Carvana’s latest milestone: 4 million cars bought and sold

Image courtesy of Carvana.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Carvana has reached a major milestone.

The online used car retailer announced Thursday it has sold more than 2 million cars and purchased more than 2 million cars from customers since it was founded in 2013.

“Carvana’s mission has always been to change the way people buy and sell cars, and we are honored to have delivered on that goal for millions of customers and counting,” Carvana founder and CEO Ernie Garcia said. “Buying or selling a car online is no longer a niche experience reserved for early adopters. It is a mainstream, growing preference for people of all stripes across the country.

“We are proud to offer a seamless e-commerce option in automotive retail and remain focused on creating better experiences for our customers as we continue on the path to buying and selling millions of cars per year.”

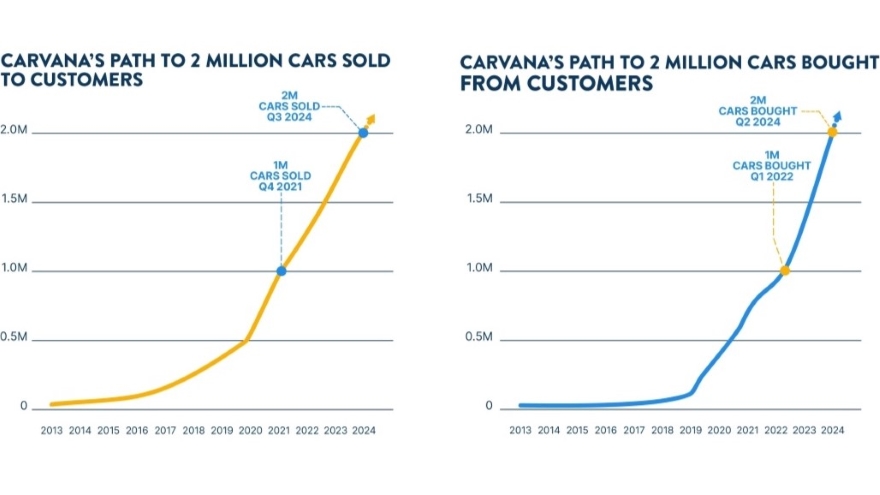

Carvana said in a news release it reached the 4 million mark in vehicles bought and sold during the third quarter with its 2 millionth sale. It issued an infographic report highlighting facts and figures from its rise “in celebration of the customers driving this progress.”

The company said it has become the fastest-growing automotive retailer in history, noting that when it launched in 2013 e-commerce was virtually nonexistent in the used car market.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It took nine years before Carvana sold its 1 millionth car in Q4 2021, but less than three to sell the next million. The company said its vehicle purchases from the public accelerated even faster. Carvana “ramped up” its efforts to buy customers’ cars in 2018, reaching the 1 million mark in 2022 and hitting 2 million just over two years later.

The report showed the wide range of Carvana’s customers in age — from 18 to 90 years old — and in the price of vehicles sold, from as low as $6,000 to $175,000. The company noted its customers skew slightly younger with a slightly higher budget than the average U.S. car buyer. Carvana vehicles have been delivered or picked up from customers in more than 22,000 zip codes in 48 states, which the report said represents “almost all zip codes with more than 5,000 residents” in the continental U.S.

Carvana pointed out that while it is one of the nation’s largest used-car retailers, it still has less than a 1% share of the market, and e-commerce penetration in the used-vehicle industry is also at less than 1% as opposed to the double-digit penetration in other industries.

“Carvana and automotive e-commerce as a whole have significant room to grow,” Carvana said in the release, “and the company’s path to its goal of becoming the largest and most profitable automotive retailer and buying and selling millions of cars per year has never been clearer.”