Amazon’s move into used-car market will not be direct-to-consumer model

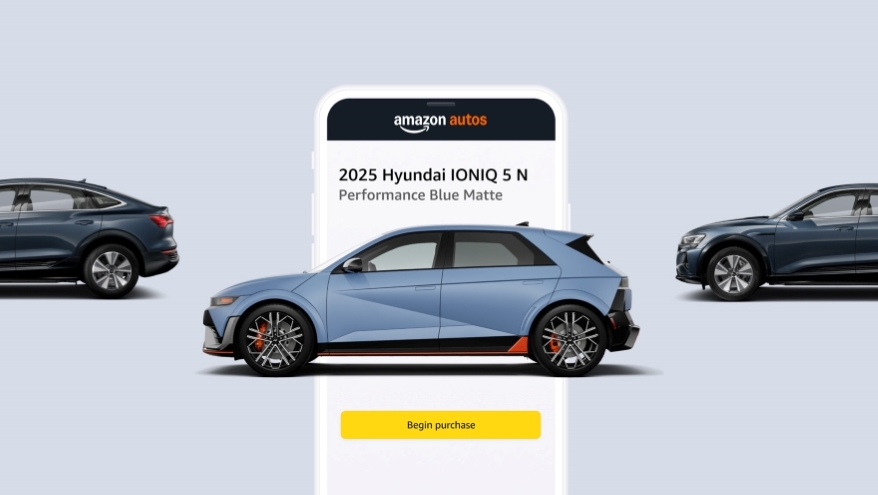

Image courtesy of Amazon.com, Inc.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Yes, Amazon Autos is moving into the used-car market, as Automotive News and others reported earlier this month.

But to be clear, it would not be a competitor to traditional dealerships, a la Carvana, CarMax, etc.

It’s not a direct-to-consumer model.

Instead, Amazon Autos would continue using a marketplace model, where dealer partners would use the platform to list and sell their own used vehicles. Amazon would not own the inventory nor be the direct seller, Amazon Autos director Matt Nuffort confirmed to Auto Remarketing this week.

“The model of Amazon Autos is dealers are the sellers of record. Dealers own the inventory. And dealers are selling the car,” Nuffort said. “The customer’s taking delivery at the dealership. So they’re going to the dealership and picking up the car.

“We really like that model because it’s a way of getting wide selection for customers,” he said. “We don’t have to own the inventory, which is also a benefit given the high cost of inventory in this space. And it’s a way of dealers reaching a wide set of customers in (a manner) that customers know and trust.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

For its used-car program, Amazon Autos is currently working with the same set of franchise dealers from its new-car program, where it has partnered with Hyundai stores.

The used-car listings available through the Amazon Autos storefront would come from the Hyundai dealers who have already onboarded with the program to start, Nuffort said.

Asked if dealers who aren’t already working with Amazon Autos could be added to the used-car program, Nuffort said: “Initially, we’re focused on the dealers who we’re working with on the new cars. We are always evaluating options for wider selection for customers.

“So, I wouldn’t say that we wouldn’t do that in the future, but at the moment, we’re working with the franchise dealers,” he said.

As for next steps in the process, he said Amazon Autos is working with its dealer partners to “define the requirements” for the used-car program.

“Used cars are a little bit different than new cars: in some ways harder, in some ways easier, right? And we are just working to define how do we ensure customer trust and transparency, just as we are on new cars, and at the same time, ensure it’s a good business for dealers,” Nuffort said. “So (that entails) working through all of the various elements of the transaction, including lending, protection products, the trade-in — all of those elements that are true for new cars will apply to used.”

Working with additional partners

In its most recent quarterly earnings report, the online wholesale vehicle platform ACV shared a bit about its partnership with Amazon, saying in its presentation slides that ACV is “the data and technology partner powering Amazon’s consumer trade-in experience for their new automotive marketplace. This dealer-friendly solution provides a seamless consumer experience while giving dealers access to new customers and increasing their vehicle acquisition success rates.”

Asked if there would be additional partners in the wholesale space, Nuffort said that “in the interest of offering wide selection to customers,” Amazon will continue seeking partnerships.

“I think that the nature of the transaction being such a complex transaction means that we work with a lot of partners in this space,” he said. “And I can envision a lot more than we are working with today to deliver that wide selection and great customer experience … And it’s really sort of amazing, you know, how many different integrations we’ve done to make this a successful transaction for both customers and for dealers.

“Having that integration with the dealer management system, for example, CRM system, so that they can provide a great customer experience and they know the customer when they walk in the door to pick up the car and the transaction is accurately reflected in the DMS,” Nuffort said.

“I think all of those elements are really important to providing a great customer experience and a great dealer experience in this space.”

Amazon Autos also plans to offer leasing and additional financing options “in the near future,” Nuffort said. Currently, Hyundai Capital is the only lending partner

Amazon Autos, instead, is “focused on the model of empowering dealers to offer their selection to customers and ensuring that’s a great experience,” he said.

One reason the company is working with dealers to sell their own vehicles is that the purchase of a vehicle “has to be supported for the lifecycle of the car,” Nuffort said.

He emphasized the importance of introducing the buyer to the dealer who then can service the vehicle down the road.

“It’s also a really complex transaction and it’s different state by state,” Nuffort said. “With dealer licenses in each state complying with the laws of that state, they offer a really important service in this whole transaction.”

Currently, when a customer purchases a vehicle through Amazon Autos, they would pick it up in person from the Hyundai store selling the car. There are some cross-state transactions that occur, Nuffort said, but that is typically in a place like the Tri-State area around New York, where a customer might cross a bridge from Manhattan into New Jersey.

Working with diverse dealer council

Nuffort would later reiterate: Amazon Autos is not a direct-to-consumer model.

The model is to help facilitate dealers selling their vehicles to consumers.

“And we’re focused on creating this marketplace that is both a great customer experience and a great dealer experience. So we really view dealers as customers. And that means working with dealers every step of the way to ensure that what we’re building delivers a great experience for dealers and their customers.”

Amazon Autos formed a dealer council over two years ago. The group includes dealers of all sizes, from large public groups to single-point rooftops, and a mix of brands. There are regular check-ins with the council as well as subcommittees specializing in various pieces of the transaction.

“Because I think at the end of the day, dealers really understand how to sell cars to customers. And it’s a very complex transaction,” Nuffort said, “so understanding all the nuances, what can go wrong – it’s really important.”