Report: Used commercial vehicle sales sagging as new sales soar

Image courtesy of Work Truck Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In a year filled with regulatory uncertainty, sales of new commercial vehicles soared.

Used commercial vehicles … not so much.

New-vehicle movement was up 14.2% from 2023, according to the 2024 Annual Commercial Vehicle Market Analysis from Work Truck Solutions, including a massive 19.4% quarter-over-quarter increase in the fourth quarter.

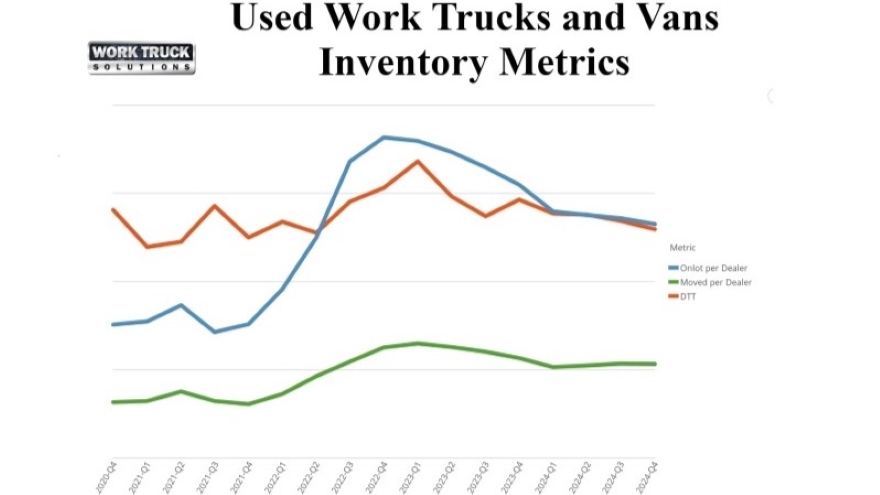

Used sales, on the other hand, sagged by 2.6% year-over-year, while the median mileage of used work trucks and vans rose 9.4%. In addition, the average used commercial vehicle price (10.8%), on-lot inventory (10.8%) and days to turn (11.4%) were all down from 2023, and the report projected significant increases are not expected in the immediate future.

“Although new vehicle sales are improving, it’s still too early in the vehicle lifecycle for used vehicle on-lot inventory to be increased by trade-ins,” the report said. “It’s likely that it will be some time before used on-lot numbers begin to rise. For commercial vehicle shoppers, the overall new vehicle trends suggest that the availability and prices of used inventory will continue to decline in 2025.”

In the new sector, prices remained flat for the year but inventory skyrocketed, up 33%, which led to days to turn jumping 62.9% year-over-year despite the increase in sales.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The report said the uptick in new vehicle supply “suggests manufacturers have addressed previous supply chain bottlenecks, resulting in a replenished stock of commercial vehicles,” while the combination of surging sales and longer days to turn “suggests that despite a longer dwell time on dealers’ lots, the demand for commercial vehicles is robust” and competition for commercial customers is intensifying.

“Right now, the commercial vehicle business is where F&I was for dealers 10 or 12 years ago,” Work Truck Solutions senior advisor Jim Press said. “Not all dealers were in it. They weren’t depending on F&I for profit. Now they’re beginning to see that commercial business is the next big income producer, because it provides revenue, multiple sales and increased fixed operations.

“This is a time for dealers to embrace technology to increase their profit margins, their customer retention and penetration of the commercial business in their market area.”

CEO Aaron Johnson agreed, noting, “The commercial vehicle market continues to see demand for work trucks and vans, with many commercial dealers looking to level up their digital presence and maximize online merchandising tools. For those previously focused only on the retail market, it’s a time to look at the B2B sector as an opportunity and a path to another revenue stream, one that’s quite strong.”