J.D. Power & Work Truck Solutions provide commercial vehicle update

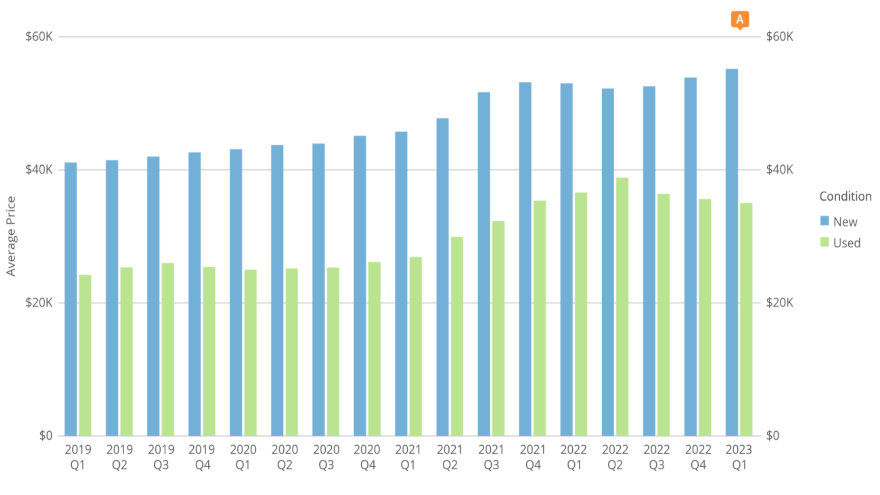

Chart showing commercial vehicle retail prices courtesy of Work Truck Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

J.D. Power Valuation Services and Work Truck Solutions each shared insights about what’s happening in connection with commercial vehicles within both the wholesale and retail segments.

Beginning with J.D. Power Valuation Services’ look at auction activity in March, analysts said sales volume with commercial units increased notably, with most trucks sold showing higher-than-average mileage. As a result, J.D. Power said depreciation accelerated.

Looking at 3- to 7-year-old trucks, average pricing for J.D. Power’s benchmark truck in March was:

—Model year 2021: $87,000; $35,200 or 28.8% lower than February

—Model year 2020: $64,317; $15,783 or 19.7% lower than February

—Model year 2019: $50,411; $4,607 or 8.4% lower than February

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Model year 2018: $36,368; $4,771 or 11.6% lower than February

—Model year 2017: $25,456; $3,759 or 12.9% lower than February

J.D. Power Valuation Services acknowledged that the “extreme” drop in its average for model-year 2021 trucks may be exaggerated due to very low volume.

“Three-year-old trucks are certainly depreciating, but a more detailed assessment will not be possible until more of these trucks cycle through the used market,” analysts said in a news release.

“With that in mind, late-model trucks averaged 14.3% less money in March than February, and 47.4% less money than March 2022,” they added.

J.D. Power Valuation Services touched on another part of the wholesale market equation.

“The definition of ‘low mileage’ is narrowing, with a notable price premium given only to trucks with less than 300,000 miles,” analysts said. “With new trucks more readily available, demand for lower mileage used units has diminished. Also, fleets and owner-operators continue to offload their highest-mileage equipment, as excess capacity is no longer needed.”

Retail view of commercial units

Last week, Work Truck Solutions released its Q1 2023 Commercial Vehicle Market Analysis, noting that a slow but steady increase of inventory available from OEMs is affecting commercial vehicle sales in predictable ways.

Looking closer at inventory trends, Work Truck Solutions made two observations, including:

—With Ford leading the charge among OEMs, new on-lot inventory per dealer continued to grow, rising 10.8% quarter-over-quarter and 46.4% year-over-year.

—With new inventory levels still only 46.3% of what they were in 2019, used vehicles continued to help fill the demand, as evidenced by the rise in used on-lot inventory per dealer, spiking 125.4% year-over-year.

Turning to pricing information, Work Truck Solutions reported average used vehicle prices continued their modest decline, softening by 1.7% quarter-over-quarter and 4.3% year-over-year.

Continuing the trend Work Truck Solutions said it has seen since Q2 of last year, analysts indicated both new work trucks and vans still carry a “significant” price tag with prices increasing 2.4% quarter-over-quarter and 4.1% year-over-year.

Within new vehicle averages, Work Truck Solutions pointed out that empty cargo vans showed no signs of stagnation with prices rising:

—5.0% quarter-over-quarter and 5.8% year-over-year for light duty work vans

—1.6% quarter-over-quarter and 7.8% year-over-year for medium duty vans

Work Truck Solutions also reported prices of service trucks also continued their upward trend, citing these movements:

—Light duty units rising 1.9% quarter-over-quarter and 6.9% year-over-year

—Medium duty units ticking up 1.5% quarter-over-quarter and 6.0% year-over-year.

Similar to what J.D. Power Valuation Services mentioned, too, Work Truck Solutions said the median mileage of used work trucks and vans maintained its upward arc, with increases of 6.3% quarter-over-quarter and 11.6% year-over-year.

Although the combination of higher mileage and more available new vehicles is influencing the decrease in used-vehicle prices, Work Truck Solutions CEO Aaron Johnson noted unmet demand is slowing that decrease.

Johnson acknowledged there is a slight increase in days-to-turn that shows both new and used inventory staying on dealer lots longer, a trend he said Work Truck Solutions will watch in the coming months.

“An interesting note in this data is that even with higher new-vehicle prices, searches for new trucks and vans remained strong, demonstrating that customers are still dependent on replacing, and adding, vehicles for their businesses,” Johnson said in a news release.

“On the other side of the equation is an uncertain economy, inflation, and rising interest rates. Taking all of this information in aggregate means the commercial vehicle industry is likely moving into not only a more competitive phase, but a world where digital tools to help buyers with acquisition, like CV Showroom and EZ Order, are necessary for dealerships to thrive. Plus, savvy dealerships will need to utilize data-driven insights to position themselves as business partners rather than mere vendors,” he went on to say.