Dealerships’ responsiveness to internet leads hits record high again

Image courtesy of Pied Piper.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Franchise dealerships are better now than they’ve ever been when it comes responding to internet leads — and no brand is doing it better than Subaru.

For the third year in a row, Pied Piper’s 2025 PSI Internet Lead Effectiveness Auto Industry Study, which measures responsiveness to internet sales leads coming through dealership websites, recorded an all-time high industry average in its overall score.

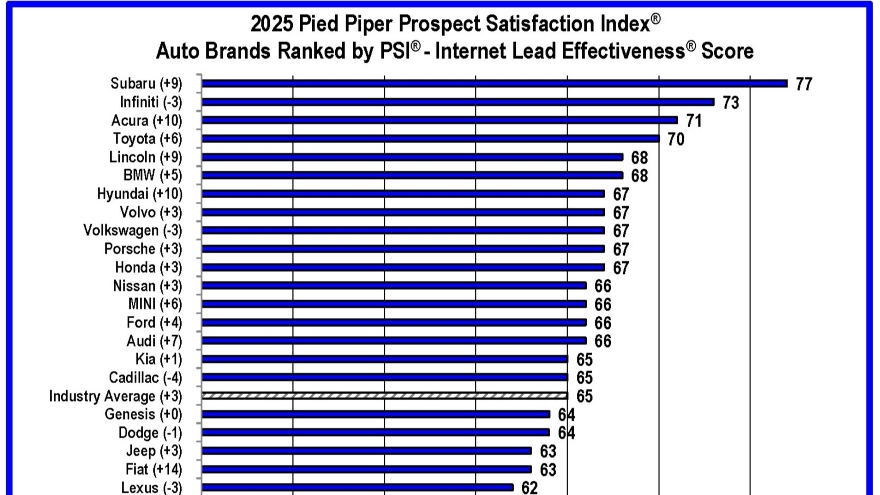

The average of 65 on a 100-point scale among the 35 brands evaluated was up three points from the 2023 record.

Pied Piper said the score is based on more than 20 weighted metrics taken from the responses to secret shopper inquiries submitted through the websites of 4,023 dealerships. The inquiries asked a specific question about a vehicle in inventory and included a customer name, email address and local telephone number. Pied Piper evaluated the speed and quality of dealership responses by email, telephone, text message and chat over the next 24 hours.

When the numbers had been crunched, Subaru’s dealers not only came out on top, their score of 77 was the highest ever recorded by the study, which has been conducted annually since 2011.

Infiniti, which set the record with a score of 76 in 2024, was next at 73, followed by Acura (71), Toyota (70) and Lincoln and BMW, which tied for fifth at 68.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The win was the first for Subaru, which improved by nine points from last year. The boost came in large part because Subaru dealers reached out to website customers through multiple communication paths 71% of the time on average, far more than the industry average of 49%. They also failed to personally respond to website leads 8% of the time, compared to 19% of the time for the industry overall.

Pied Piper vice president of metrics and analytics Cameron O’Hagan said communicating through multiple channels is “the behavior mathematically most likely to boost auto sales,” noting customers often miss emails, ignore calls or get overwhelmed by texts.

This year’s study showed while 85% of dealers responded to a customer through at least one channel, multiple paths were used less than half the time. O’Hagan said mastering communication in multiple ways improves the chance of reaching customers, and once that happens dealers can use the customer’s favored method chosen from there.

“A consistent multi-prong response to every customer is critical,” O’Hagan said. “You never know in advance which communication method will be most effective at reaching a specific customer.”

Fiat made the greatest year-over-year improvement among all brands, shooting up 14 points, though its score of 62 was still below the average. Acura and Hyundai (tied for seventh overall at 67), gained 10 points.

In a news release, Pied Piper noted a steady improvement by the industry as a whole. In addition to three consecutive record years for the average score, 28 brands scored 60 or better in the 2025 study while just eight hit that mark in 2021.

The 2025 study found dealers are now much more likely to answer a customer’s question by email or text, doing so 69% of the time on average, a jump of 10 percentage points from last year. Other notable improvements include responding to inquiries through multiple channels (49%, up from 44%), suggesting next steps in email responses (73%, up from 67%) and giving compelling reasons to buy from their dealership (27%, up from 22%).

Overall, the study showed dealers this year are more likely to answer customers’ questions and on average did so in less time.

On the down side, the rate of texting customers fell from 70% in 2024 to 64% this year. But Pied Piper said that drop was offset by an increase in texts that answered the customer’s question (38%, up from 34% in 2024). Dealers phoned a web customer 66% of the time, down from 68%.

The study also looked at individual dealership performance, finding 40% of all the dealerships measured scored better than 80 — which corresponds to providing a quick and thorough personal response — while 19% of dealerships scored less than 40, failing to personally respond to website customers. That marked a six percentage-point rise for the top dealerships and a two-point drop in those under 40.

“The effort to improve is worth it,” O’Hagan said. “Historically, dealers who improve their ILE performance from scoring under 40 to scoring over 80 on average sell 50% more units from the same quantity of internet leads.”