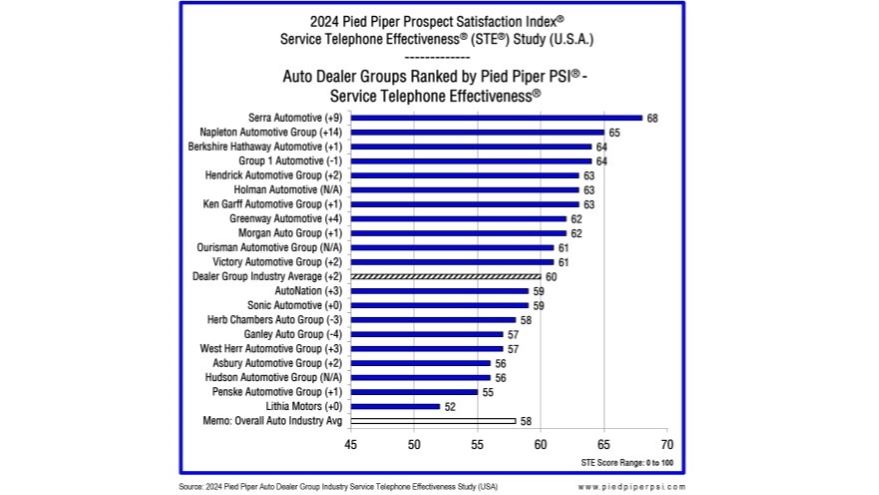

Serra, Napleton take giant steps forward in responses to service appointment calls

Chart courtesy of Pied Piper.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The results of Pied Piper’s 2024 PSI Service Telephone Effectiveness Study bear little resemblance to those of last year.

At the top of the new list, which ranked 20 dealer groups by their efficiency and quality of service telephone calls in quickly and easily setting up a service appointment from the customer’s perspective, is Serra Automotive, with an STE score of 68 on a 100-point scale. In the 2023 study, Serra ranked in the middle of the pack, tied for eighth place with a score of 59.

Making an even bigger jump was Napleton Automotive Group, which ranked second with a score of 65 after finishing dead last among the 17 groups under consideration in 2023 at 51 points.

The top two groups from the 2023 study — Group 1 Automotive and Berkshire Hathaway Automotive — tied for third in the current study at 64.

“Successful service departments value customer loyalty, and a customer’s attempt to schedule service is the first interaction that fosters that loyalty,” Pied Piper CEO Fran O’Hagan said in a news release. “Customers who encounter challenges when scheduling service may choose to go to a different dealership or independent repair shop, or they may decide to replace their vehicle as well as their dealership.”

The study was conducted from January through July by phoning the service departments at every dealership location owned by each of the dealer groups. STE scores are calculated from a mix of weighted measurements that support the customer’s mission of quickly speaking with a service representative who can schedule an appointment in a reasonable amount of time.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Pied Piper said 62% percent of the score is determined by efficiency measurements and the rest by quality metrics that measure to what degree dealerships provide a proactively helpful experience that goes above and beyond the customer’s basic expectations.

The average STE score for the groups studied rose two points from 2023 to 60 — two points above the overall industry average — indicating an overall stronger performance. The study found the average time for service customers to reach a service advisor dropped from 82 seconds last year to 57 seconds in 2024, and service appointments averaged 4 days out, one day sooner than 2023.

On the flip side, what Pied Piper calls “Mission Failure,” when a service customer hangs up without scheduling an appointment (for reasons including no response, an “endless hold,” getting lost in phone tree and no availability), increased from 11% of calls to 13%.

Serra’s dealerships had the second highest rate of “Mission Acceptable” service calls, in which a service advisor was reached within one minute and scheduled an appointment less than a week out, 76% of the time on average, well above the industry average of 53%.

It also had the lowest rate of “Mission Failure” calls — less than 1%, while the industry average is 13%. Holman Automotive was the only other group with less than 5%. Penske Automotive Group, Hudson Automotive Group and Lithia Motors had more than 15% “Mission Failures.”

Serra stores sent the average customer to a service advisor in 31 seconds, about half the industry average time, and left no callers on hold for more than two minutes, compared to a 13% industry average.

Napleton’s huge leap was fueled by cutting its average caller wait time to speak with a service advisor from 70 seconds to 40 seconds and increasing its rate of “Mission Excellent” calls — those that resulted in an STE score of 70 or more — from 30% to 62%. It also reduced its average service appointment days out from five in 2023 to three in 2024.

Napleton was one of two groups, along with Berkshire Hathaway, with more than 55% of their calls receiving a “Mission Excellent” score. At the bottom of the scale, Ganley Auto Group, Penske and West Herr Automotive Group were at less than 35%.

West Herr, Ken Garff Automotive Group and AutoNation were the best in terms of asking customers if they’re experiencing any other issues, doing that on more than 60% of their calls, while Greenway Automotive, Morgan Auto Group, Ourisman Automotive Group and Hudson were at less than 30%.

O’Hagan said a better service customer experience begins with dealerships understanding what actually occurs during customer calls, which can often be a surprise.

“Paying attention to service phone calls is well worth the effort,” he said. “Customers who find it simple and easy to schedule service are on the path to higher loyalty, not just for future service needs but also when purchasing a new vehicle.”