Service satisfaction up overall but EVs lag behind, JD Power study finds

Image courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Customer satisfaction with the dealer service experience is up, even as wait times for appointments and vehicle service continue to rise, according to the latest research from J.D. Power.

The company’s 2024 U.S. Customer Service Index Study found overall customer satisfaction rose by five points on its 1,000-point scale, to 851.

The study, in its 44th year, measures satisfaction with service at franchise dealer or aftermarket service facilities for maintenance or repair work from a survey of 64,781 owners and lessees of 1- to 3-year-old vehicles based on service quality, service advisor, vehicle pickup, service facility and service initiation.

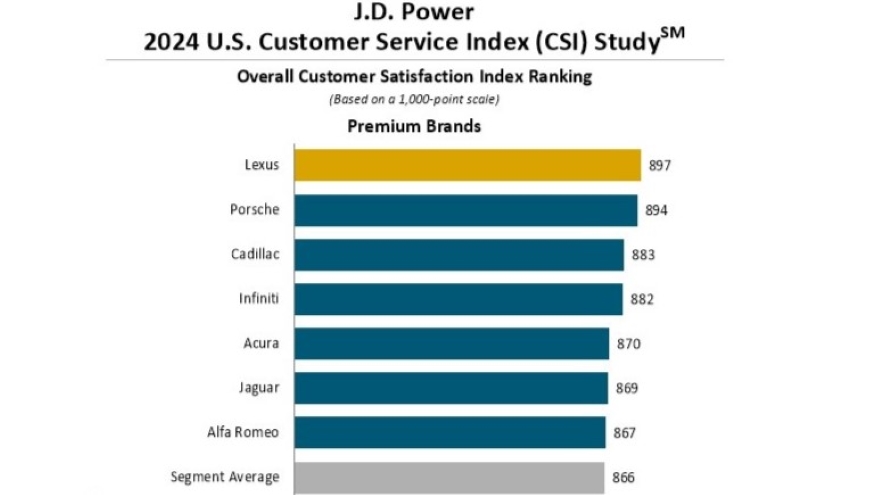

At the top of the list are Lexus, which scored 897 to edge out Porsche (894) to lead premium brands for a third consecutive year, and Buick, which topped mass-market brands at 887, ahead of MINI (884) and Subaru (877).

At the bottom are battery electric vehicles — other than Tesla, which is not included in the study. EVs are recalled twice as often as gas-powered vehicles, and EV customers gave their recall repair experience the lowest scores of any segment at 782, 50 points less than the overall score for gas-powered vehicles.

The study showed EV owners’ trust in dealerships to perform repairs and provide guidance lags behind other vehicles, with a score of 5.62 on a seven-point scale compared to 6.00 among gas vehicle owners and 5.74 among plug-in hybrid owners.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

J.D. Power vice president of automotive retail Chris Sutton called the service experience for EV owners “underwhelming.”

“As sales of BEVs continue to grow and the industry moves out of the early-adopter phase, the typical owner will not be as willing to tolerate a less-than-stellar service and ownership experience,” he said in a news release. “On the manufacturer side, a higher rate of BEV recalls is also contributing to an inconsistent experience.

“This is an area automakers and dealers need to address now to help make the transition to electrification as pain-free as possible for owners in the future.”

The study also found the time between setting an appointment and the appointment itself has increased much to the frustration of vehicle owners.

The average wait time for mass-market vehicles rose to 5.2 days, up from 4.8 in 2023, while premium vehicles improved slightly year-over-year but were still at 5.4 days — both significantly longer than before the COVID pandemic.

Those waits are driving customers away from dealership service departments, J.D. Power said. The study showed 35% of customers in the mass market segment said their reason for choosing aftermarket service is the ability to get their car in right away, surpassing lower costs (34%).

“It’s encouraging to see an improvement in service satisfaction,” Sutton said, “but, unfortunately, the capacity and wait time issues have gotten progressively worse since the pandemic and show no immediate signs of easing up.”

Other findings include:

Technology improves service experience: Almost 70% of customers said they would rather get service updates via text message than via a phone call (16%). And customer satisfaction improves 31 points to 911 when service advisors provide photos or videos to support the results of a multi-point inspection.

Amount spent per visit rises: The average amount spent on a recent dealer service visit has risen 30% over the past two years. Owners of premium vehicles paid an average of $380, up $66 year-over-year, while owners of mass market vehicles paid $140, up $15. J.D. Power attributed the increases to inflation and higher parts and labor costs.