February used-car sales jump could bolster improving dealer sentiment

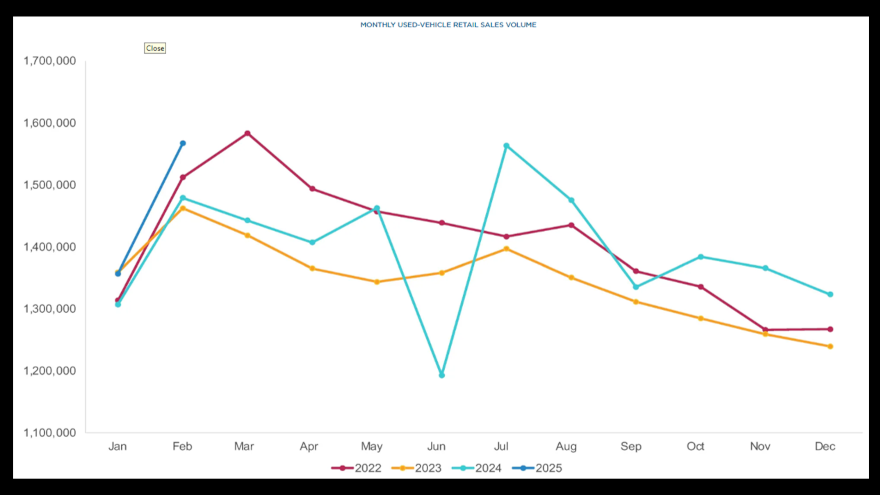

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While certified pre-owned sales ticked up only marginally, Cox Automotive spotted “the largest jump seen in recent years,” when analysts combed over retail used-vehicle sales information for February.

And the estimated sales lift might continue to help dealer sentiment that Cox Automotive said already was improving.

According to an analysis of Cox Automotive’s vAuto Live Market View data estimates, retail used-vehicle sales in February increased month-over-month compared to January.

Analysts determined franchised and independent dealers combined to retail 1.57 million used vehicles during February, which was up 6% year-over-year.

Cox Automotive mentioned that days’ supply of used vehicles at the beginning of March stood at 42, which was down eight days from the beginning of February and down three days compared to last year.

Scott Vanner, senior analyst of economic and industry insights at Cox Automotive, said in reaction to the sales information: “While the used-vehicle sales pace typically increases from January to February with the influx of tax refunds, this year’s 16% increase is the largest jump seen in recent years.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The certified space hasn’t enjoyed quite the lift the rest of the used-car market has.

According to data reviewed by Cox Automotive, February’s CPO sales were estimated at 203,663, up from 203,071 in January, marking a 0.3% increase.

Analysts said certified retail volume increased a little less than 600 units last month but fell more than 7,000 units from last year.

All told, CPO sales in February softened by 3.4% year-over-year, according to Cox Automotive tracking.

Cox Automotive reiterated the retail used-vehicle sales estimates are based on observed unit changes tracked by vAuto.

Just before sharing this sales analysis, Cox Automotive also released its Q1 2025 Dealer Sentiment Index (CADSI), which showed dealers’ view of current market conditions increased from an index score of 42 in Q4 to 44 in Q1.

The survey, conducted in late January and early February, indicated an upward shift in dealer sentiment.

However, Cox Automotive acknowledged the score of 44 — below the threshold of 50 — showed more dealers view the market as weak rather than strong.

Franchised dealers had a positive outlook with a score of 54, seeing the market as strong. The Q1 index score rose from 50 last quarter and 49 a year ago.

Independent dealers rated the current market as weak, with a score of 42, although this was higher than last quarter and last year.

“Certainly, a theme that continues through all of the findings is that the first quarter is better than a year ago for sure,” Cox Automotive chief economist Jonathan Smoke said in a news release. “Even though we have some risks about the future, and it’s not exactly a straightforward bet for improvement by dealers, the sentiment at the time of this survey was certainly more positive than it was a year ago.”

The market outlook index improved in Q1, rising for the second consecutive quarter to 58, its highest score since 2022. Analysts explained this increase reflects optimism for the spring selling season. A score of 58 indicates more dealers anticipate a strong market in the next three months.

“At the time of this survey, U.S. automobile dealers were feeling pretty good about the market,” Smoke said. “A combination of positive factors has been working in the dealers’ favor – inventory is healthy, and consumers have some urgency to buy. At least as we head into spring, conditions are favorable. However, considering the administration’s current and shifting tariff stance, how long this momentum will last is unclear.”