KBB Analyst Gauges Residual Impact of Treasury Selling Chrysler Shares

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

WASHINGTON, D.C. –

It’s official. The U.S. Treasury has agreed to end its ownership share in Chrysler, inking a deal late last week for Fiat to buy its remaining 6 percent interest in the Detroit automaker for $500 million.

While this certainly is a landmark for the automaker, what kind of impact will it have in the long run? For example, how will residuals be affected?

An analyst with Kelley Blue Book suggested that while this news will be positive for the general public, it won’t necessarily have any impact on the residual front.

“Regarding Fiat taking a controlling interest in Chrysler, our residual value forecasts for Chrysler vehicles have been made with the assumption that Marchionne is calling the shots. While this transaction makes it official, it is likely that little, if anything, will change in Auburn Hills,” Eric Ibarra, KBB’s director of residual consulting, told Auto Remarketing on Friday afternoon.

“To date, the results of Fiat’s involvement with the Chrysler, Dodge, Jeep and Ram vehicles have been great, with a very nice redesign on the Jeep Grand Cherokee and pretty significant refreshes on a number of other vehicles,” Ibarra continued.

“The fact that this will close a chapter on the government ‘bailing out’ Chrysler will also be a plus to the general public. However, as far as tangible improvements on residual values, it does not necessitate a restatement of residual value for the Chrysler products,” he added.

Moving along to explaining the agreement in more detail, officials noted that the Treasury is also taking all of the rights it had under the Equity Recapture Agreement with VBA and assigning them to Fiat, which will purchase them for $75 million. Of that amount, $60 million is going to the Treasury while $15 million will go to the Government of Canada.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

All told, the Treasury will pull in about $560 million in proceeds from the sale, and the department will officially have no TARP investment remaining in the automaker once the sale has wrapped up.

“As Treasury exits its investment in Chrysler, it’s clear that President Obama’s decision to stand behind and restructure this company was the right one,” Treasury Secretary Tim Geithner commented.

“Today, America’s automakers are mounting one of the most improbable turnarounds in recent history — creating new jobs and making new investments in communities across our country," he continued.

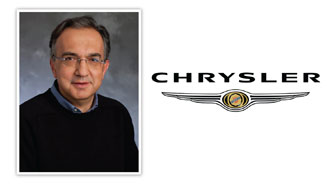

Echoing much of what Geithner said, the automaker’s chief executive officer Sergio Marchionne said last week: “The agreement reached today marking the complete exit of the United States Treasury as a Chrysler Group shareholder does not lessen the sense of gratitude that we feel toward President Obama’s administration for believing two years ago in Chrysler’s partnership with Fiat.

“The acquisition of the UST’s rights under the Equity Recapture Agreement is a further demonstration of the trust we have in the future of Chrysler and its ability to continue on a path to take its rightful place in the global automotive industry landscape,” he continued.

“Today’s announcement not only allows Fiat to strengthen its stake in Chrysler Group, but it also accelerates our integration agenda designed to create a global, efficient and competitive automaker and guaranteeing our extended Chrysler family a sound future built on an open and multi-cultural environment of shared values of integrity and respect for others,” he added.