Kerrigan dealer survey about profits & valuations in 2023

Charts courtesy of Kerrigan Advisors.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

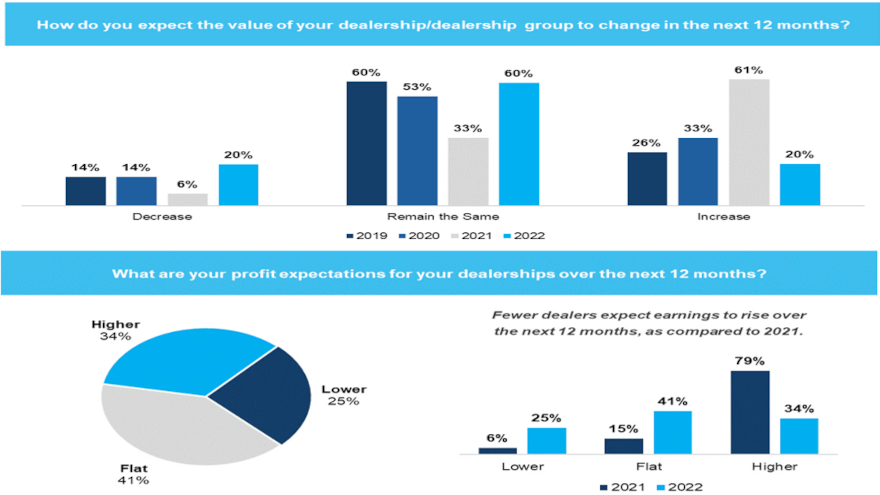

While blue sky values evidently are becoming harder to assess, most dealers who participated in the 2022 Kerrigan Dealer Survey have strong optimism about the valuation of their dealerships heading into 2023.

According to the survey findings released on Monday, 80% of respondents are expecting record valuations to remain steady or increase over the next 12 months, while the other 20% projecting a decline in valuation.

The survey by Kerrigan Advisors questioned more than 600 dealers about their views on the future value of their businesses, as well as their perspectives on franchise valuations and acquisitions.

The firm highlighted the results show sentiments about the year ahead fall in line with industry consolidation trends, the high level of buy/sell activity, and record valuations, as reported in Kerrigan Advisors’ Second Quarter 2022 Blue Sky Report.

Kerrigan Advisor also mentioned the survey aligns with the second quarter report’s findings that blue sky values are becoming harder to assess with the impact of rising interest rates beginning to affect public auto retailer valuations and possibly leading to a softening in consumer demand.

“After high expectations shaped by over two years of record-breaking profit increases, dealers today are striking a more moderate stance as compared to last year’s bullish outlook. Although the majority expect profits and valuations to remain the same, or increase, over the next 12 months, a rising minority of dealers have modified their expectations downward for the next 12 months,” Kerrigan Advisors founder and managing director Erin Kerrigan said in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“As a result, while we believe transaction activity will remain elevated in 2023 as dealers seek to add scale to their businesses, we also think there is slightly more risk to valuations, and to the buy/sell market, going into next year,” Kerrigan continued.

While only 6% of dealers anticipated a valuation decline last year, the survey showed that 20% now expect a decline in the next 12 months, marking a 233% increase year-over-year.

Kerrigan Advisors noted its survey reveals a clear increase in cautiousness by dealers about the future since just 34% of dealers expect higher profits in the next 12 months, representing a sharp decline from the 79% that expected profit increases in 2021.

Dealers who are expecting profits to decline also has increased to 25%, from 6% in 2021, according to the survey.

Nevertheless, Kerrigan Advisors discovered only 2% of participants are planning to sell any of their dealerships.

In fact, nearly half — 48% to exact — told the firm that they plan to grow their business through the acquisition of one or more dealerships in the next 12 months.

“The survey illustrates that a disproportionate number of dealers are planning for growth, rather than exit. This is consistent with what we see in the marketplace. There are still many more buyers than sellers, and we expect this supply/demand imbalance to persist into at least 2023,” Erin Kerrigan said.

“Furthermore, we believe the supply/demand imbalance will sustain current valuations over the next 12 months in keeping with the outlook of most dealers, according to our 2022 survey results,” she added.

The survey also queried dealers on the expected impact of OEM planned changes to the dealer model, specifically in terms of future profitability.

With the exception of Ford, the majority of dealers surveyed do not expect OEMs’ changes to negatively impact future profits, though they were decidedly more negative on Cadillac, Chevrolet, Buick GMC, Lincoln, and Volvo. Toyota, the most trusted OEM, once again, had the most positive outlook, with 22% expecting an increase in profits from future changes and just 18% having a negative outlook.

“With the exception of Ford, dealers seem relatively unconcerned by potential OEM changes to the auto retail model at this point,” said Ryan Kerrigan, managing director of Kerrigan Advisors.

“For the most part, dealers are skeptical of OEMs’ timelines for electrification and other new retailing concepts. For this reason, we believe dealers have not factored in any dramatic business model adjustments and do not expect a near term impact on dealership profitability,” Ryan Kerrigan continued.

Dealers also shared their perspectives on the direction of specific franchise values.

Hyundai (45%), Kia (46%), and Toyota (41%) are projected to increase in value over the next 12 months, according to the survey. This is the first time Hyundai and Kia surpassed Toyota to lead the survey results.

Kerrigan Advisors pointed out that four franchises that had met this criterion in 2021 — Honda, Lexus, Porsche, and Subaru — no longer do, with significantly fewer dealers expecting their values to increase.

The firm said Honda, in particular, saw the largest percentage point decline of any import franchise in the survey as compared to 2021 results, likely due to the brand’s loss of market share in 2022.

More than 90% of dealers surveyed identified BMW, Lexus, Porsche, and Toyota as the franchises least likely to decline in value, significantly fewer than the nine franchises that met this criterion last year.

At least 30% of dealers expect to see valuation declines for Acura, Buick GMC, Cadillac, Ford, Infiniti, Lincoln, and Volvo in the next 12 months.

“While it is worth noting that a minority of dealers in the survey expect a decline in valuation, and fewer dealers — across all franchises — expect values to increase, most dealers remain optimistic about the year ahead and believe their franchises will retain their record valuations into 2023,” Ryan Kerrigan said. “These results demonstrate the resilience of the dealer business model and the sustainability of elevated profits, even in the face of more negative economic indicators.”

Additional franchise valuation highlights from the 2022 Kerrigan Dealer Survey included:

— Hyundai and Kia surpassed Toyota for the first time to become the franchises most expected to increase in value over the next 12 months – a dramatic 26-percentage point shift since 2019, when just 19% of dealers surveyed projected their valuations to increase. This improvement is consistent with Kerrigan Advisors’ positive outlook for Hyundai and Kia in the Second Quarter Blue Sky Report: blue sky multiples for the franchises have increased 42% since 2020.

— Ford saw the largest increase in dealers expecting the franchise to decline in value (18 percentage points) and the biggest drop in the percentage of dealers projecting an increase in value (24 percentage points) compared to 2021. These results are consistent with Kerrigan Advisors’ negative outlook on Ford’s blue sky multiple and dealer concerns about the future profitability of the franchise with electrification. Kerrigan Advisors noted that the firm finds smaller dealers are the most negative on Ford, while larger groups are less negative and, in select cases, positive about Ford’s future.

— Honda had fewer dealers projecting an increase in value in the next 12 months, coming in second to Ford in terms of the drop in dealers projecting an increase in value compared to 2021. Honda also saw an 8 percentage point increase in the number of dealers expecting a decline in value.

— Nissan was the only franchise to see an improvement over 2021 results, with an 8 percentage point decrease in the number of dealers expecting the franchise to decline in value and no change in the percentage of dealers projecting an increase, retaining the brand’s improved metrics from the 2021 survey. This improvement is consistent with Kerrigan Advisors’ reported improvements in Nissan’s blue sky multiple, up 33% since 2021.

The data for The Kerrigan Dealer Survey was gathered from Kerrigan Advisors’ annual survey of auto dealers in conjunction with the issuance of The Blue Sky Report. The Kerrigan Dealer Survey is based on more than 600 responses from franchised auto dealers in Kerrigan Advisors’ proprietary dealer database.

Responses were collected from June to October.

To download the full Kerrigan Dealer Survey report, go to this website.