commercial vehicles jumped again in Q2, rising by 9.7% quarter-over-quarter and a whopping 66.6% year-over-year.

That movement prompted Work Truck Solutions to say in a news release that “with quarterly growth being primarily early in the quarter, indicating a need to continue to closely monitor these numbers to see if a new trend is developing, or it’s an anomaly.”

Finally, when it comes to days to turn, Work Truck Solutions said the metric in the used market decreased 8.3% year-over-year to an average of 55 days, “suggesting a leveling-off trend.”

And with new inventory rising noticeably, Work Truck Solutions added that days to turn for new commercial units rose 14.5% quarter-over-quarter and 40% year-over-year, reaching 119 days. The firm said that’s the highest average level since 2020, “largely due to increased inventory as well as increasing interest rates.”

Here’s how Work Truck Solutions summarized its data from the commercial vehicle market: it’s revealing an “inexorable swing from the days of scarce inventory, with many of the corresponding ripples that come with increased availability.”

The firm added the landscape of alternative fuels in the commercial vehicle market remains in flux.

“Although inventory is not back to pre-pandemic levels, we’re seeing indicators that suggest a run toward a buyer’s market is in the making,” Work Truck Solutions CEO Aaron Johnson said in the news release. “We noted the data shift in our Q1 2024 data report, and we can reasonably expect these trends to continue. Of course, all of this is subject to emerging local and international affairs, which impact trajectories

“With many OEMs producing fewer EVs, and sales spiking over the last quarter as buyers take advantage of government incentives, we’ll have to watch to see if this becomes a pronounced trend following the November elections,” Johnson continued.

“The way end-users shop has evolved into a highly digital affair and is certain to remain that way, so it is wise for commercial vehicle dealers and upfitters to embrace modern merchandising technology,” Johnson went on to say.